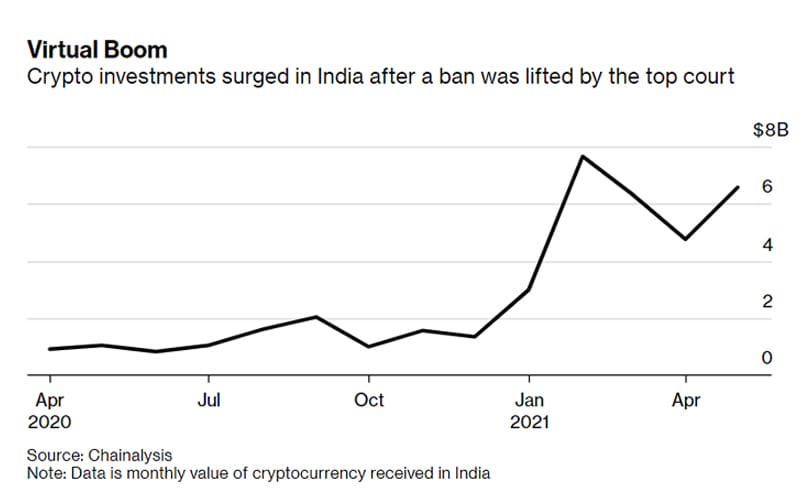

Despite India’s regulatory pressure from the government, cryptocurrency is winning over gold in India. Post covid lockdown Indians are investing billions of dollars in the crypto industry. In the past year, crypto investment surged from $200 million to $40 billion.

According to data from blockchain forensic firm Chainalysis, crypto investments in India rose 19,900% over the past year, Bloomberg reported. The surge comes despite the regulatory uncertainty about crypto in India.

The country’s 32-year-old entrepreneur, Richi Sood swerved from gold to crypto. Since December, she put just over 1 million rupees ($13,400) into bitcoin, Dogecoin, and Ether.

“I’d rather put my money in crypto than gold”, Soon said. “Crypto is more transparent than gold or property, and returns are more in a short period.”

Nowadays more than 15 million are trading crypto, 8 million fewer than in the U.S., and compares with just 2.3 million in the U.K. The growth in India is coming from the 18-35-year-old cohort, says the co-founder of India’s first cryptocurrency exchange.

“They find it far easier to invest in crypto than gold because the process is very simple,” said Sandeep Goenka co-founder of Zebpay. “You go online, you can buy crypto, you don’t have to verify it, unlike gold.”

In 2020, the supreme court quashed banning crypto trading by banking entities, resulting in a trading surge. Though RBI says it has “major concern” about the asset class. Now as the bans is removed Indians are investing billions of dollars in the crypto industry.

Also Read: Indian Government Brings Crypto Ban Bill Under Review

“I am flying blind,” said Sood “I have a risk-taking appetite, so I’m willing to take the risk of a ban.