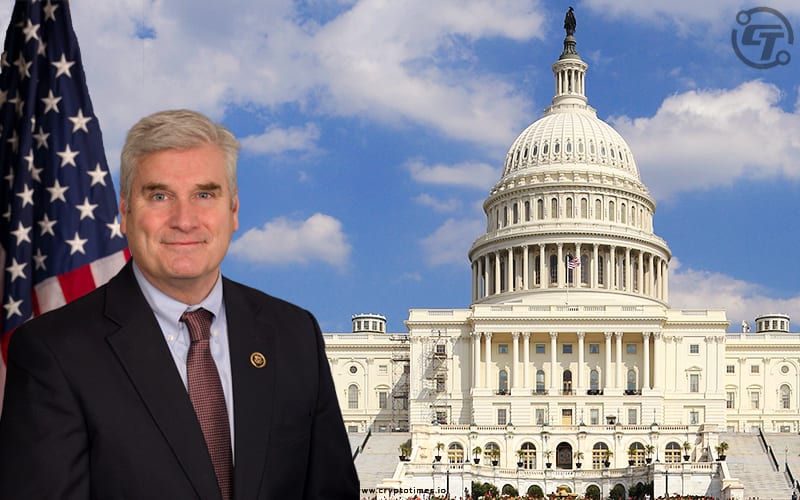

Congressman Emmer introduced the Bipartisan Securities Clarity Act with Reps. Darren Soto and Ro Khanna. Bill aims to provide a clear definition of assets like digital tokens and emerging technologies under the current securities law.

US representatives introduced a bill known as the “Securities Clarity Act”. The legislation wants to change the 75 years old definition of a term. The status of any asset sold as an “Investment contract” by new definition becomes “Investment contract asset.”

The bill provides a solution for individuals who have complied with current securities registration requirements or qualified for an exemption. After meeting these requirements, innovative entrepreneurs can sell/trade their assets to the public without fear of additional regulatory burdens.

Congressman Emmer said, “There has been an unreasonable approach by regulators as to how federal securities laws should be applied to transactions involving the sale of blockchain-based tokens, and this lack of clarity is hurting American Innovation.”

The Securities Clarity Act states that an investment contract asset is separate and distinct from the securities offering. The approach is technology-neutral, and it applies equally to all assets offered and sold, whether tangible or digital.

“As congress works to protect those who invest in this technology, the Securities Clarity Act will add critical definition and jurisdiction to create certainty for a strong digital asset market in the United States,” said Congressman Soto.

The introduction of the bill comes a day after the Chairman of Federal Reserve, Jerome Powell spoke in favour of Digital Dollar. He asked for strict regulations on stablecoins.