In a blog published on Tuesday, the CEO of Circle Internet Financial LLC. explained the firm’s dollar pegged stablecoin is backed by “prioritized trust, transparency, and accountability.”

In the blogpost, Jeremy has also included the letter from the Centre Consortium’s accountant, Grant Thornton explaining that the stablecoin’s reserve account information matches the accompanying reserve account report, which is “correctly stated”. Circle also revealed that the majority of the stablecoin USDC’s reserves are held in cash or cash equivalents.

Allaire says that Circle and the Centre Consortium have ensured the “pillars of trust” so the public understands that USDC remains backed on a 1:1 basis with dollar-denominated assets.

Allaire’s blog post emphasizes that the “pillars of faith” include:

- Ensuring the highest level of regulatory and prudential standards governing the USDC ecosystem.

- Providing assurance, demonstrated by reserve verification issued by Grant Thornton, one of the world’s leading accounting firms, that dollar-denominated assets can meet circulation for USDC dues. Today is the 33rd such reserve verification since the first USDC went into circulation, reflecting our unwavering commitment to the fundamental trust in the USDC ecosystem.

- The main economic activities that underpin USDC are built within the periphery of the US financial system, not outside it. Creating an open medium of exchange on the Internet that imports the fundamental belief of the US dollar and the fundamental oversight and first principles of the US financial system. To this end, our commitment to openness, competitiveness and responsible financial services innovation remains a cornerstone for both the Center Consortium and Circle.

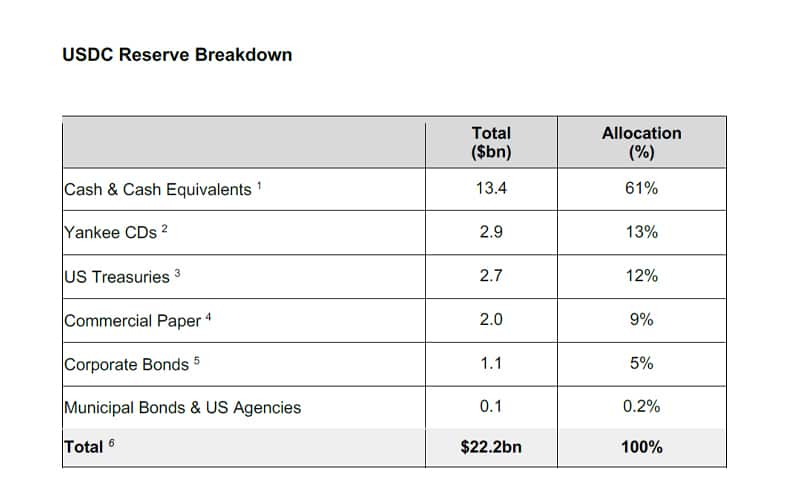

To show transparency and accountability, Allair also attached an Attestation providing Reserve Account Report. According to the new attestation, there are 22 million USDC in circulation. The report also shows the breakdown of its reserves for backing CBDC.

Circle’s attestation and the letter from Grant Thornton gives the public a perspective on how the USDC backing is calculated. While a majority of USDC backing is through cash, it also includes fractions of corporate bonds, U.S. Treasuries, and Yankee Certificates.

Circle intends to go public later this year in a merger with a special purpose acquisition company. With the SPAC deal Circle’s valuation will become $4.5 billion.