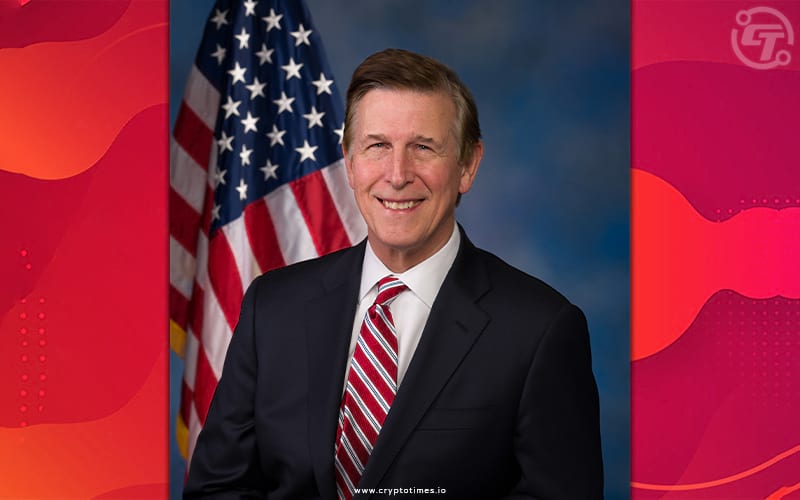

Representative Don Beyer (D-VA) introduces new legislation, the Digital Asset Market Structure and Investor Protection Act. The legislation would incorporate digital assets into existing financial regulatory structures to protect consumers and promote innovation.

The “Digital Asset Market Structure and Investor Protection Act” seeks to outline the treatment of crypto assets under five securities acts, the Commodity Exchange Act and the Bank Secrecy Act, as well as Federal Reserve treatment of stablecoins and possible digital legal tender.

“Digital asset holders have been subjected to rampant fraud, theft, and market manipulation for years, yet Congress has hitherto ignored the entreaties of industry experts and federal regulators to create a comprehensive legal framework,” said Beyer in a statement. “Our laws are behind the times, and my bill would start the long-overdue process of updating them to give digital asset holders and investors basic protections.”

Among its many provisions the measure would:

- Create statutory definitions for digital assets and digital asset securities. Provide the SEC with authority over digital asset securities and CFTC with authority over digital assets

- Require digital asset transactions that are not recorded on the publicly distributed ledger to be reported to a registered Digital Asset Trade Repository. This should be done within 24 hours to minimize the potential for fraud and promote transparency

- Explicitly add digital assets and digital asset securities to the statutory definition of “monetary instruments,” under the Bank Secrecy Act (BSA), formalizing the regulatory requirements for digital assets and digital asset securities to comply with anti-money laundering, recordkeeping, and reporting requirements

- Provide the Federal Reserve with explicit authority to issue a digital version of the U.S. dollar. Clarify that digital assets, digital asset securities and fiat-based stablecoins are not U.S. legal tender. And also provide the U.S. Treasury Secretary with authority to permit or prohibit US dollar and other fiat-based stablecoins

- Direct the FDIC, NCUA and SIPC to issue consumer advisories on “non-coverage” of digital assets or digital asset securities. This is to ensure that consumers are aware that they are not insured or protected in the same way as bank deposits or securities.

Also Read: Senators Want Crypto Taxes To Raise Funds For Bipartisan deal

Through a joint SEC/CFTC rulemaking session, the bill provides legal certainty to the regulatory status for every digital asset in the top 90% of the market, measured by market capitalization and trading volume.