In Brief:

- The RBI is exploring the choice between having a centralized ledger for digital currency, so-called distributed ledger technology (DLT)

- The central bank stepped up its efforts to explore digital currencies over the past year.

The Reserve Bank of India may launch its first digital rupee trails programs by the end of the year.

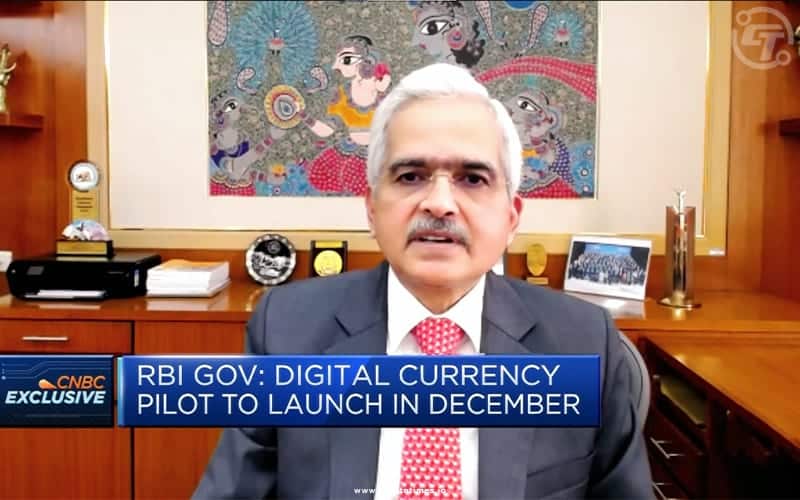

According to the CNBC Report, RBI governor Shaktikanta Das said, “We are being extremely careful about it because it’s completely a new product, not just for RBI, but globally.”

Notably, central banks around the world are analyzing digital currencies. China, Europe, and the U.K. are exploring digital currencies that they could issue to commercial lenders.

According to the governor, “The RBI is studying various aspects of digital currency including its security, impact on India’s financial sector as well as how it would affect monetary policy and currency in circulation.”

Das highlights that RBI is exploring the choice between having a centralized ledger for digital currency, so-called distributed ledger technology (DLT). DLT refers to a digital database that allows multiple participants to access, share and record transactions simultaneously. The centralized ledger would mean that the database is owned and operated by a single entity, the central bank.

“I think by the end of the year, we should be able to – we would be in a position, perhaps- to start our first trials,” Das told CNBC. He said that RBI called central bank digital currencies or CBDC as legal tender issued by the central bank in digital form.

Last month, RBI Deputy Governor T. Rabi Sankar said that the central bank was working towards a “phased implemental strategy” for a digital currency.

Also Read: RBI is Making Strong Efforts to Make CBDC a Reality

The central bank stepped up its efforts to explore digital currencies over the past year. That decline in cash usage and growing interest in cryptocurrencies like bitcoin.

The People’s Bank of China is leading the way, with real-world trails across various cities. The European Central Bank and the Bank of England are also looking into a digital euro and a U.K. CBDC, respectively.