In Brief:

- SEC threatened to sue Coinbase over its yet-to-be-launched “Lend” program.

- Armstrong claimed that the SEC didn’t explain how it made such a determination.

- Coinbase will not launch the Lend product till October.

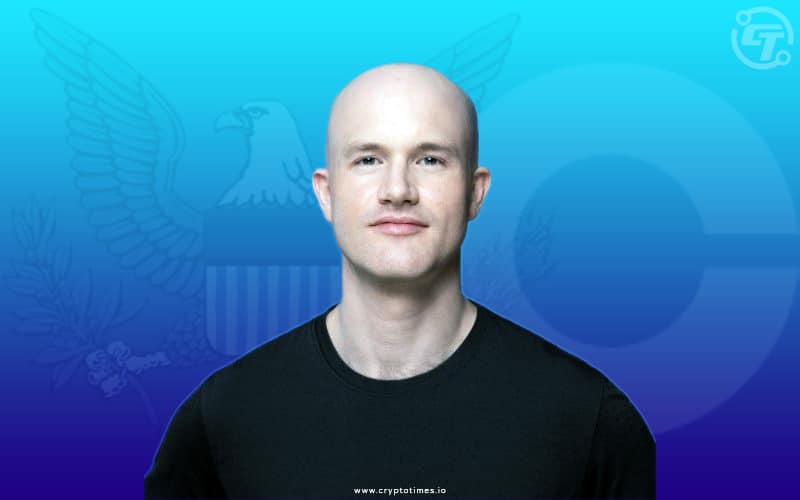

Coinbase Global Inc. CEO Brian Armstrong suddenly came down on the U.S Securities and Exchange Commission on twitter and said SEC’s behaviour “Sketchy”. SEC gave the exchange “Wells notice” about its Lend program, said Coinbase in a blogpost.

In a lengthy twitter, CEO Armstrong disclosed that U.S SEC had threatened to sue the exchange over its lending feature.

Coinbase announced the launch of the “Lend” product in June, which was supposed to go live in a few weeks. For the launch of the product, they also reached out to the SEC and gave them a “friendly heads up and briefing”. SEC described this lending feature as security without giving any explanation.

“They refuse to tell us why they think it’s a security, and instead subpoena a bunch of records from us (we comply), demand testimony from our employees (we comply), and then tell us they will be suing us if we proceed to launch, with zero explanation as to why.”

Armstrong specified that they are committed to following the law. If the SEC publishes guidance on the unclear law, “We are also happy to follow that.”

Moreover, as per Armstrong in this case the SEC is refusing “to offer any opinion in writing to the industry on what should be allowed and why”. There are plenty of other crypto companies that offer a lending feature, but the SEC is only restricting Coinbase.

In Background

The lend product is designed to allow consumers to earn 4% APY on USD Coin with Coinbase. In a blog post, Paul Grewal, Coinbase’s Chief legal officer, says how the exchange is in talks with the SEC about Lend feature for six months. However, how it sends a letter that notifies recipients about the substance of its charges.

Grewal adds that submitting a written defence would be futile since the company doesn’t know the reasons behind the SEC concerns.

“The SEC has repeatedly asked our industry to ‘talk to us, come in, We did that here. But today all we know is that we can either keep Lend off the market indefinitely without knowing why or we can be sued.”

According to the Grewal SEC are assessing Lend product through the prism of decades-old Supreme Court cases called “Howey and Reves.” The SEC won’t share the assessment itself, only the fact that they have done it. These two cases are from 1946 and 1990. Wells notice tells the exchange that the SEC will skip basic regulatory steps and go right to litigation.

Grewal said the net result of all this is that Coinbase will not be launching Lend until at least October. However, Coinbase is ready to fight against the SEC in the court if needed.

At the end, Armstrong said, “Hopefully the SEC steps up to create the clarity this industry deserves, without harming consumers and companies in the process.”