In Breif:

- RBI Deputy governor said crypto should be treated as an asset or commodity in India.

- Regulating crypto can decrease the illegal activities involving digital assets

- The jurisdiction should have a clear framework for every part of economic activity

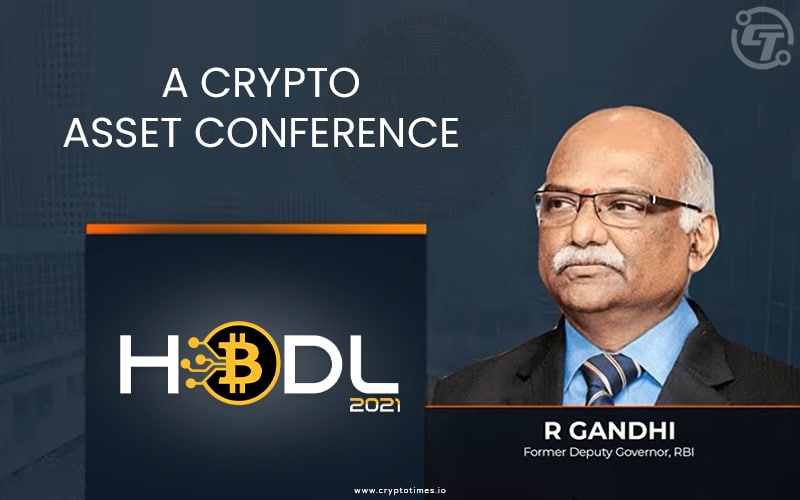

A Former RBI deputy governor R. Gandhi said crypto should be treated as an asset or commodity in India and governed by existing laws for exchanges.

Speaking at the inaugural HODL 2021 virtual conference organized by Mobile Association of India (IAMAI) and Blockchain & Crypto Assets Council (BACC), Deputy Governor R. Gandhi said “treating and regulating crypto as a separate asset class with a view to allowing governments around the world to effectively deal with illegal activities”.

After quite a lot of debate over the years, he said, people have fully understood that crypto cannot be a currency. The fundamental element of a currency is that it should be legal tender in this case it’s missing. He said in this case, one cannot force cryptocurrency to be accepted by another person as it is not a legal tender.

“So, once we have an understanding and acceptance that it is an asset (not a currency), then it becomes relatively easier to have regulation around it,” he said.

He also explained that general consensus among many policymakers is that it should be allowed as an asset, not a currency, “not as a payment instrument and not a financial instrument as there is no clear identified issuer.”

The Deputy governor expressed apprehension that there is a possibility of using the virtual asset for criminal activity in absence of regulation. The Jurisdiction should have a clear framework by which any part of economic activity should “not be seen as supportive of any criminal activity.”

R. Gandhi stated that the government should have an open mind towards economic transactions involving cryptocurrencies. The basis of the origination of crypto around 12 years back as an asset was that it cannot be traced and taxed.

“So the very idea of crypto was that it should be anonymous, independent, and it cannot be taxed or tracked, so as I said every society will have its own rules, which expects compliance by all its members and it penalizes non-compliance,” he said.

In July, Indian Finance minister Nirmala Sitharaman said that the Indian crypto bill is ready. They have prepared a bill after taking input from stakeholders of the industry. Somehow, the regulatory situations in India always remained unclear.

If you want to receive daily crypto news then subscribe The Crypto Times.