In Brief:

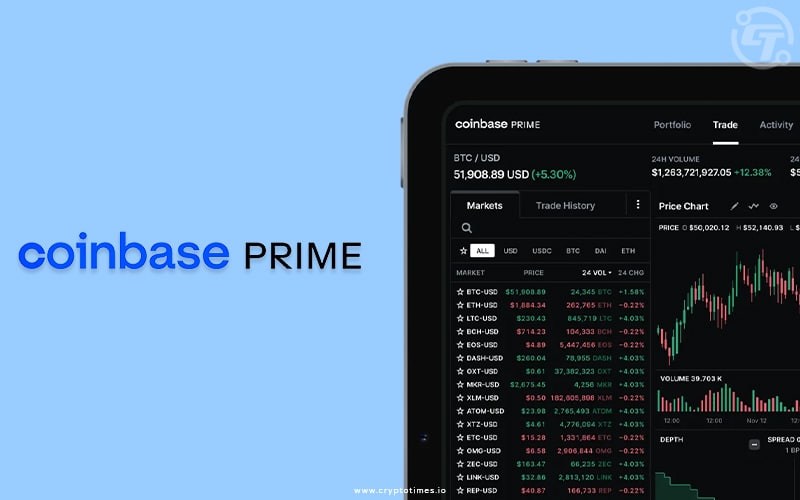

- Coinbase launched ‘Coinbase Prime’ to help institutions to purchase cryptocurrencies.

- This platform will provide features such as Trading, Custody and a set of tools.

- Lot of institutions worked with Coinbase to complete OTC trades and handle custody for assets.

Coinbase officially launched its ‘Coinbase Prime’ platform to serve the growing demand of its clients and institutions of purchasing cryptocurrencies such as Bitcoin and Ethereum.

This new platform will provide vital features like trading, custody, and a set of tools designed, which will help clients to understand the crypto market in a better manner. A batch of institutions has worked with Coinbase to complete Over Counter (OTC) trades and handle custody for assets.

These features on Coinbase Prime will allow institutions to perform these tasks autonomously, which will help new investors to increase their reach in the crypto world. It will allow clients to easily transfer assets between their trading balance and vault.

The beta version of Coinbase Prime was launched in May. In June, Coinbase Institutional announced the launch of a revamped version of its prime brokerage platform to attract institutional investors.

Earlier, Coinbase had also catered to institutions like Tesla and Microstrategy through OTC trades and played the role of custodian for big purchases of digital assets. The Crypto exchange has also a hedge fund One River and a Hong kong-based Meitu to execute one of the largest trades in the industry.

Recently, Coinbase has received a large amount of investment from leading and world-famous institution groups, which will boost the confidence in the crypto market as Coinbase is planning to introduce new products and features on their platform to target an international audience and to give exposure to Decentralised Finance.