In Brief:

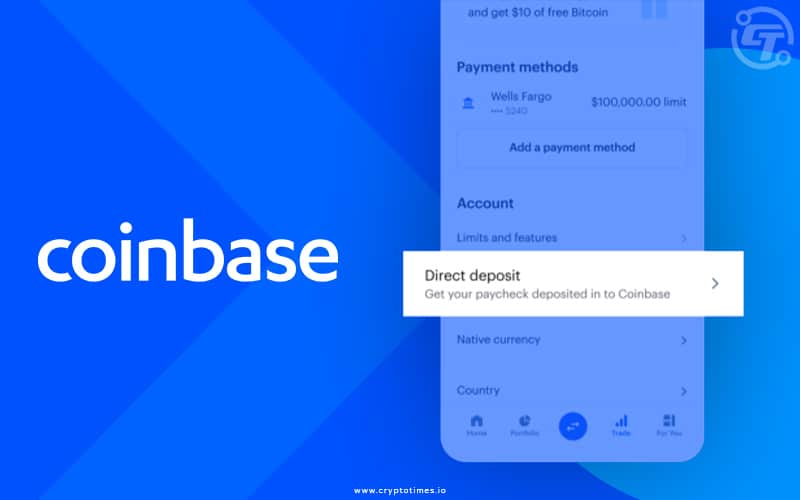

- Coinbase will allow US users to directly deposit their paychecks into their Coinbase account.

- Users can convert the paycheck into crypto with no transactions fees.

- The company has partnered with Fortress Investment Group, M31 Capital, Nansen, and SuperRare Labs.

Cryptocurrency exchange platform Coinbase will roll out a new feature that allows users to deposit their paychecks into accounts at the exchange.

According to the announcement, users can select which cryptocurrency they would like their paycheck to be converted to. They can hold their money in dollars or immediately transfer it into cryptocurrency like bitcoin, Ethereum. The new features will start in the next week.

Users will be able to deposit as much or as little of their paycheck as they like with no fee. The Coinbase account-holders can opt to get paid in any of the 100+ cryptocurrencies available. There will be no transaction fees on direct deposit funds. The people can utilize the fund on regular crypto investment, earning rewards, or spending on Coinbase cards.

Coinbase Senior Director, Product Prakash Hariramani, gave many reasons for making frequent transfers easy. The feature will allow users to make short/long-term investments, earn interest on yield-generating assets and other services easily and speedy.

Users can create and modify their direct payments through some steps in the Coinbase app. Coinbase will give instructions to set up automatic paycheck allocation or manually deposits via the company’s payroll system. Users can modify their preferences at any time within their settings.

“Now you’ll save time on the extra steps it takes to move money so you can immediately earn interest on your income,” Hariramani said in the blog post.

The company has partnered with Fortress Investment Group, M31 Capital, Nansen, and SuperRare Labs to allow employees via creator economy and financial services to use the feature.

The US Securities and Exchange Commission threatened to sue the cryptocurrency exchange over its product called Lend. The exchange has since abandoned its lending plans.