In Brief:

- Marathon has now secured a $100 million revolving line of credit (RLOC) facility with Silvergate Bank.

- RLOC will be available for one year and can be renewed annually

- Marathon increased its bitcoin production by 91% quarter-over-quarter to 1,252 bitcoin with increasing total holdings to 7035

One of the active bitcoin miners in North America, Marathon Digital Holdings has updated its bitcoin production and miner installation for September 2021 and announced a $100 million revolving line of credit (RLOC) with Silvergate Bank.

RLOCs, which are secured by Bitcoin and USD, is initially available for one year and may be renewed by agreement between Silvergate Bank and Marathon each year.

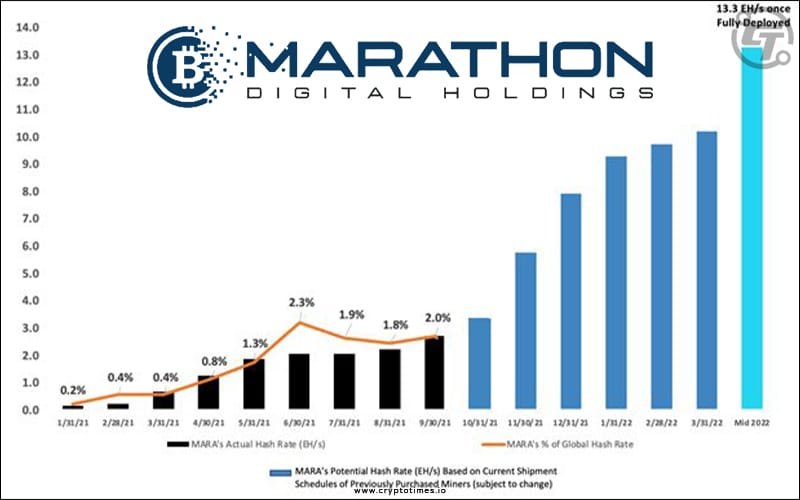

According to the report, as of October 1, 2021, Marathon’s mining fleet had produced approximately 2,098 newly minted bitcoins. Marathon’s existing mining fleet consists of 25,272 active miners producing approximately 2.7 EH/s.

Some additional highlights of the report are as follow:

- Amounts on hand were approximately $32.9 million, while the amount of liquid assets, including bitcoins, was approximately $369.1 million.

- ASIC miners worth approximately 26,960 dollars were received from Bitmain in the first quarter, and another 8,459 are currently on their way.

- The company received a revolving credit line of $100 million from Silvergate Bank, secured with bitcoin and USD, by October 1, 2021.

Silvergate is a Federal Reserve member bank that specializes in offering services and solutions to bitcoin and cryptocurrency companies. As of Q3 2019, the bank had over 750 clients in the digital currency and fintech industries.

Also Read: Marathon Digital to Buy New Mining Machines From Bitmain

Marathon is a company that mines cryptocurrencies with a focus on blockchain technology and digital assets generation, while Silvergate Bank is a commercial bank that lends businesses into the domain of fintech and cryptocurrency.