In Brief

- Blackrock CEO Larry Fink sees huge opportunities in digital currency

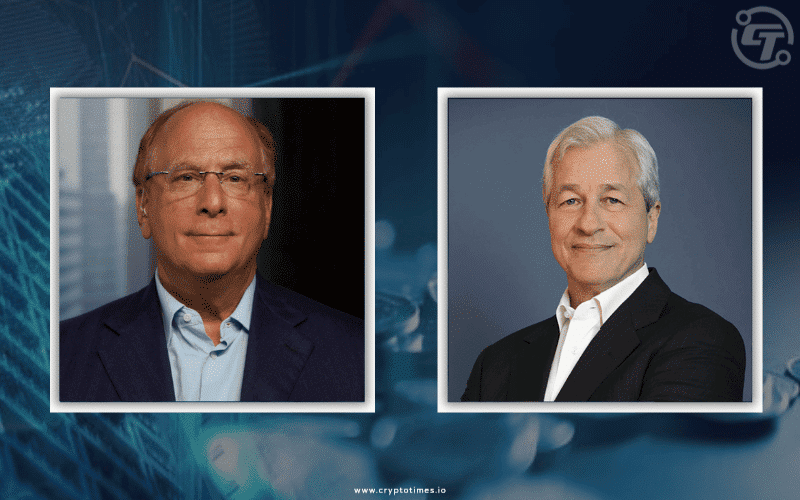

- He called himself “Jamie Dimon Camp”, who called Bitcoin “Worthless”

- However, as per the Larry Fink, Bitcoin can help to increase the pace of currency digitization worldwide

Larry Fink, a Chief Executive Officer (CEO) of United States investment management corporation “Blackrock” stated in the interview with CNBC that he sees huge opportunities in “digitized crypto-blockchain-related currency”.

He said he doesn’t understand Bitcoin much & can’t predict its price but he believes the crypto market has a huge potential.

“I’m not a student of bitcoin and where it’s going to go so I can’t tell you whether it’s going to $80,000 or zero. But I do believe there is a huge role for a digitized currency and I believe that’s going to help consumers worldwide,” said Fink.

He “probably” agrees with JPMorgan CEO Jamie Dimon’s point of view on Bitcoin that it has “no Value”. But, also he is looking at Bitcoin as an opportunity for currency digitization and blockchain.

In an interview when CNBC asked for Fink’s view on Dimon’s comment, which he referred to Bitcoin as “worthless”. Fink said on this question “I’m probably more on the Jamie Dimon camp,”.

However, the business approach of Dimon’s Bank is completely in contrast with his statement as the bank is continuously locking up business with clients and investors, who want access to the World’s most-traded cryptocurrency.

On the question about whether Fink has changed his view to offer crypto product and its access to Blackrock’s investors, he said “We’re studying blockchain and the whole concept of crypto and we believe that will play a very large role,”

“I see huge opportunities in a digitized crypto-blockchain-related currency and that’s where I think it’s going and that’s going to create some big winners and some big losers,” he said.

Fink’s comments show his lack of understanding in blockchain technology and Bitcoin but he does realize the potential Bitcoin holds. BlackRock’s quarter one filing also revealed that the company has invested in the Bitcoin Futures market.

According to the filing with the Securities and Exchange Commission on July 31, Blackrock Global Allocation Fund gained $369,137 from Bitcoin futures.

On Wednesday, Bitcoin took the 0.3% hike and marked the $56,360 value. It seems like Bitcoin is again gaining momentum to recover its last 5 month fall. Now, Bitcoin is holding up more than $1 trillion of market cap.