In Brief:

- New York’s AG ordered the shutdown of two crypto lending platform

- Three other platforms have been directed to immediately provide information about their activities and products.

- The crypto firms were kept unnamed in the official announcement.

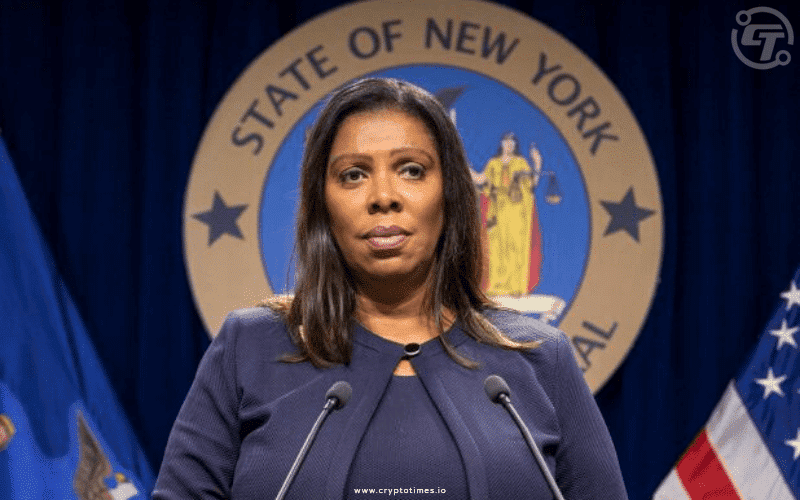

New York Attorney General (AG) Letitia James has directed two unregistered crypto platforms to cease operations immediately and has also warned of additional investigations. Three other platforms have been directed to immediately provide information about their activities and products.

The press release also mentions that this action has been taken as a repercussion to the previous warnings to virtual currency platforms that unlawful activity will not be tolerated in New York.

Although the names were kept redacted in the official press release, Nexo said in a statement that it received a cease-and-desist letter and other than that Celsius have been seemingly targeted.

“Cryptocurrency platforms must follow the law, just like everyone else, which is why we are now directing two crypto companies to shut down and forcing three more to answer questions immediately,” said James in a press release.

The NY Martin Act gives AG broad law enforcement powers to conduct investigations of suspected frauds in the offer, sale, or purchase of securities. Citing this notorious act, it was declared that virtual currency lending products must squarely fall within any of several categories of “security” under this Act.

As a reaction to the cease-and-desist letter by the officials, Nexo CEO wrote, “Nexo is not offering its Earn Product and Exchange in New York, so it makes little sense to be receiving a C&D for something we are not offering in NY anyway. But we will engage with the NY AG as to if this is a clear case of mixing up the recipients of the letter.”

Earlier this year, NY AG James had taken legal action to stop the illegal operations of Coinseed App. In May, Attorney General James had filed a motion asking the court for a “temporary restraining order” and “immediate blocking of Coinseed and its CEO Delgerdalai Davaasambuu from making any future unauthorized trade.” Explaining the precautionary measures for traders and investors, the OAG had informed those dealing in virtual currencies directly (such as trading platforms) must register with the Investor Protection Bureau unless exempted.

Of late there have been many cases of the government cracking down on crypto lending platforms. This one too sends out a strong message from the state regulators. As the AG further warned, “that we will not hesitate to take whatever actions are necessary against any company that thinks they are above the law.”