In Brief:

- Joe Biden signed the $1.2 trillion infrastructure bill on Monday.

- The bill requires reporting of the transaction worth more than $10,000 to IRS

- Node operators will have to report identifying information for crypto transactions that they have no way of gathering.

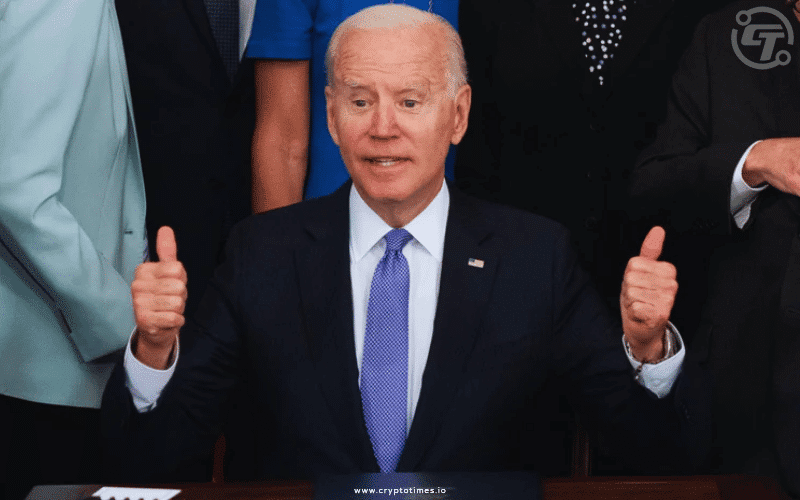

President Joe Biden signed the $1.2 trillion infrastructure bill in front of the media, lawmakers, and union workers on 15th November in a ceremony that took place at White House at 4:21 pm EST.

In the current bill, the measure imposes stricter regulations on enterprises that deal in cryptocurrencies and expands broker reporting obligations. Digital asset transactions worth more than $10,000 must now be disclosed to the Internal Revenue Service. Node operators will have to report identifying information for crypto transactions that they have no way of gathering.

Also, a group of senators suggested an amendment to the bill in August that would have clarified the crypto tax reporting obligations, but it failed to get support.

President Biden said, “look folks, for too long, we’ve talked about having the best economy in the world.” President Biden commented on this,“America is moving again, and your life is going to change for the better.”

Although the bipartisan bill is intended to support roads, bridges, internet access, solar panels, electric vehicle charging stations, and other significant infrastructure projects. Also, lawmakers incorporated wording that applies to cryptocurrencies before it was passed by both chambers of Congress.

Although it’s now difficult for any US legislator to amend the substance of the crypto reporting rule, which is set to take effect in 2024.

Senators Ron Wyden and Cynthia Lummis submitted new legislation in response to the announcement, aiming to limit those terms in the statute itself, reflecting the original compromised text.