In Brief:

- Ted Cruz introduced legislation to repeal the Infrastructure Bill’s crypto broker definition.

- According to him, the bill compromises crypto participants’ privacy and is a hurdle to innovation.

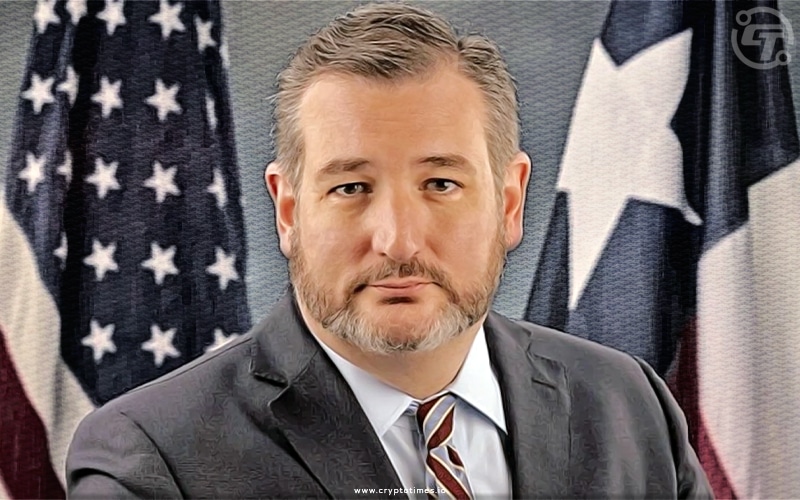

Ted Cruz, Junior United States Senator for Texas, introduced legislation to repeal the Infrastructure Bill’s new reporting requirements for participants within the blockchain industry.

President Biden signed this $1.2 trillion infrastructure bill just two days ago. The bill has been a contentious issue in the crypto community as it contains controversial crypto tax reporting.

Crypto advocates oppose this motion as they believe it’s a devastating attack on the emerging cryptocurrency industry. The provision is likely to abrupt innovation, invade the privacy of many Americans involved in cryptocurrency.

The infrastructure bill includes multiple provisions to ensure capital gains are properly reported, recorded, and taxed. The purpose is to improve tax reporting among crypto users. More precisely, the bill entirely changed the definition of “broker” to improve the Internal Revenue Service (IRS) to those dealing with crypto assets such as bitcoins and other cryptocurrencies.

The new reporting rules introduced in the bill seem harmless to the crypto industry but it’s quite the opposite. As per rules, Bitcoin miners, wallet providers, altcoin stakers, and blockchain software developers are required to hand over data to the IRS to comply with the guidelines.

The infrastructure bill was previously challenged by Senators Cynthia Lummies and Ron Wyden regarding the definition of crypto brokers. But the bill made its way to the floor without any amendments.

Now, Ted Cruz is aiming to repeal this infrastructure bill and he even requested all his colleagues saying – “I urge my colleagues in the Senate to repeal this harmful language that will create regulatory uncertainty and in turn an unnecessary barrier to innovation.”

According to the ‘broker’ definition mentioned in the infrastructure bill, nearly all participants in the crypto industry are considered as financial institutions, which means they have to report consumer information to the IRS, even if these participants do not have access to that information. It is mandatory to collect addresses, names, and transactions of customers which is not possible.

These rules substantially push every company dealing with crypto to report their users’ information. Critics are against this bill as it defies the very concept of decentralized finance.