In Brief:

- Ray Dalio addressed investors saying “cash is not a safe investment.”

- Dalio also recommended a tried-and-true balanced portfolio.

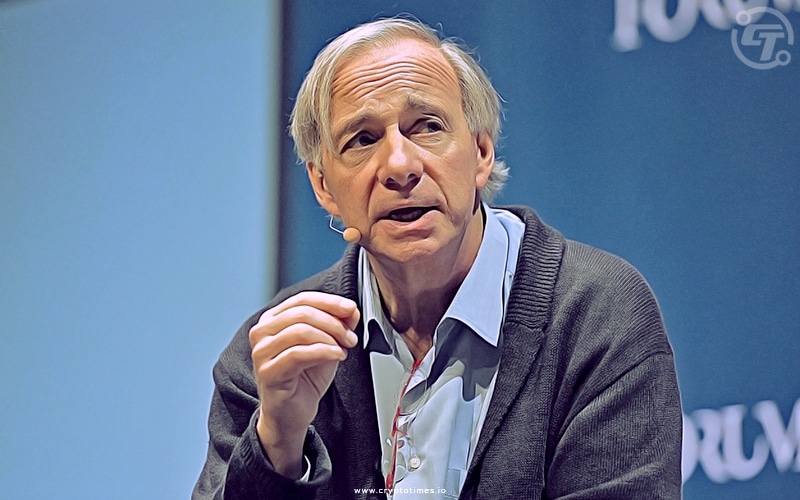

Founder of Bridgewater Associates, Ray Dalio expressed his thoughts on cash in an interview with CNBC, saying that while stocks may be tumbling like a rock, that didn’t imply one should boost their cash holdings.

The hedge fund legend Dalio also stated – “Cash is not a safe investment, is not a safe place because it will be taxed by inflation.”

Money-market funds offer as low as 0.01 percent, while consumer prices rose 6.2% in the 12 months through October, the biggest inflation surge in more than 30 years. During turbulent times like this, it becomes vital to be in a safe, well-balanced portfolio.

He also suggested that investors can lower risk without lowering returns. This could be possible if you were a great market timer, the things that are happening can change the world, so it changes what could be priced into the market.

The omicron strain of coronavirus, first identified in South Africa, has rattled not only the global stock market but also the crypto market. Despite heightened market volatility, Cash is not safe because it will be taxed by inflation. The central bank has been wrestling with inflation that has been more aggressive than they had expected.

In May this year, billionaire investor Dalio announced “I have some BItcoin” when he was more optimistic about blockchain technology. His statements have always been making headlines about one or the other thing. Not long ago, he also emphasized that “Cash is Trash” and he would always choose bitcoin over a bond. Dalio’s concern over inflation and taxation influenced him to call cash investments “unsafe”.

“You can’t raise living standards by raising the amount of money in credit in the system because that’s just more money chasing the same amount of goods,” he explained his statement further. “It will affect financial markets in the ways we’ve seen and it will affect the inflation rate. It won’t raise living standards in an important way. As inflation then begins to bite, it has political consequences.”

Ray’s recent statements show his interest leaning towards crypto. He considers cash as trash and says he’ll choose bitcoin over bonds. Crypto community always considered Bitcoin as a hedge against Cash. This indirectly contemplates digital assets as less prone to factors such as taxation and inflation and hence they act as Safeguard against unforeseen hurdles in the traditional financial system.