In Brief:

- Shaktikanta Das, RBI governor expressed two major concerns regarding CBDC including cybersecurity and digital frauds.

- Though the potential threats to CBDC, RBI also recognized its benefits such as less dependency on cash and reduced settlement risks.

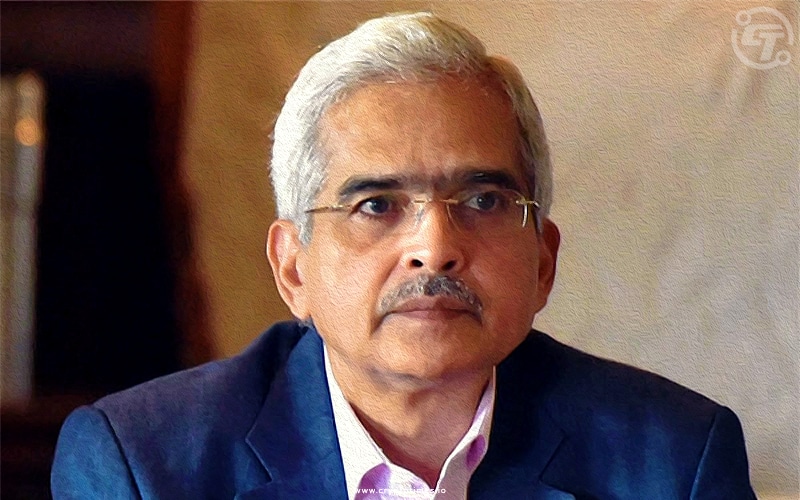

Cryptocurrency has captured India’s attention this year – and also the concerns regarding rolling out its Central Bank Digital Currency (CBDC). The Reserve Bank of India (RBI) Governor Shaktikanta Das today highlighted digital frauds and cyber security as two major areas of concern in a CBDC framework.

Das also stated that cyber security and the possibility of digital frauds pose a threat to RBI’s digital currency. A few years ago the nation faced the consequences of fake currency notes circulation. Similar things can also happen while launching CBDC.

To avoid these kinds of frauds, RBI is much more careful with regard to ensuring cyber security and taking cautionary steps because there will be attempts. He added – “We have to have robust systems and firewalls.”

The RBI governor has always been suspicious about cryptocurrencies. Last month, he addressed cryptocurrencies as a serious concern, and now the concern has shifted to cyber risks and digital frauds associated with it.

He even questioned the number of crypto traders in India saying the reports are “highly exaggerated”. The thought given to at least not banning crypto in the country is a good sign, and the prospect of regulating crypto gives crypto players hope.

Well, that’s only partially true, as CBDC differs from standard cryptocurrency. CBDC will be a legal currency issued by the RBI in a digital form. Also, It will be backed by the government with higher seigniorage. Seigniorage is a difference between the value of the currency and the cost of printing it.

The RBI has listed out CBDC benefits like lesser dependency on cash, as there will not be any need to print notes. As a result, there would be lower transaction costs and reduced settlement risk for banks. In addition to that, there will also be no volatility as seen in cryptocurrencies.

The central bank has already paved its way to roll out CBDC. The new regulatory framework for digital currency would be implemented in the Cryptocurrency and Official Digital Currency Bill, 2021, scheduled for the current winter session.

Last month, RBI also revealed its plan to introduce the digital currency pilot in Q1 of FY23. Taking a one step further, Deputy governor of RBI, T. Rabi Sankar also commented on the matter saying – “There are two areas of CBDC – wholesale and retail -where the RBI is working on. A lot of work has been done on the wholesale side. Some more work is be required on the retail front. Whichever gets readied first, we will release it for pilots”