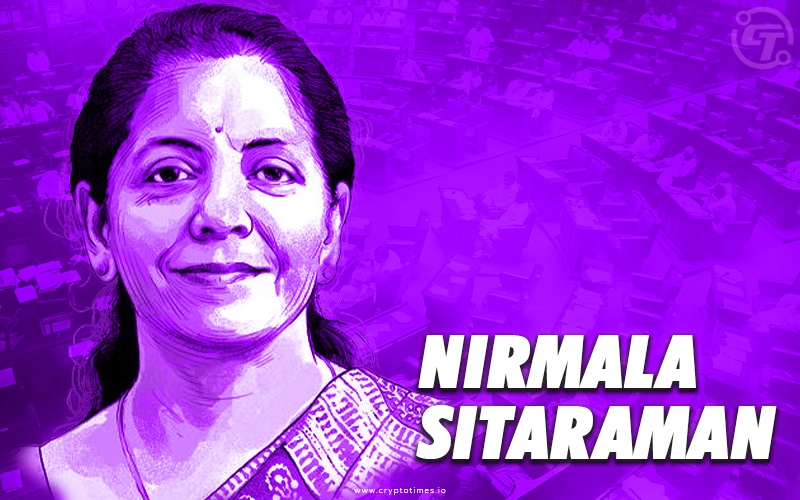

‘In the epic crypto episode’ of Friday, Indian Finance Minister Nirmala Sitharaman said the government has the sovereign right to tax profit emanated from cryptocurrency transactions. However, she further said that the decision on banning or not banning will be taken based on the reports from consultations.

During the Union Budget discussion in Rajya Sabha, the minister said, “I am not going to legalise it or ban it at this stage. Banning or not banning will come subsequently, when consultations give me input”.

In the same reign, she clarified that “(Whether it is) legitimate or illegitimate, it is a different question, but I will tax because it is a sovereign right to tax”.

The statements about the future of cryptos were made in response to the questions raised by the opposition Congress member Chhaya Verma.

On February 1, the government shocked crypto traders and crypto enthusiasts alike when the Finance minister of India proposed that any income from the transfer of crypto assets will be taxed at 30% from April 01. In addition to this, no deductions and exemptions are allowed except the cost of acquisition.

The ‘30% tax figure’ then took social media by storm and people got united for a collective online petition asking the government for a reasonable crypto tax policy.

The Budget 2022-23 had also proposed a 1% TDS on payments towards virtual currencies beyond Rs 10,000 in a year and taxation of such gifts in the hands of the recipient.

However, Sitharaman also said that only RBI-issued ‘Digital Rupee’ will be recognised as currency, thus keeping hopes for cryptos in future quite alive.(if not discard them altogether!)