The co-founders of one of the largest cryptocurrency exchanges and derivative trading platforms, BitMEX pleaded guilty to violating the U.S. Bank Secrecy Act (BSA) in federal court, the press release by the US Department of Justice (DOJ) said.

In Brief:

- BitMEX did not have appropriate compliance programs in regards to the identification of customers, avoiding money laundering.

- It also allowed trading activity in sanctioned jurisdiction.

- Each co-founder will pay $10 million each as a criminal fine for the offense’s monetary gain.

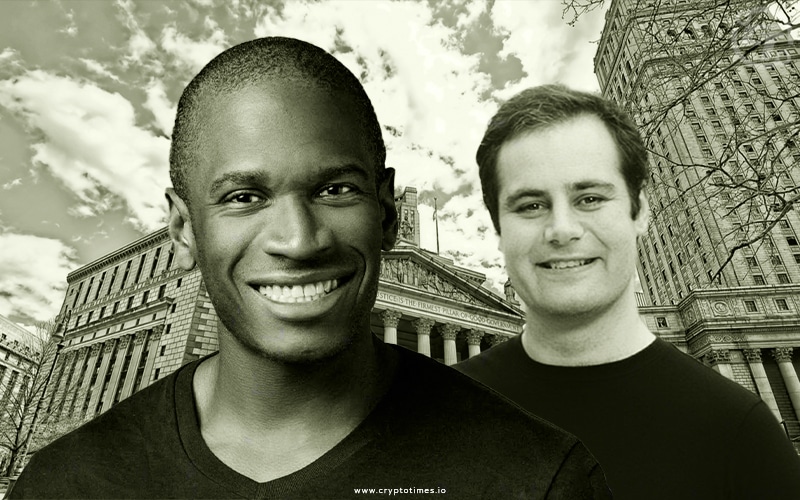

Arthur Hayes and Benjamin Delo, the founders and executives of the Bitcoin Mercantile Exchange (BitMEX) were accused of failing to put in place and maintain appropriate compliance programs to identify customers (or KYC program) and prevent money laundering. The exchange failed to report any suspicious activity (between 2014 and September 2020).

BitMEX is also accused of violating sanctions i.e; it allowed customers from Iran, an OFAC sanctioned jurisdiction, to use the platform.

Hayes and Delo each agreed to pay a separate $10 million criminal fine for the offense’s monetary gain. They could face up to five years in prison, though their actual sentences will be determined later by a federal judge.

Not only did Hayes and Delo fail to institute Anti-Money Laundering (AML) and KYC programs at BitMEX, but Delo also allowed a customer to continue using a BitMEX trading account by falsely changing internal tracking information despite the fact that the customer was explicit “US-based,” simply because that customer was “famous in Bitcoin.”

According to US Attorney Damian Williams, the opportunities and benefits of doing business in the US are numerous, but they come with the obligation for the businesses to do their part to help drive out crime and corruption.

“Arthur Hayes and Benjamin Delo built a company designed to flout those obligations; they willfully failed to implement and maintain even basic anti-money laundering policies. They allowed BitMEX to operate as a platform in the shadows of the financial markets. Today’s guilty pleas reflect this Office’s continued commitment to the investigation and prosecution of money laundering in the cryptocurrency sector, he said.

Hayes resigned as BitMEX’s CEO shortly after the charges were filed.

In 2020, the DOJ and the Commodity Futures Trading Commission (CFTC) both filed federal charges against BitMEX and its founders.

Last year, the CFTC and the Financial Crimes Enforcement Network (FinCEN) settled their own charges against BitMEX, with the company paying a $100 million fine to the two regulatory agencies.