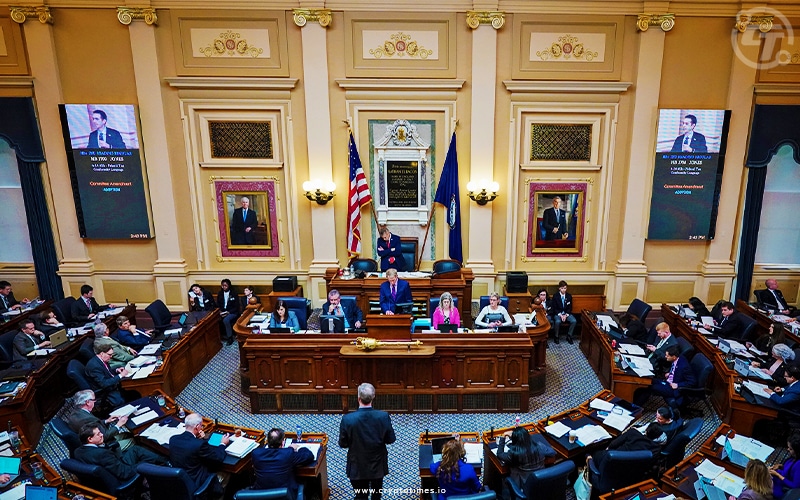

The Virginia Senate unanimously passed a bill for traditional banks operating in the Commonwealth of Virginia to provide crypto custody services if they have the resources to manage the risk.

In Brief:

- The bill passed Senate with a 39-0 vote and will be signed by Governor of Virginia Glenn Youngkin.

- Services can be in fiduciary and nonfiduciary capacities by the banks.

- In the fiduciary capacity, customers have to create new private keys and park their crypto with the banks.

Crypto custody is not the same as a traditional wallet, and it caters to institutional investors. This bill allows banks to keep customer wallet keys on file, and it’s intended for institutional investors with large crypto holdings.

The bill cleared the Senate with a 39-0 majority. Governor Glenn Youngkin will sign it making it applicable.

Banks that want to offer this service to their customers must meet three particular conditions outlined in the bill:

- They must develop appropriate risk management systems

- Have adequate insurance coverage

- Start a cryptocurrency risk oversight program

The press release stated that the bill defines “virtual currency” and stipulates that a bank may provide custody services in either a nonfiduciary or fiduciary capacity.

The bank must have trust powers and a trust department approved by the State Corporation Commission if it decides to provide such custody services in a fiduciary capacity.

Customers will be required to transfer their virtual currencies to the bank’s ownership by creating new private keys that will be held by the bank in a fiduciary capacity.

Bill no. 263, introduced by Delegate Christopher T. Head earlier, aims to capitalize on the growing popularity of bitcoin. Although there was an amendment to allow eligible banks to offer crypto custody services, as he said,

“A bank may provide its customers with virtual currency custody services so long as the bank has 26 adequate protocols in place to effectively manage risks and comply with applicable laws.”

As the bitcoin market evolved through 2021, favorable regulations have come along. One of the largest retail banks of the country U.S. Bank had announced that it has begun offering cryptocurrency custody services to fund managers.