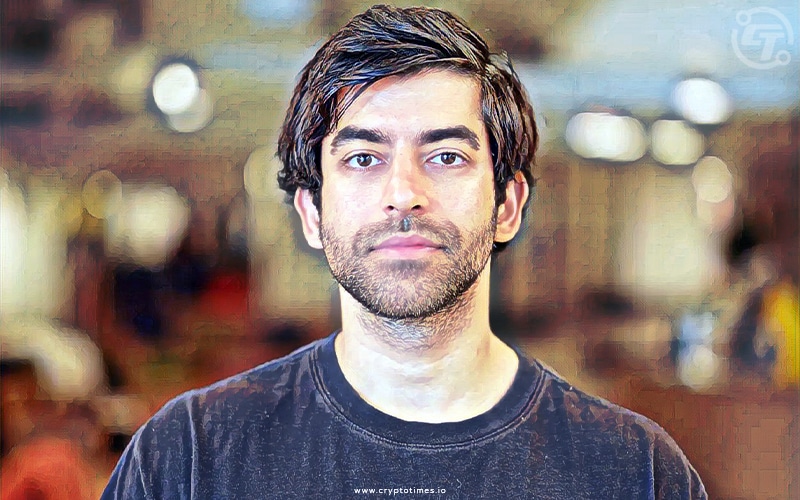

The former Polychain partner and co-founder of Blockchain Association, Tekin Salimi, launches a $125M crypto venture fund titled ‘dao5’ which will be transformed into a founder-owned DAO in three years.

According to a Forbes report, dao5 is set to invest in early and pre-seed stage firms and projects in a range of crypto verticals. This includes Layer 1 blockchain technology, privacy tech, DeFi, DAOs, gaming, and NFTs. The average investment will range from $500k to $2M.

Emin Gün Sirer, the founder of the Avalanche protocol, Do Kwon, the founder of the Luna protocol, and Meltem Demirors, the chief strategy officer at CoinShares, are among dao5’s board of advisors.

Tekin Salimi plans to convert dao5 into an actual DAO by 2025. “We have around three years to figure it out and get it entirely right,” Salimi stated.

The whole outline is that when dao5 invests in a new business, the project’s founder will be granted governance tokens in the future DAO. Portfolio founders will have financial exposure to each other’s work overtime, as well as a direct incentive to collaborate.

Upon the transition to a DAO, the legal entities that comprise the fund will be dissolved, and tokens will be minted and distributed to the fund’s investment team, advisory board, and portfolio company founders.

Salimi noted, “The goal of dao5 is to explore a new model to bootstrapping a DAO by focusing first on talent and capital acquisition through venture investing, and second on growing the treasury value through leveraging the collective talent of the dao5 community.”

Salimi concedes that much of the future roadmap is still out in the air, but he is optimistic that the industry will eventually provide some of the tools and regulatory clarity he requires to make this work.

Several other venture capital firms are also exploring the idea of DAOs in recent times. Just a week back Bessemer Venture Partners launched a $250M crypto fund for Web3 projects and announced the upcoming BessemerDAO.