Alexandre Arnault, the 29-year-old son of LVMH mogul and the third-wealthiest person in the world, Bernard Arnault is being accused of insider trading of Hypebear NFTs .

He reportedly placed a $3,100 bid for an NFT dubbed as HypeBear #9021 on marketplace OpenSea after being tipped on its rather ‘secret rarity’.

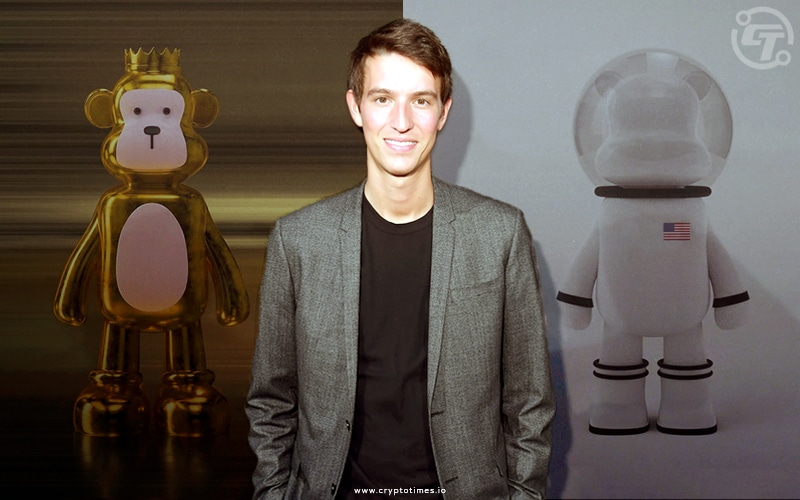

HypeBears #9021 is a cute golden-monkey faced digital bear that stands upright and wears golden crocs. It is one of the rarest and also one of the most valuable in the 10,000 image collection.

As per reports, in February, buyers were bidding during the “pre-reveal,” wherein the traits of the bears are kept hidden and no one has the slightest idea about them. Also, which bear has the rarest trait is not known to anyone. Arnault, an executive at Tiffany & Co., was apparently bidding blindly and got hold of a great deal.

Arnault was so resolved to buy HypeBear #9021 that he bid almost 32% more than what other unrevealed HypeBears were being sold on that day. He won the bid. And so, he did the same for HypeBear #7777 by bidding 58% above the then ongoing rate. He continued to make similar offers for seven other digital bears.

The real marvel was that when two days later, the identities and details of each of the 10,000 bears were revealed, Arnault had ‘surprisingly’ bid on five and had gotten three of the ten rarest, including #9021 and #7777.

Seemingly, it is quite an odd coincidence, that his offers were randomly made, without knowing about the rarity of the items and he still got hold of the rarest ones.

The odds of getting a lucky deal on the rarest of the NFTs is one in 440,000, as per Convex Labs, a tech startup aiming to make the crypto and NFT markets more transparent.

Arnault pitched the ultra rare #9021 four days later for $14,700, thus, earning a 377% gain amounting to a profit of $11,600. HypeBear #7777 is decked in a white astronaut suit adorned with an American flag.

Arnault initially paid $3,900 for it and sold it a month later for $12,900 through his multiple cryptocurrency accounts to make the trades.

A spokesperson for Arnault ardently denied the ‘rumours’ that he had inside information about the bears’ attributes.

Oddly, although there are many transactions that involve market manipulation and insider trading, they are not ‘overtly’ illegal. Thanks to the largely unmonitored world of cryptos and NFTs.

Infact, last year, OpenSea had admitted that Nate Chastain, head of product at OpeanSea was accused of taking advantage of the platform’s front-page NFT drops before its release, and was thus, involved in insider trading.

Ricardo Rosales, the CEO of Convex Labs suggested that there’s a lot of promise in NFTs, even when there are a lot of bad agents. He added, “We approach it from the perspective that if something can go wrong, it will, and if somebody can take advantage, they probably are.”

On February 10, the day when HypeBears were revealed, founder of the HypeBears project Ernest Siow tweeted a screenshot of him and Arnault on a video call and captioned it as , “Great catchup brother! Let’s now check out our bears.” Even Arnault retweeted it.

That leaves many speculating that Arnault was tipped off by Siow!