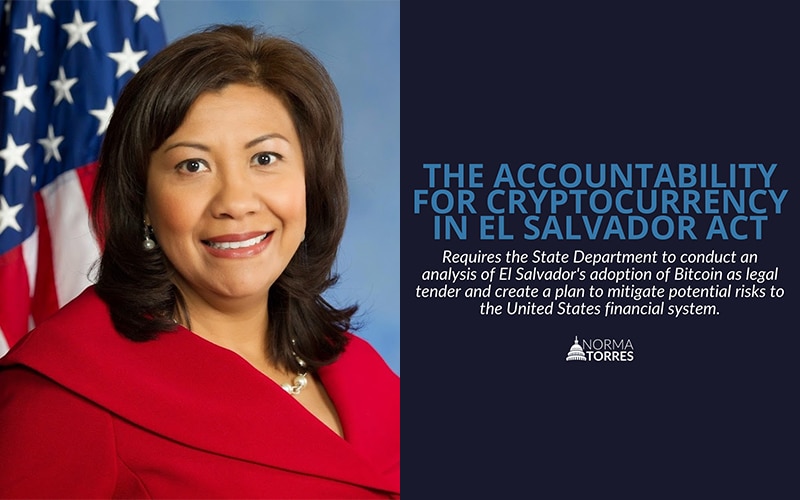

On Monday, the US senate introduced the ‘Accountability for Cryptocurrency in El Salvador Act’ to ease the risks from El Salvador’s adoption of Bitcoin(BTC) as legal currency to the United States.

As per the press release, the bill directs the State Department to outline a plan to mitigate the perils to the U.S. financial system on account of the analysis of the risks to El Salvador’s “cybersecurity, economic stability and democratic governance” due to El Salvador’s legalization of Bitcoin last year.

It is also informed that this bill was introduced as companion legislation to a bill introduced last month by the Senators Jim Risch, Bob Menendez and Bill Cassidy which in turn irked El Salvadoran president Nayib Bukele.

Thus, the aim of the bill is to have the Secretary of State and federal department heads report to Congress within 60 days on a plan to “mitigate any potential risks to the United States financial system posed by the adoption of a cryptocurrency as legal tender” in El Salvador.

The bill also aims to check threats posed to other countries accepting the U.S. dollar i.e. Micronesia, Ecuador, Palau, East Timor, Zimbabwe and the Marshall Islands.

Expressing her concerns, Congresswoman Torres said “El Salvador is an independent democracy and we respect its right to self-govern, but the United States must have a plan in place to protect our financial systems from the risks of this decision, which appears to be a careless gamble rather than a thoughtful embrace of innovation.”

Torres also quoted the IMF’s reports that the legalization of Bitcoin involves “large risks” related to financial stability, financial integrity and consumer protection. It even advised El Salvador to remove the tag of legal tender from Bitcoin.

Reiterating similar apprehensions, Representative Crawford stated “El Salvador’s hasty decision to adopt Bitcoin as legal tender causes concern for the stability of the U.S.-Salvadorian economic relationship. It is our job as policymakers to better understand the potential effects of the adoption of Bitcoin as legal currency in El Salvador and what the U.S. can learn going forward.”