Amid the ongoing crypto market chaos caused by the Luna token crash, the Do Kwon’s stablecoin is unbelievably coming back to the markets as Luna 2.0.

The Terra ecosystem voted to pass Do Kwon latest plan, Proposal 1623 with a 65.5% majority.

The proposal lays out a plan for creating a new Terra chain without the algorithmic stablecoin.

The old chain will be called Terra Classic and the token Luna Classic (LUNC), while the new chain will be called Terra and the token Luna (LUNA).

Popular Terra projects such as Astroport, Prism, RandomEarth, Spectrum and Nebula will also transfer to the new chain.

The new Luna token will be airdropped to Luna Classic stakers, Luna Classic holders, residual UST holders, and essential app developers of Terra Classic.

The amount of Luna tokens received by a user will depend on:

- the type of tokens held on the Terra Classic chain,

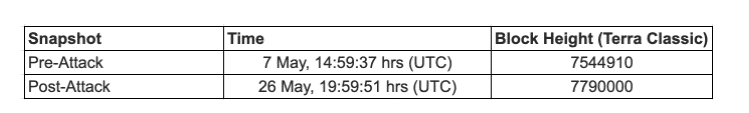

- the amount of holding time of these tokens (based on Pre-Attack and Post-Attack snapshots)

- the quantity of tokens held.

The Pre-Attack and Post-Attack snapshots are as follows:

The TFL’s wallet, LFG’s wallet and the distribution module where the Community Pool exists will not be included in the airdrop whitelist.

A full distribution schedule has been released by Terra, with the airdrop initiating on May 27. The same day the genesis block of the new Terra chain will be created.

Terra has already released the Terra Core code for the new chain, while the testnet is also now live.

The token drop is already garnering support from major crypto exchanges across the globe. FTX, Bitfinex, Bitrue, Huobi and HitBTC have already announced that the new token will be listed on their platforms.

Binance, the world’s largest exchange platform tweeted “We are working closely with the Terra team on the recovery plan, aiming to provide impacted users on Binance with the best possible treatment.”

Tomorrow’s markets will be an interesting playground to witness whether the debut of Luna 2.0 makes a difference or not.

Regardless of the market scenario, Luna and Terra’s creator Do Kwon is in hot waters with the South Korean government. The South Korean police are seeking to freeze the LFG Assets while on the other hand, South Korean Luna investors are mobilizing to sue Do Kwon for fraud and illegal fundraising.