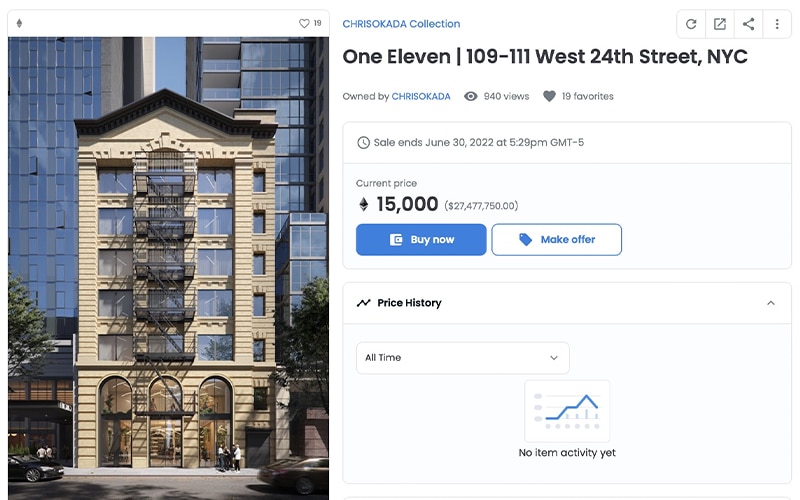

It seems like the future of real-estate is already here as a New York based real estate investment and brokerage firm Okada lists a NY building as NFT on OpenSea for a whopping 15,000 ETH, approximately $27M.

The sale of the NY building NFT will end on July 1st at 3:59 AM GMT+5:30.

Okada & Company is selling One Eleven|109-111 West 24th Street, New York, NY (the “Property”) a 46,299 RSF office & retail building in the NoMad / Flatiron section of Chelsea, NYC.

The purchaser of the building NFT will receive the exclusive rights to acquire the building, including all of its uses rights and accompanying deed covenants.

The sale of the NFT does not guarantee the completion of the real estate transaction or represent the transfer of the deed or title given the nature of real estate sales.

This means that typical real estate procedure must be followed in its entirety by the NY City building NFT purchaser.

The purchaser is recommended to interact with both the property and NFT Teams before the completion of the NFT purchase in order to ensure a quality transaction and to prevent fraud both before and after the transaction.

Before finalizing the NFT purchase, multiple steps of wallet verification should be performed.

A time stamped buyer & wallet registration form will be required of the buyer. Only wallets stamped before the end of the auction will be considered, and both the pre-transaction and post-transaction wallet addresses must match.

This is not Okada’s first NFT venture. The firm began offering NFTs in March to entice brokers to assist in the leasing of a commercial building in NY City. Membership in a private dining club billed as “the world’s first NFT restaurant” was the incentive.

Christopher N. Okada, the firm’s chief executive, stated “It’s a way to embrace what’s happening within the world of commerce and technology,” in March.

When the firm put up the NY building as an NFT this time questions arose from the community asking why even bother to list it as an NFT if the purchaser has to go through traditional real estate procedure to own the property later anyways.

To which Christopher replied that the firm is exploring ways to find new and innovative ways to sell a property. But due to the U.S. SEC’s regulations, the firm had to do this way for the time being but are trying to find a way to fully tokenize the procedure soon.

By all means, Okada & Company is truly revolutionizing the real estate industry with this bold move. Other realtors should catch up soon because the web3 space is fast evolving and they will get left out of this amazing opportunity.

Read Latest Update on NFT