The Celsius Network, one of the largest crypto lenders and fintech platforms known for challenging traditional banking models, has paused withdrawals, swaps, and transfers between accounts. It stated that this move was made “due to extreme market conditions”, sparking speculations about Celsius’ alleged liquidity crisis.

In a blog post that left users anxious, the DeFi platform stated, “We are working with a singular focus to protect and preserve assets to meet our obligations to customers,” as it informs of having activated a clause in its Terms of Use to halt withdrawals.

The announcement follows one of the most severe weekends in the cryptocurrency market, during which hundreds of millions of dollars were lost. Aside from that, the Celsius Network is allegedly running out of liquid funds to pay back their investors who are redeeming positions.

A liquidity crisis occurs when an entity lacks withdrawable assets or assets that are “easy to convert”.

What are the indicators of such a crisis on the Celsius Network?

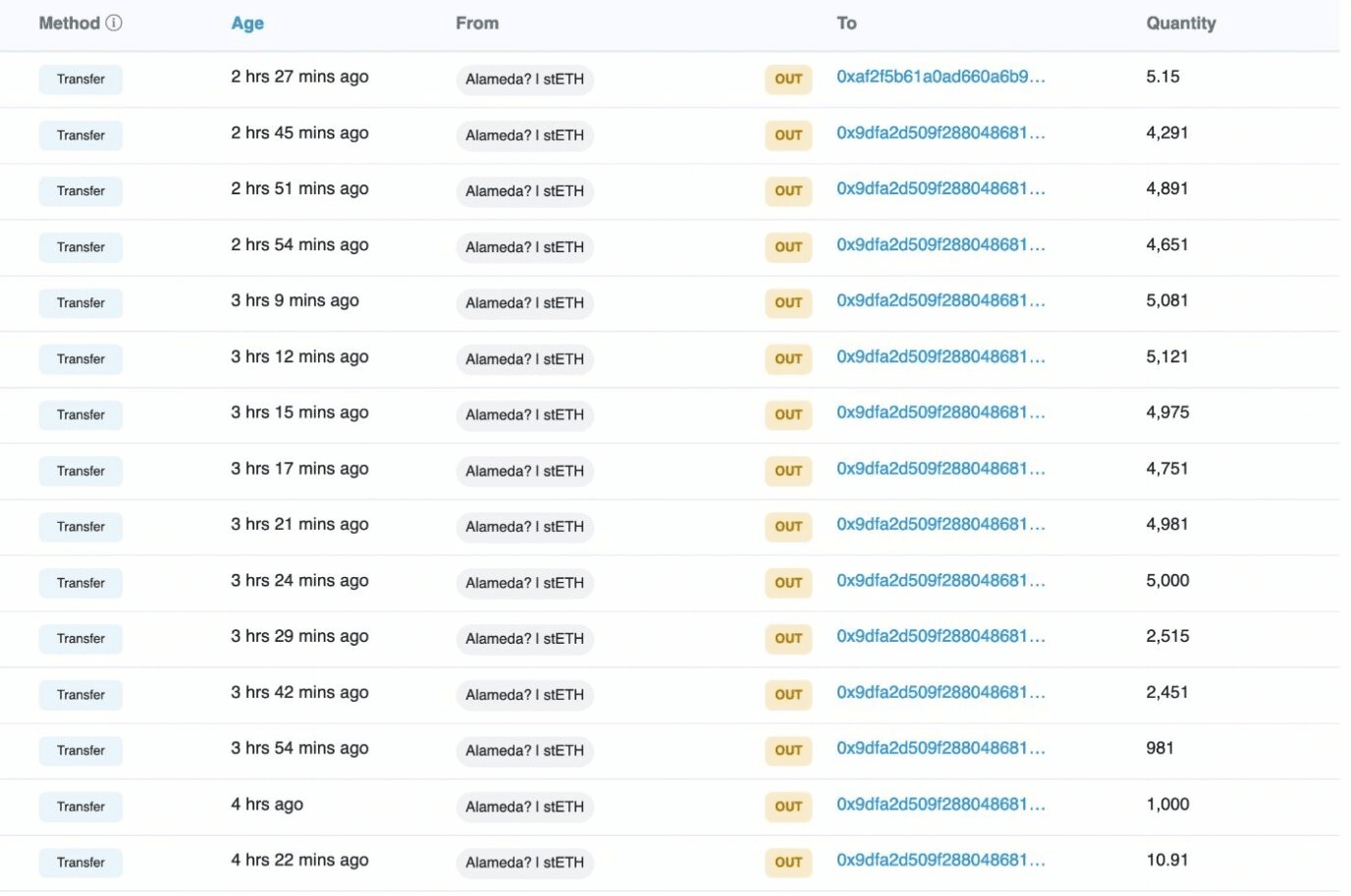

Alameda Research, led by SBF, appears to be exiting its positions on stETH. Lido Finance’s stETH is a staked version of ETH. Alameda Research is one of the seven holders of Lido (stETH), and it is known for being early in big moves. The leading trading firm redeemed 50,000 stETH for ETH.

While the redemption of the position is not in and of itself a cause for concern, analysts are concerned that the Celsius network may not have enough liquid funds to pay investors who are redeeming their positions.

Celsians reported that the firm implemented the HODL Mode feature, a security feature that allows Celsius Network account holders to temporarily disable outgoing transactions, without user consent at the end of May.

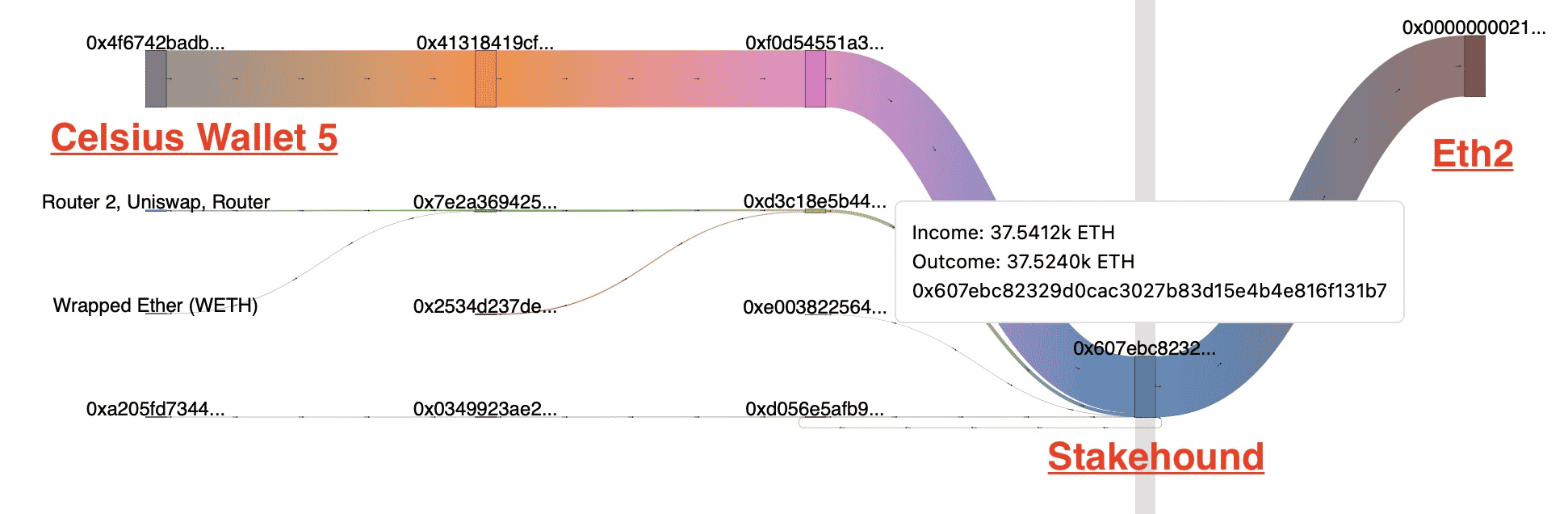

Celsius Network allegedly lost a significant amount of money over the last year because of various incidents. One of these was a $70 million loss caused by a StakeHound exploit.

There have been token movements in Celsius’ main DeFi wallet since it began removing WBTC from the Aave staking and lending platform. Following a series of transactions, it sent all those tokens to the FTX exchange.

The firm may be attempting to ensure the stability of its liquidity by replacing many of its assets.

You can stay up to date on such DeFi news by subscribing to The Crypto Times.