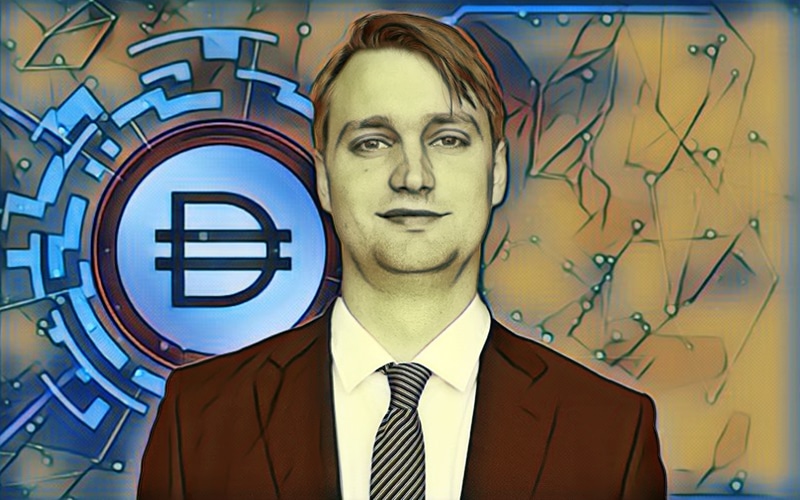

Co-founder of MakerDAO, Rune Christensen outlined the necessity of limited RWA exposure and free-floating Dai in the recent DAO forum.

The forum entitled, “The Path of Compliance and the Path of Decentralization: Why Maker has no choice but to prepare to free float Dai”, affirmed that “we must choose the path of decentralization, as was always the intent and the purpose of Dai.”

In his forum, he asked MakerDAO community to emphasize more on free floating currency backed by other decentralized entities “that could falls in value”.

The news came after Rune Christensen advised the DAO community on the Discord server to seriously consider the precaution for de-pegging in their stablecoin with USD.

Also, he stated that authoritarianism is a far more bigger threat than RWA risk associated with decentralized entities. According to him DAI can not become blacklistable and hence, it doesn’t require compliance.

He advised community members to consider one and only option to mitigate attack surface by reducing RWA exposure to a maximum fixed percentage of the total collateral. To make this possible, DAI stablecoin must be free floating away from USD.

He slammed the regulatory’s “post-9/11 paradigm” behavior as their stance over financial compliance is “either you’re with us or you’re against us”. Currently, most governments follow “zero tolerance for anything that doesn’t give full control and surveillance powers to the state”.

Furthermore, he cited two effective tools, MetaDAOs and Protocol Owned Vault to make its stablecoin free floating from USD.

MetaDAO token will provide justification “for why a free floating currency should exist and why users should accept something that falls in value vs USD”. Also, it can incentivize more supply of Dai generated from decentralized collateral, which will help the community to scale up.

Protocol Owned Vault will allow Maker to gain profit from negative Target Rate of Dai, and put a lower limit to how negative the Target Rate can go.