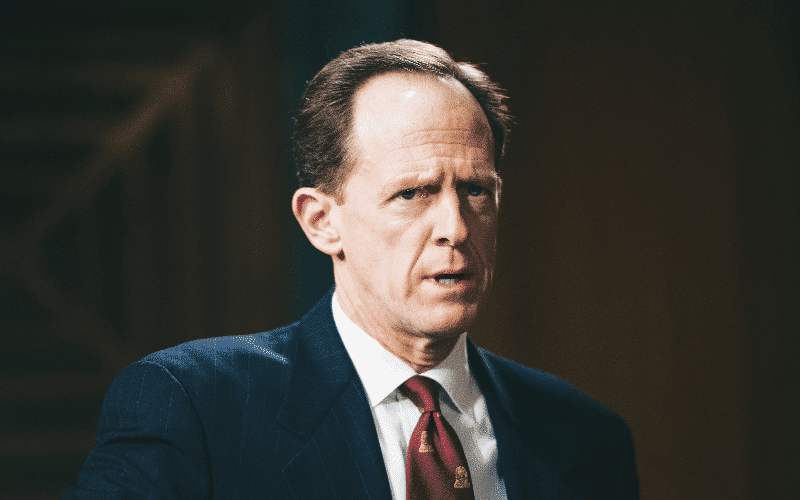

Republican Senator Pat Toomey grilled the SEC and its chair Gary Gensler about the framework they use for regulating crypto, and over Gensler’s view that nearly all cryptocurrencies are like unregistered securities.

Toomey suggested that the SEC isn’t doing its job well enough during a Thursday oversight hearing of the agency by the Senate Banking Committee.

Toomey said, “Unfortunately, some of the SEC’s recent actions and inactions raised concern about how well it’s carrying out this important mission [protect investors; maintain fair, orderly, and efficient markets; and facilitate capital formation].”

Toomey also suggested that the SEC is not as transparent as it should be. “The problem is that the SEC isn’t sharing with us the framework they’re using” he said.

Toomey also pointed out the differences between traditional securities and crypto, noting that these differences “merit a clearly stated and tailored regulatory framework.”

Gensler reiterated his view that the Supreme Court has addressed the definition of a security, that there is a well-established, multifactor test that most tokens meet.

Toomey also suggested that the Congress might need to intervene and develop a clear framework for crypto investors, however the SEC ought to provide “much more clarity” in the meantime.

The SEC did not do enough to help the investors when the market fell in a slump earlier this year, said Toomey.

Gensler responded that many companies have not directly communicated with the SEC over listing and selling tokens and need to come forward and do so.

Gensler also believes that it is necessary to have “one cop on the beat” regulating cryptocurrency.

Read Also: SEC Chair Gensler Sharpens Stance on PoS Crypto as Securities