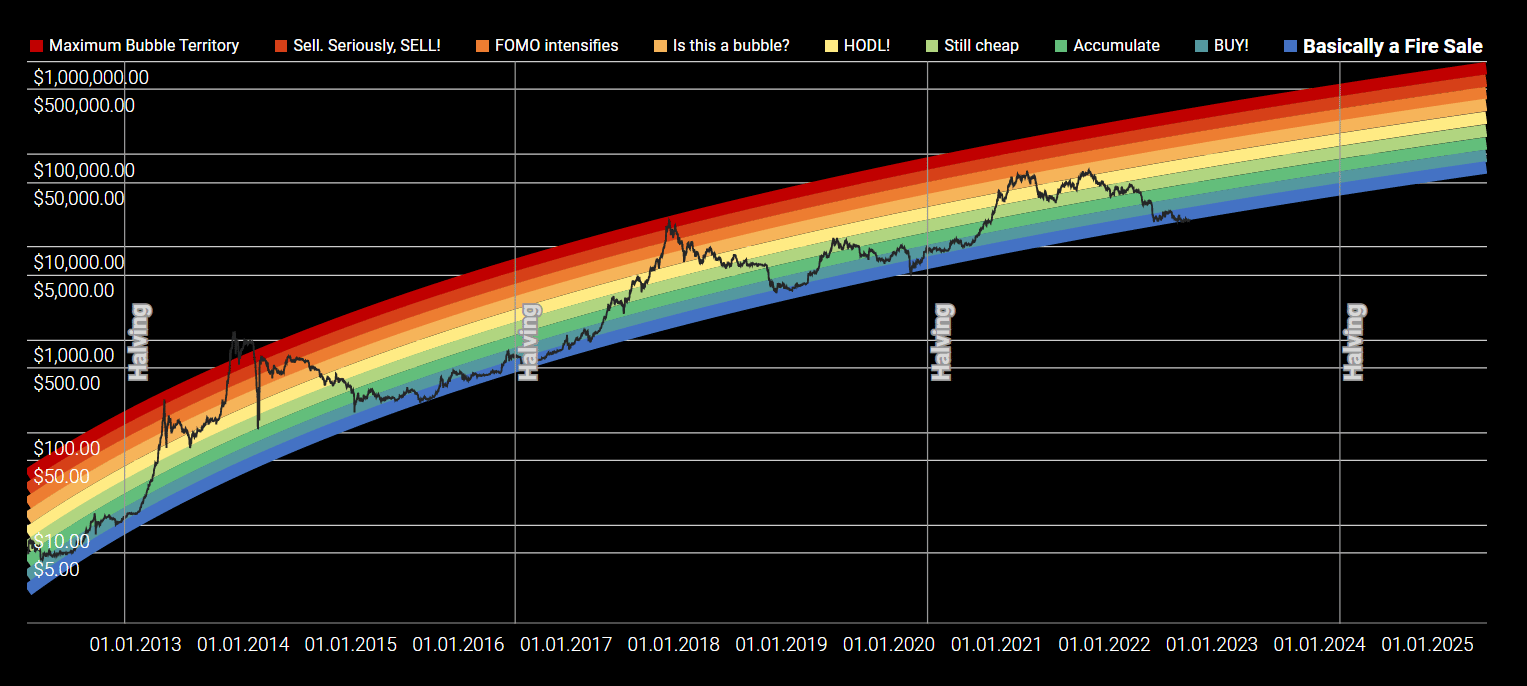

The Bitcoin Rainbow Chart is a tool for visualizing the price action of Bitcoin over time. While it is not an accurate predictor of future prices, it can be used as a guide to help you make investment decisions. It uses color bands to support buying and selling decisions, based on market sentiment.

It was developed by an early Bitcoiner who goes by the name Azop on Reddit, as a “fun way of looking at long-term price movements, disregarding the daily volatility ‘noise’.”

From an all time high price of $68K for the Bitcoin in Nov 2021, bitcoin’s price fell precipitously to $47K at the end last year. Year to date, the price of bitcoin has continued to tumble, retracing briefly in March, only to persist in falling.

Since June, the world’s first cryptocurrency has traded in a range bound by $24K and $18.8K, with key support holding around the psychologically important $20,000 level.

That was the first eye-popping record price of the Bitcoin way back in 2017, when a searing hot bull run flew the price of bitcoin up from under $1,000 to start the year— all the way to $20,000. From this brief summary of the wild swings in bitcoiners’ fortunes, it’s apparent that investing or saving your money in bitcoin can be a very risky business.

Whatever else it may be to its many enthusiasts and critics, Bitcoin has certainly been one of the most interesting investments of the last decade.

The Downside of Investing in Bitcoin: Volatility

Many bitcoin investors have made some good profits, many have made a fortune, many have taken some tough losses, and many have lost a fortune. Even at the intraday time scale, the bitcoin price is unusually volatile among traded investment assets. Indeed at any time scale, bitcoin price movements are very volatile.

As Bitcoin has experienced numerous price fluctuations recently, and many investors and traders are constantly seeking reliable methods to predict the market’s direction. To further enhance your cryptocurrency experience and quickly convert between digital assets, check out the cryptocurrency converter at CoinChefs.

Day traders love bitcoin for its volatility, as their business is based on profiting from trading against volatility. But not everyone who invests or saves some of their money in bitcoin is a day trader. In fact, most aren’t!!

If only there were a simple way for those with less appetite for risk— who don’t actively manage their investment portfolios every day or week— to scoop a little extra profit by exiting before big price drops and entering at attractive price points.

One model for maximizing ROI and mitigating losses that crypto investors have taken a liking to in 2022 are Bitcoin Rainbow Charts. These charts make it clear enough when to sell, when to hold, and when to buy bitcoin. They base these recommendations on ten years of historical price data from major crypto exchanges.

Before going over the advantages and disadvantages of the Bitcoin Rainbow Charts, and whether it is a reliable guide for buying and selling Bitcoin, here’s a quick overview of what the rainbow chart is and how it works.

Buy Low, Sell High: The Bitcoin Rainbow Charts

The Bitcoin Rainbow Charts are based on a simple truism of investing that applies to any asset classes, not just cryptocurrency. Wall Street has long said it about stocks— shares of corporate equity— and it’s just as true about fixed income instruments (bonds) and commodities.

The dictum “Buy Low, Sell High” is fundamental and self-evident. The Bitcoin Rainbow Charts are therefore not irrational investment tips or some obscure, overly technical trading lingo.

The graph is a logarithmic historical price graph for bitcoin that spans many years. In other words, as you move up the chart, every multiple of $10 after that gets flattened to occupy the same amount of vertical space as the multiple of $10 before it. In this manner, you can truly visualize the price of bitcoin as a line graph without needing a very large screen!

Overlaid on the line graph of the price is a band of nine recommendations color coded using the ROY G BIV of the visible color spectrum. That’s how the Bitcoin Rainbow Charts got its name. You can see the line graphing bitcoin’s price wiggling up and down within this band, through its various recommendations.

The Bitcoin Rainbow Chart consists of 9 rainbow colors. Each color has the following meanings:

- Dark Red – The bubble is about to burst.

- Red –The investors should start selling by now.

- Dark Orange – The investors just started being too FOMO (Fear of Missing Out).

- Orange – This could become a bubble very soon.

- Yellow – HODL! (stands for “Hold on for dear life!”)

- Light Green – The price started to drop

- Green – The investors should start buying by now (accumulate).

- Bluish Green – BUY IT!

- Indigo – Fire sale like the world’s going to end.

When an investor sells at the low end, is oversold and cheap to buy, bitcoin is a tempting entry point to maximize profit. It can be difficult to decide whether to sell immediately and take a loss or to keep your money invested in bitcoin until the next bull run because it is overbought and expensive to buy at the high end.

Are The Bitcoin Rainbow Charts Reliable?

The Bitcoin Rainbow Charts are calibrated to be reliable historically. That is, if you had taken the recommendation of the chart over the historical price movements of bitcoin on crypto exchange markets, most of the time it would have served you well.

The advantage of using the Bitcoin Rainbow Charts is that they take all the emotion and guesswork out of managing your bitcoin holdings.

Because markets often behave in a clunky manner, investor psychology usually causes people to feel egotistical about their investments and make poor investment decisions on the spur of the moment. This might be helped by selecting one or two straightforward, smart tactics and adhering to them.

However, the fact that the Bitcoin Rainbow Charts make static recommendations is also a disadvantage, because it doesn’t take into account all the dynamics of the changing industry and marketplace, and as a technical analysis tool, it is agnostic to fundamental analysis.

Past results are no guarantee of future results, but they can often help make better future projections.

Conclusion:

Bitcoin Rainbow charts could be an excellent tool for users if combined with other crypto trading indicators, such as the Fear and Greed Index, RSI (relative strength index), etc.

However, the Bitcoin Rainbow chart is not investment advice. It is for educational and entertainment purposes only. There is no guarantee that past performance fit within the rainbow channel will continue to play out in the future.