The collapse of FTX has caused a destructive wave to wash over crypto, causing significant collateral damage, and rival exchanges have attempted to reassure jittery investors of their own stability. Kris Marszalek, CEO of Crypto.com, denied that the exchange is in trouble and reiterated that it has a strong balance sheet.

The CEO fielded questions during a live-streaming YouTube address, stating that the platform always kept reserves to match every coin customers held on its platform.

The AMA (ask-me-anything) session came after investors questioned a transfer of 320 ETH tokens to the Gate.io exchange on Oct. 21 on Twitter over the weekend.

“At no point were the funds at risk of being sent somewhere where we could not get it back. It happened over three weeks ago. It had nothing to do with any of the craziness that has been happening since FTX collapsed,” he said.

Marszalek stated that an audited proof of the exchange’s reserves report would be published within weeks and that the exchange did not engage in any “irresponsible lending products.”

He also stated that withdrawals are working as expected and that the exchange’s token (CRO) has never been used as loan collateral, in contrast to the relationship between FTX and Alameda and FTX’s token, FTT. According to him, its exposure to FTX was limited to $10 million.

“We recovered $990 million from FTX,” Marszalek said.

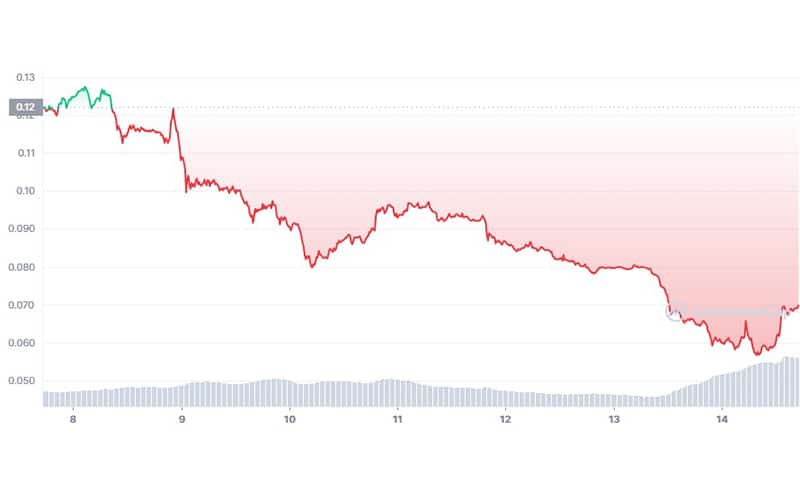

Crypto.com’s CRO token has dropped nearly 45% in the last week due to liquidity crisis FUD about the exchange.