DeFi Giants Aave and Compound have frozen markets and imposed lending caps as part of their de-risk effort. The decision has been taken considering the ongoing turmoil in crypto markets.

Compound implemented the action plan to avoid any potential vulnerabilities in its lending mechanism after an alleged exploit attempt on Aave.

In response to recent market events, both DeFi lenders proposed to reduce the risk profile across many higher volatile assets. Compound Finance passed a proposal to impose loan limits and introduce new borrowing caps to lower risk on its platform.

The community voted in favor of introducing or lowering the maximum borrowing amount for ten cryptocurrencies on Compound protocol including WBTC, BAT, UNI, COMP, LINK, SUSHI, ZRX, AAVE, YFI, and MKR.

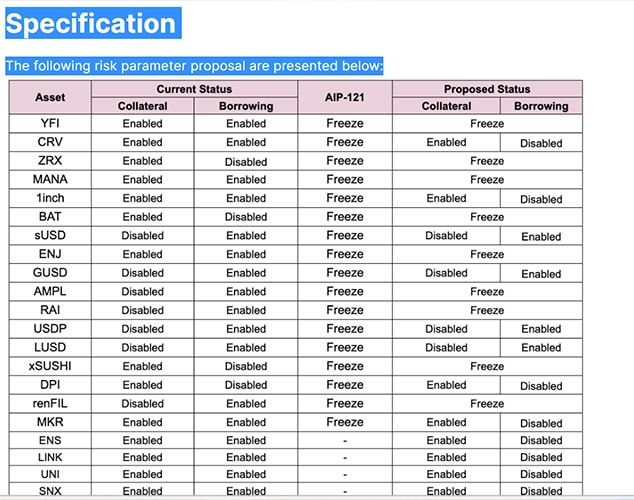

On the other hand, Aave proposed to pause lending markets in the Aave V2 for 17 Ethereum-based tokens comprising 5 stablecoins given the current highly volatile condition of these assets.

The concerned lending markets are yearn.finance, 0x, Decentraland, Curve DAO, 1inch, Ampleforth, Basic Attention Token, DeFi Pulse Index, Enjin, renFIL and Maker, xSUSHI, and five stablecoins including sUSD, GUSD, RAI, USDP, and LUSD.

Aave and Compound account for $3.7 billion and $1.7 billion worth of the total value locked in the DeFi ecosystem. The ongoing liquidity crunch in the market has led these crypto lending protocols to set borrow caps, avoiding high-risk attack vectors.

Both saw huge downward swings recently with Aave having 31% fewer assets on its platform compared to a month ago whereas the compound slumped by 26%.