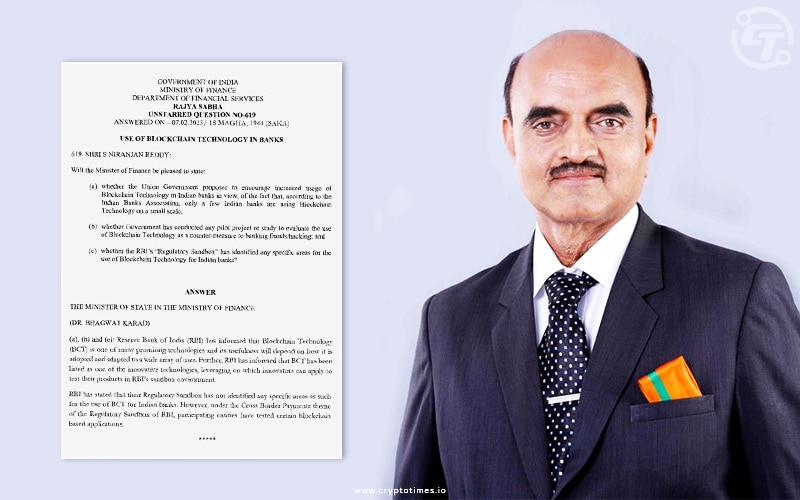

The Indian Union Minister of State for Finance, Dr. Bhagwat Karad, responds to questions raised in the Rajya Sabha on the use of blockchain technology in banks.

Member of Rajya Sabha, S. Niranjan Reddy, queried if the Union Government proposes to encourage increased usage of Blockchain Technology in Indian banks because as per Indian Banks Association, only a few Indian banks are using Blockchain Technology on a small scale.

Reddy further asked if the Indian Government has conducted any pilot project or study to evaluate the use of Blockchain Technology as a countermeasure to banking frauds or hacking. He questioned the Minister on whether the RBI’s “Regulatory Sandbox” has identified any specific areas for the use of Blockchain Technology for Indian banks.

Minister Karad replied that the Reserve Bank of India (RBI) has informed Blockchain Technology (BCT) is one of many promising technologies and its usefulness will depend on how it is adopted and adapted to a wide array of uses.

Karad said that RBI disclosed BCT has been listed as one of the technologies, allowing innovators to apply to test their ideas in RBI’s sandbox environment.

“RBI has stated that their Regulatory Sandbox has not identified any specific areas as such for the use of BCT for Indian banks. However, under the Cross Border Payments theme of the Regulatory Sandbox of RBI, participating entities have tested certain blockchain-based applications,” Karad responded.

Another Member of Rajya Sabha Narayana Koragappa queried on how the Ministry looks at 7% of Indians owning crypto, which is the 7th highest in the world, and how the Ministry looks at that, except the US, there is no other country having a large economy in top seven positions.

Minister Pankaj Chaudhary responded by stating that crypto Assets are unregulated in India and the Government does not collect data on crypto assets. On the banning of Crypto he further said that, “any legislation for regulation or for banning can be effective only with significant international collaboration.”

A few days back, Economic Affairs Secretary Ajay Seth also stated that India is aiming for consensus on crypto regulation at G20 Presidency. Seth explained that because crypto is a class of asset that can be traded internationally, “it requires all countries” to accept the policy.