The crypto market tends down as Coinbase chief Brain Armstrong criticises US Security and Exchange Commission’s plan to shut down staking for retail investors. Additionally, the oldest P2P bitcoin exchange LocalBitcoins is unable to survive in crypto winter, and it’s going to shut down on 16 February 2023.

Thus Bitcoin price dipped below $22K on Thursday and it led the entire crypto market down. Resulting in, market cap plunged nearly 4% overnight and stayed $1.02 Trillion at press time.

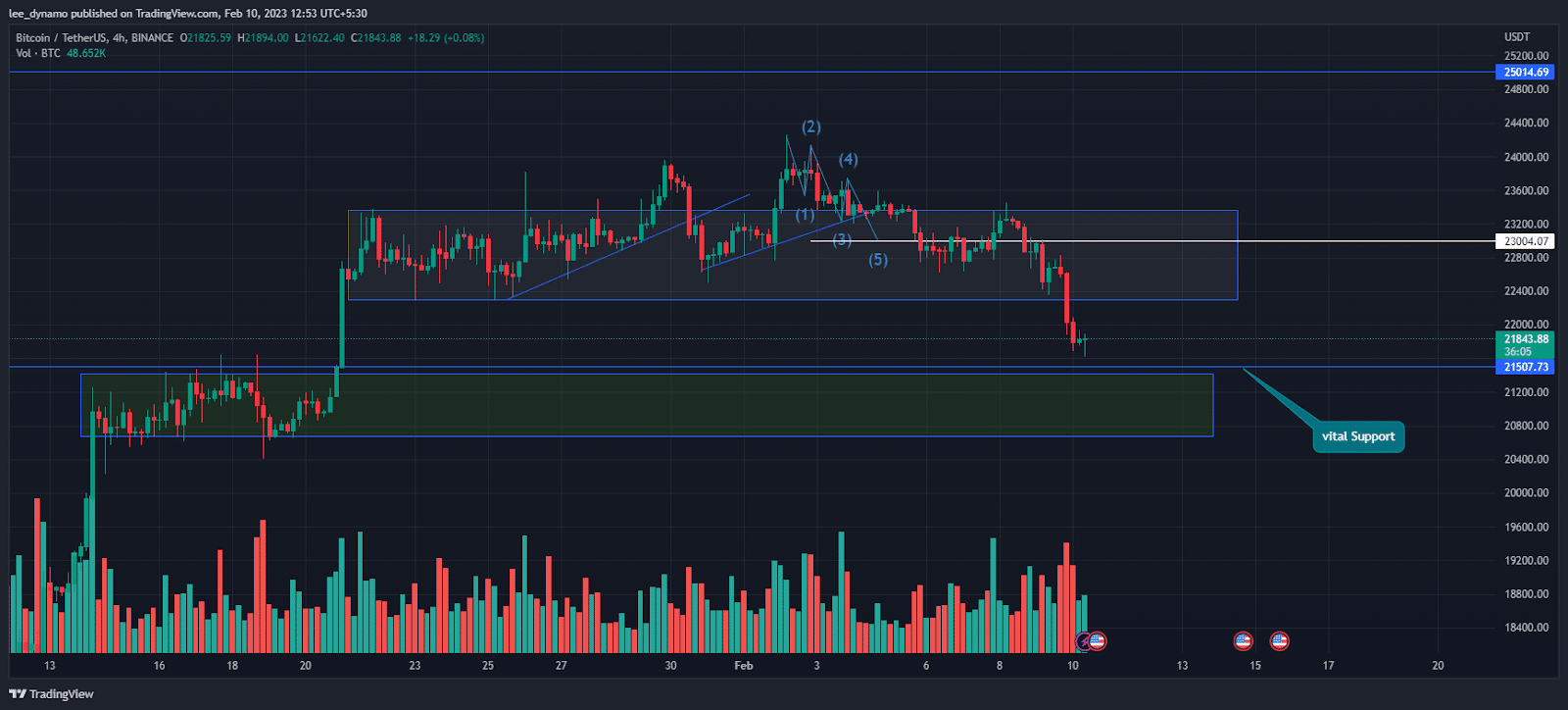

From January 20 to February 9, market bulls well managed bitcoin’s price stability above $22,000. Eventually, investors faced market volatility as bitcoin settled with the current trading price at $21,860. Similarly, the second largest cryptocurrency – Ethereum is retesting the $1500 support level.

The panic has been enforced as large cryptocurrency exchange Kraken has been granted a period to shut down its ongoing crypto staking operations in order to settle fees with the US SEC.

The US Security and Exchange Commission further stated that Kraken will “immediately” shut down its crypto staking-as-a-service platform for US consumers and pay $30 million to satisfy SEC claims that it was marketing unregistered securities.

Closing Thought

If crypto staking is banned in the United States, bears will aggressively dominate the market trend and bitcoin could soon revisit $20,000. Furthermore, the overall market valuation could retrace below $1 trillion.

Also read: Coinbase CEO slams rumours of the SEC prohibiting crypto staking