The year 2022 was full of roller coasters for the crypto market. Meanwhile, investors met with over 1.1 million new tokens last year. Due to misleading statements or hype, investors witnessed the ‘pump and dump’ scheme.

Crypto investors and speculators spent nearly $4.6 billion buying newer tokens alleged to be a part of a “pump and dump” scheme in 2022 as Blockchain investigating firm Chainalysis published a report on 16 Feb.

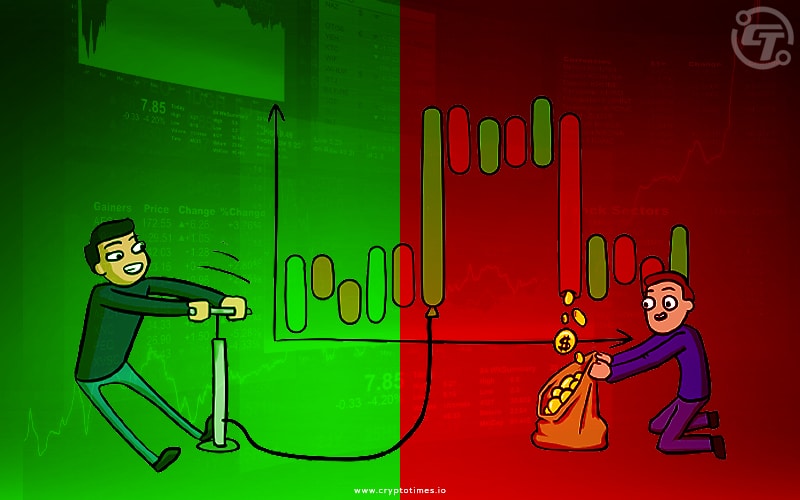

Sneak brief of ‘Pump and Dump’

Pump and dump is an illegal scheme to make too much money in less time. It’s common in the cryptocurrency market, where holders can hype any tradable coin to influence new investors by seeding the initial trading volume and controlling the circulating supply.

Later on, at overvalued prices, the heavy selling by schemers brings a ‘dump’ where newer investors are stuck in this with cheap value assets.

Chainalysis reported around 9,900 several suspected fraudulent tokens in the previous year.

Chainalysis analyzed all tokens launched on Ethereum and BNB blockchains in 2022. With the criteria of a minimum of 10 swaps and four consistent days of trading on decentralized exchanges (DEXs) in the week after its introduction, the number decreased from 1.1 Million to 40,500.

Following ahead, if these qualified tokens in given requirements fell 90% or more in its first week of launch, even then Chainalysis considers tokens for “pump and dump.” The firm found 24% of the 45.5K tokens met with the secondary criteria.

Source: Chainalysis

In addition, Chainalysis identified that 445 individuals or groups have a big hand behind this 24% of 9900 suspected ‘pump and dump’ tokens, making $30 million in profits amid a dump of their holdings.

Also read: 5 Most Common Crypto Scams to be aware of in 2023