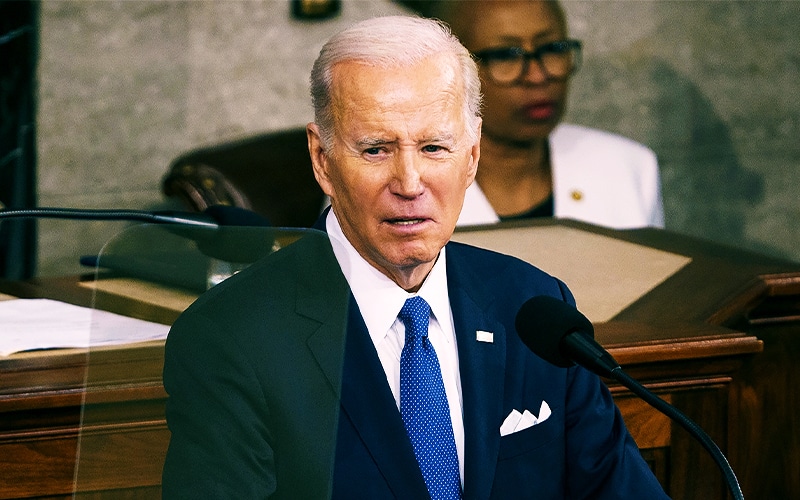

In the 2024 federal budget plan, President Joe Biden proposes to eliminate lucrative tax incentives for private equity fund managers, energy firms, and crypto and real estate investors.

According to a description of the idea, the White House intends to target a series of high-profile tax benefits worth tens of billions of dollars for rich investors and corporations in the president’s budget request to Congress, which will be made public Thursday.

The reforms would also include a change in the long-term capital gains. Currently, the long-term capital gains are taxed at 20% making at least $1 Million. Under the new changes, investors would be taxed 40% on long-term gains.

Biden proposes abolishing the carried-interest tax loophole, which allows private equity and venture capitalists to pay reduced tax rates on returns from investments. This provision was deleted from last year’s Inflation Reduction Act due to objections from Kyrsten Sinema, an Arizona senator who just defected from Democrat to independent.

The administration also wants to abolish a loophole that allows crypto investors to sell their assets at a loss and quickly repurchase them, resulting in significant tax savings. Referred to tax-loss harvesting, the Biden administration plans to fix tax loopholes for better revenue generation.

Also Read: Joe Biden Might Sign Executive Order for Cryptocurrencies This Week