The cryptocurrency market has had a surprising correction in the last three days, where the total market capitalization crossed $1 trillion this week. Investors are celebrating again after seeing their portfolios in the green.

Some ongoing news flow and a recent tweet from Binance CEO Changpeng Zhao changed the whole game. Analysts attribute the bounce to converting $1 billion of Industry Recovery Initiative funds into native cryptocurrencies such as bitcoin, Ethereum, and BNB.

At the time of writing, the largest crypto Bitcoin trades around $24,495 against the USDT pair. Bitcoin registered a sharp recovery in the past three days, leading all altcoins to rally.

Following the footprint of BTC, other coins such as Ethereum, BNB, and many more also surged. Thus, Ethereum is up more than 15% and is now trading at $1675, and BNB remains at the $304 mark with a gain of 10%.

Bitcoin Price Climbs 25% from a Two-month Low

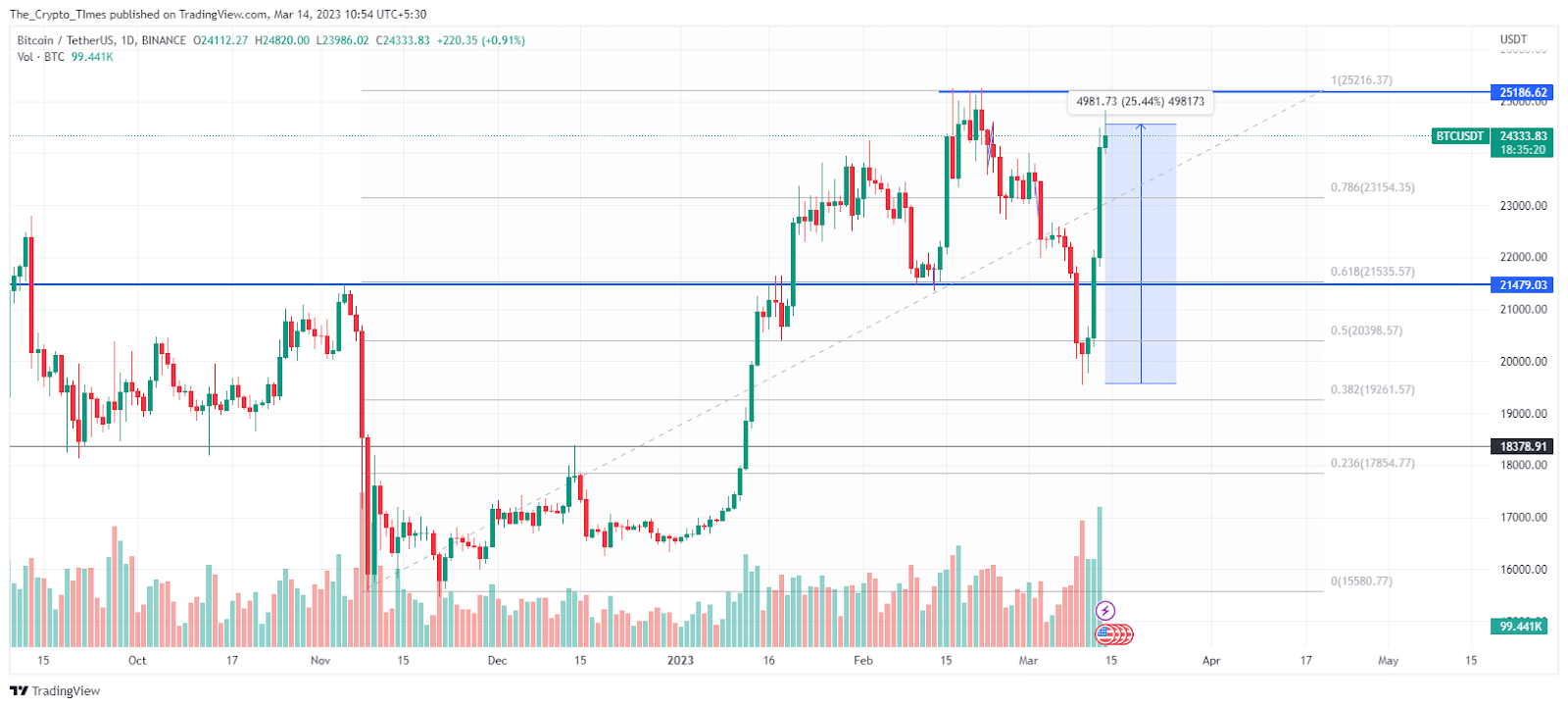

Due to roller-coaster ride buyers saw the 55-day lowest price of BTC at $19,549 on Friday, 10 March. The range from $20,000 to $19,550 appears as a pivotal demand zone, and again BTC jumped from this support level.

Monday morning brought a sharp fall in U.S. Bank stocks but Bitcoin price steeply increased on the same day. This happened due to fear of a similar banking crash on a regional outlet following the failure of Silicon Valley Bank last week.

On the higher region, market sellers often sold BTC at the $25,200 zone, so the breakout of this hurdle may lead to an ongoing bullish rally until $28,000.

The trading volume increased 37% overnight and was reported at $48.3 billion. As per price action, Bitcoin turned into bull dominant as it overcame lower-lows and lower-highs formation. Meanwhile, buyers stand at the make-or-break territory closer to $25K.

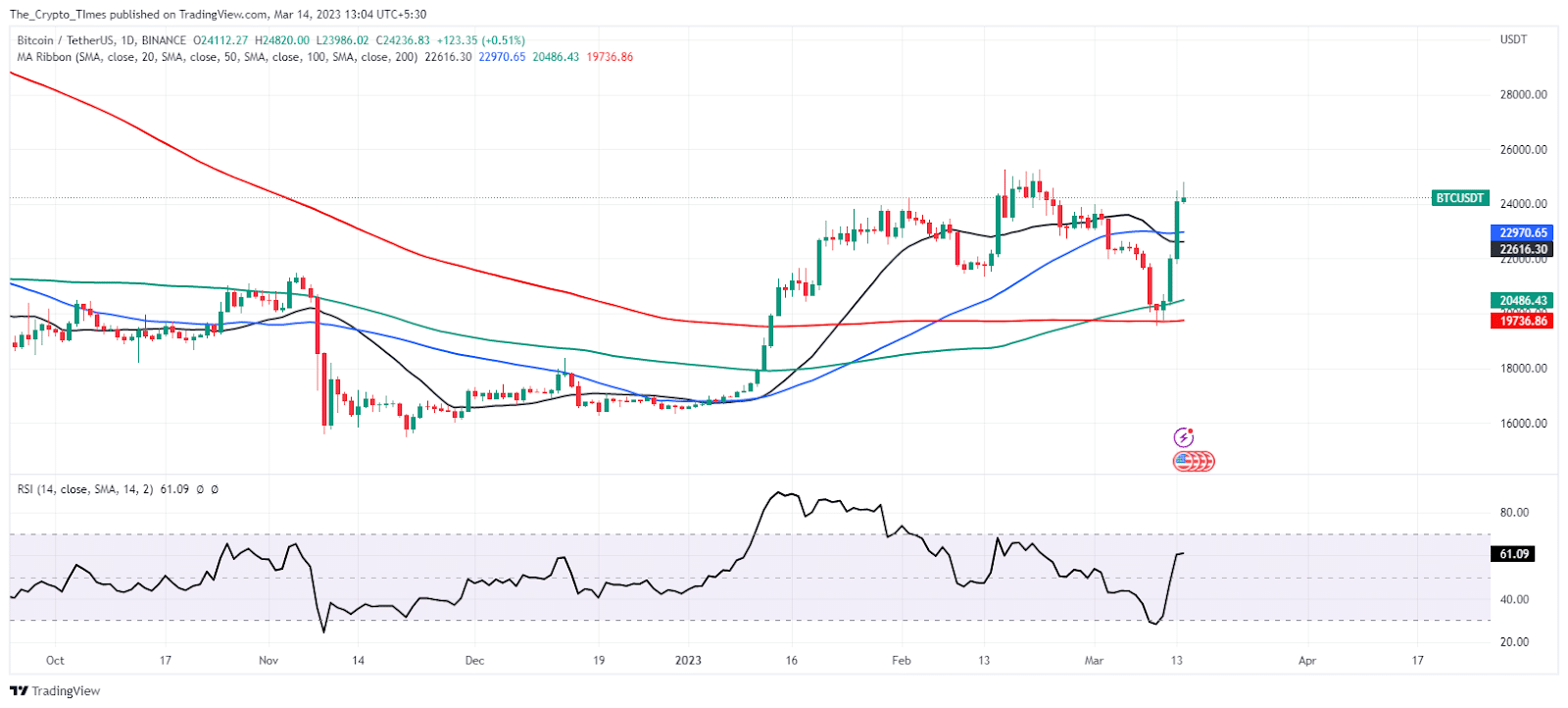

Buyers hedged at the 200-day moving average on the daily time frame. The 200 DMA is providing strong support to the bulls. As a result, BTC remains above the all-important DMA. Additionally, the daily RSI indicator completed the plunge into the oversold zone and the RSI peak moved toward the overbought zone.