The second largest stablecoin USDC de-pegged from the actual value of the U.S. dollar. Thus, the profitable opportunity influences debtors to repay loans and save more than $100 million on loans.

Due to the collapse of crypto-friendly banks such as Silvergate Capital, Silicon Valley Bank, and Signature Bank, stablecoins like USDC and DAI started de-pegging from $1 and recorded yearly low amid a crypto-clatter.

The second largest stablecoin USDC fell from the dollar value on 11 March and hit the yearly low at $0.8774 as per CoinMarketCap. Silicon Valley Bank breakdown on 10 March. Similarly, DAI — stablecoin of Maker DAO — dropped to $0.897 on Saturday.

However, USDC recovered as Circle co-founder Jeremy Allaire said its reserves were safe and the company had already lined up a new banking partner. The result was seen in USDC at $0.999, and DAI was also present at $0.9981 at that time of writing.

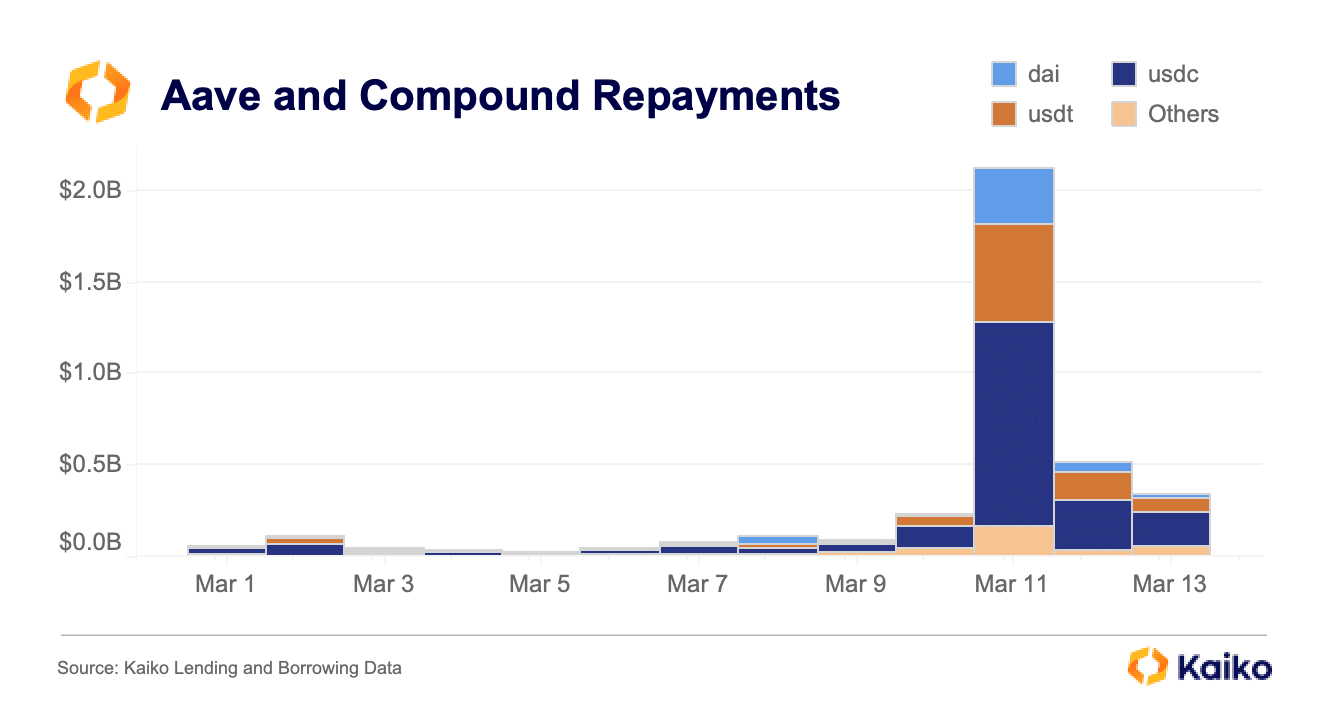

As per the analysis report from Kaiko, the de-pegging pushes the borrowers to repay the loan at a discount, resulting in over $2 billion in loan amount repaid on Aave and Compound, a decentralized crypto landing platform.

According to the report, more than $1 billion of loans were settled in USDC and about $500 million in DAI on Saturday. However, the volatile USDC and DAI have so far recovered.

Also Read: MakerDAO Issues Emergency Proposal to Mitigate $3.1B USDC Risk

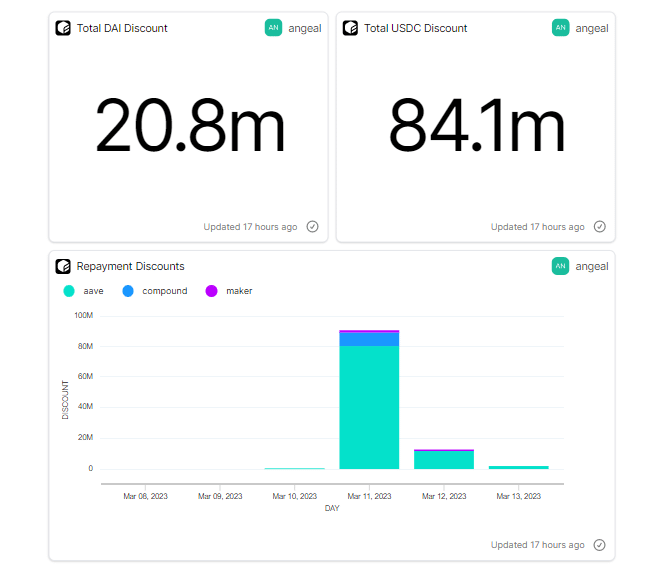

Flipside Crypto, another analytics firm, published a report on the estimated saved money by debtors. Around $84 million in funds was saved by USDC borrowers amid de-pegging, and $20.8 million in DAI borrowers received discounts during the widespread crypto unrest.

“Overall, DeFi markets experienced two days of huge price dislocations that generated countless arbitrage opportunities across the ecosystem, and highlighted the importance of USDC,” the Kaiko report said.