It is no secret that many people around the world try to reduce their tax burden, and this includes businesspeople and investors. However, a Swedish-based firm specializing in cryptocurrency taxation has recently produced a report on the topic.

According to a report released on the 5th of April by Divly, only 0.53% of crypto investors worldwide had filed their taxes to their local tax authority on digital assets in 2022, and almost 99.5% of crypto users and investors remained silent, and hidden.

Cryptocurrencies such as Bitcoin and Ethereum have registered rapid value growth over the past few years and mass adoption due to decentralization and increased security. On the flip side, it also brought the unique tax problem where heavy crypto users avoid taxes on digital assets.

Tax firm Divly developed this anticipated tax report by using many strategies. Interestingly, the company looked at the relationship between the volume of searches for crypto tax-related terms across various nations and the number of persons who filed tax on their cryptocurrency.

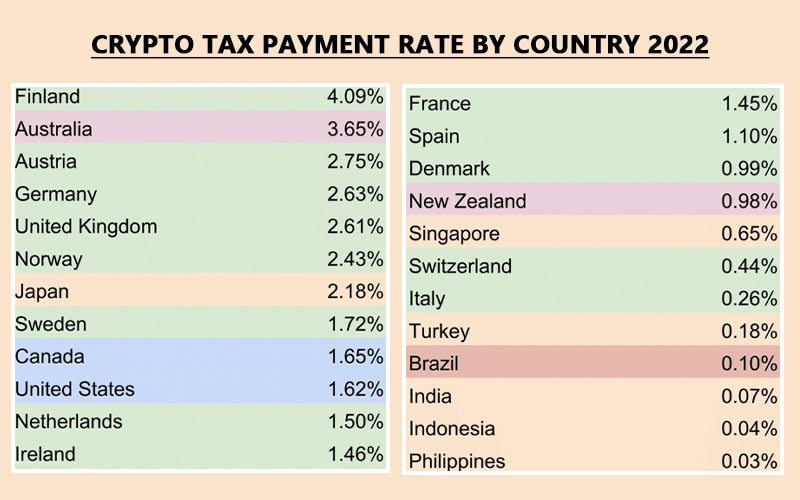

Among all the countries, cryptocurrency holders in Finland were reported to pay the highest taxes in 2022, followed by Australian users in second place. Despite being the most popular regulation in the US, it ranks 10th as only 1.62% of users have declared tax returns.

The table below shows several countries that have paid taxes on cryptocurrency in the past year.

Brazil, India, Indonesia, and the Philippines sit at the bottom, with users paying only 0.10%, 0.07%, 0.04%, and 0.03% taxes on crypto respectively.

Also Read: Demystifying Crypto Taxes in India: What You Need to Know

While this is only an estimated number, not exact, as only some people search for tax-related content online, keyword search data may not fully indicate the number of Bitcoin taxpayers in a jurisdiction.

India, amongst others, has only recently released cryptocurrency tax regulations. These more defined regulations should encourage cryptocurrency traders to declare their crypto to the tax authorities.