World’s largest cryptocurrency exchange Binance, finds itself at odds as it has been unable to establish relationships with banks in the United States to handle its customers’ cash.

Following the collapse of major crypto-friendly banks, the United States division of cryptocurrency exchange Binance is having trouble finding a bank to provide its customers with satisfactory services such as money and fast transactions, media outlet Wall Street Journal reported.

For now the exchange is using a third-party finance technology firm called Prime Trust to store its customers’ funds, which is slower and less responsive to the exchange’s needs than before.

In particular, repeated attempts to form banking partnerships with other banks, such as Cross River Bank and Customers Bancorp, to hold Binance US customer funds directly have failed.

In March, The US Commodity and Exchange Commission (CFTC) sued Binance and its CEO, Changpeng Zhao (CZ), on March 27 for violating derivatives trading rules, resulting in a loss of investor confidence in the exchange and the withdrawal of approximately $1.6 billion.

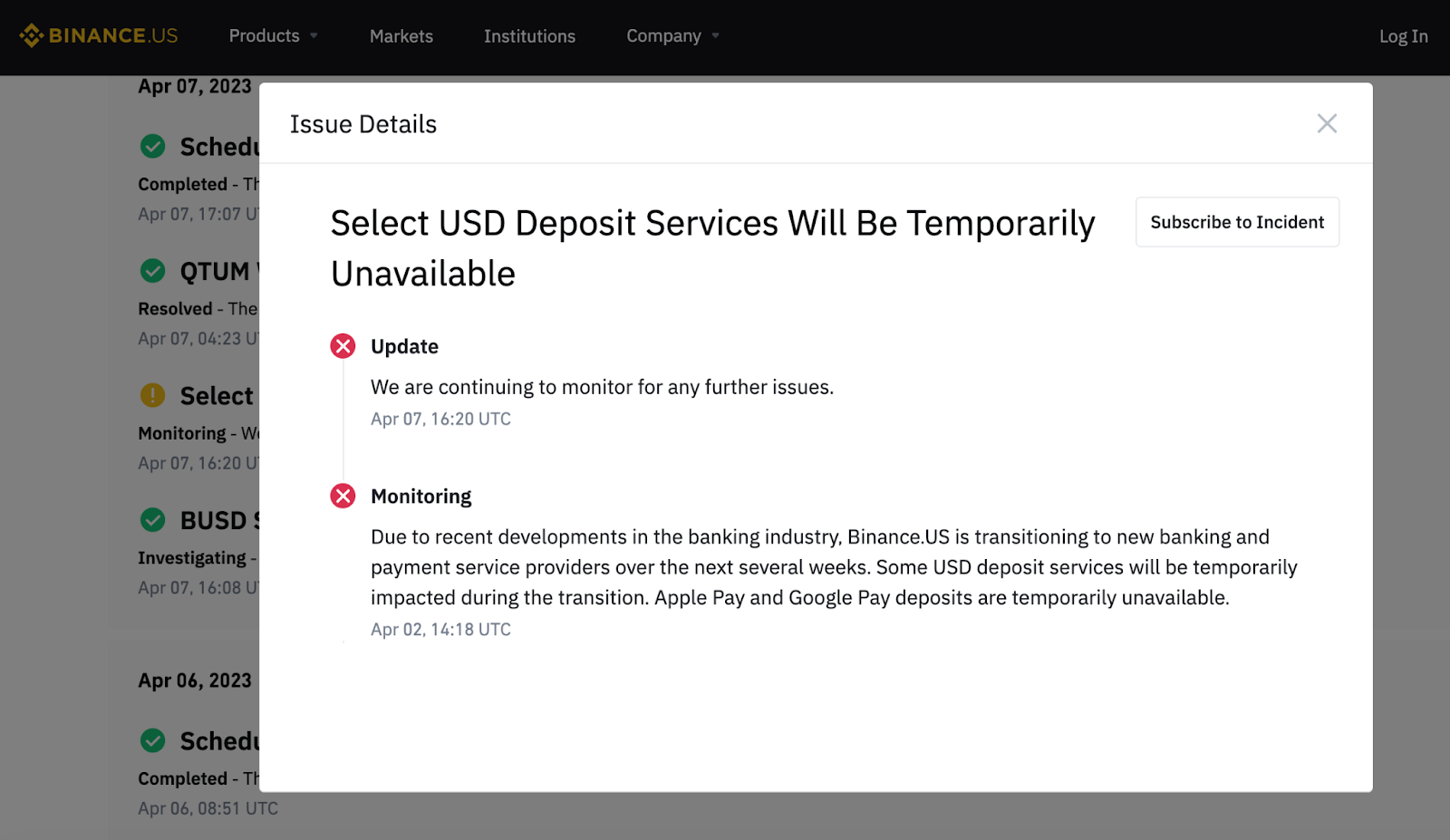

The US division of cryptocurrency exchange Binance revealed that USD deposit services would be temporarily suspended until the exchange finds a new banking partner.

Furthermore, a representative from Binance US informed The Wall Street Journal (WSJ) that “we work with multiple U.S.-based banking and payment providers and continue to onboard new partners while upgrading our internal systems to create a more stable fiat platform and offer additional services.”