The cryptocurrency giant Bitcoin surged 6.13% overnight, crossing the $30k mark for the first time in 2023. Investors are celebrating and hoping for further gains as bitcoin breaks through the $29k resistance, creating a bullish atmosphere in the market.

In the last 24 hours, the total cryptocurrency market capitalization has increased by 4.15%, reaching $1.23 trillion.

It is the first time in recent months that the global crypto market cap has reached $1.23 trillion as the price of crypto giant Bitcoin is trading at $30,000 against the USDT pair, with an overnight gain of 6.13%.

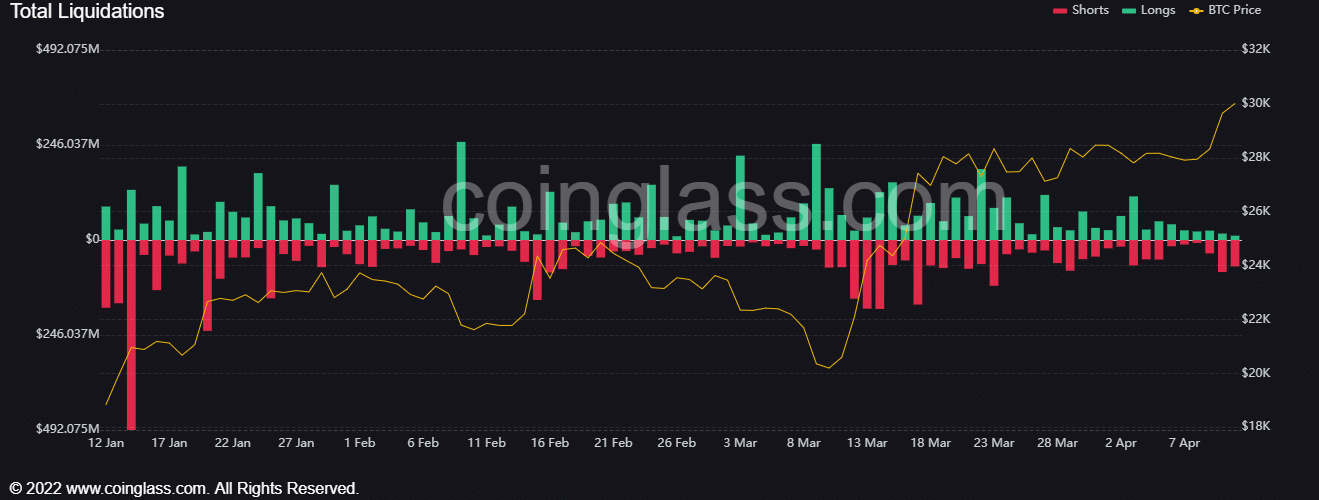

According to data from CoinGlass, there has been a total liquidation of around $105.93 million in the last 24 hours. Notably, the short position holders have been losing money for the past few days. On April 10, the $82.94 million short-position liquidated, meaning sellers were gradually moving away from the market.

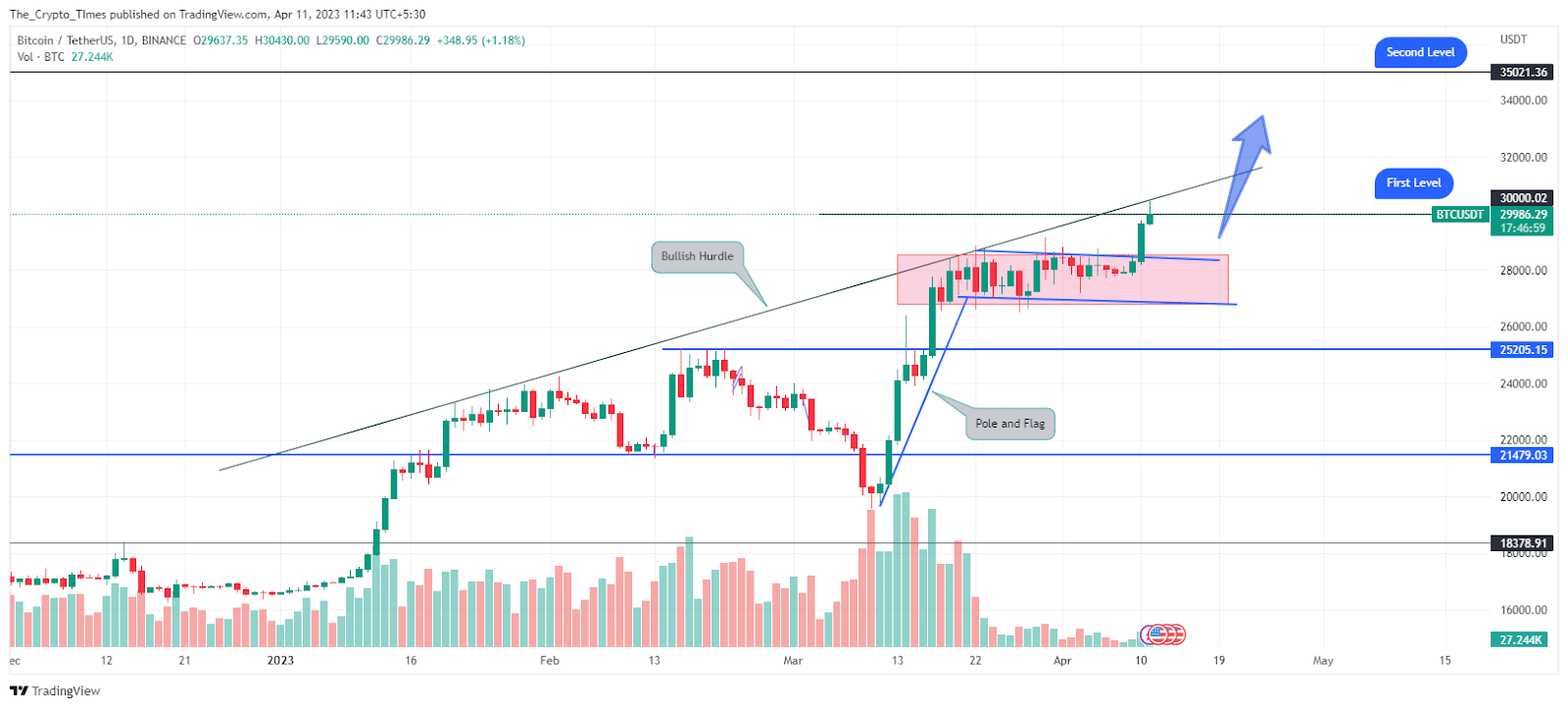

Bitcoin Price hit $30K resistance, What’s next?

As previously analyzed by The Crypto Times, a bullish break-out of the pole and flag pattern can lead Bitcoin to $35K. Buyers must overcome the ascending bullish barrier (mentioned above on the chart), which could lead to an imminent bullish rally toward the $35,000 resistance in the coming weeks.

In the past 24 hours, the trading volume increased by 89% to $23.5 billion, suggesting an aggressive buying force in the largest cryptocurrency Bitcoin.

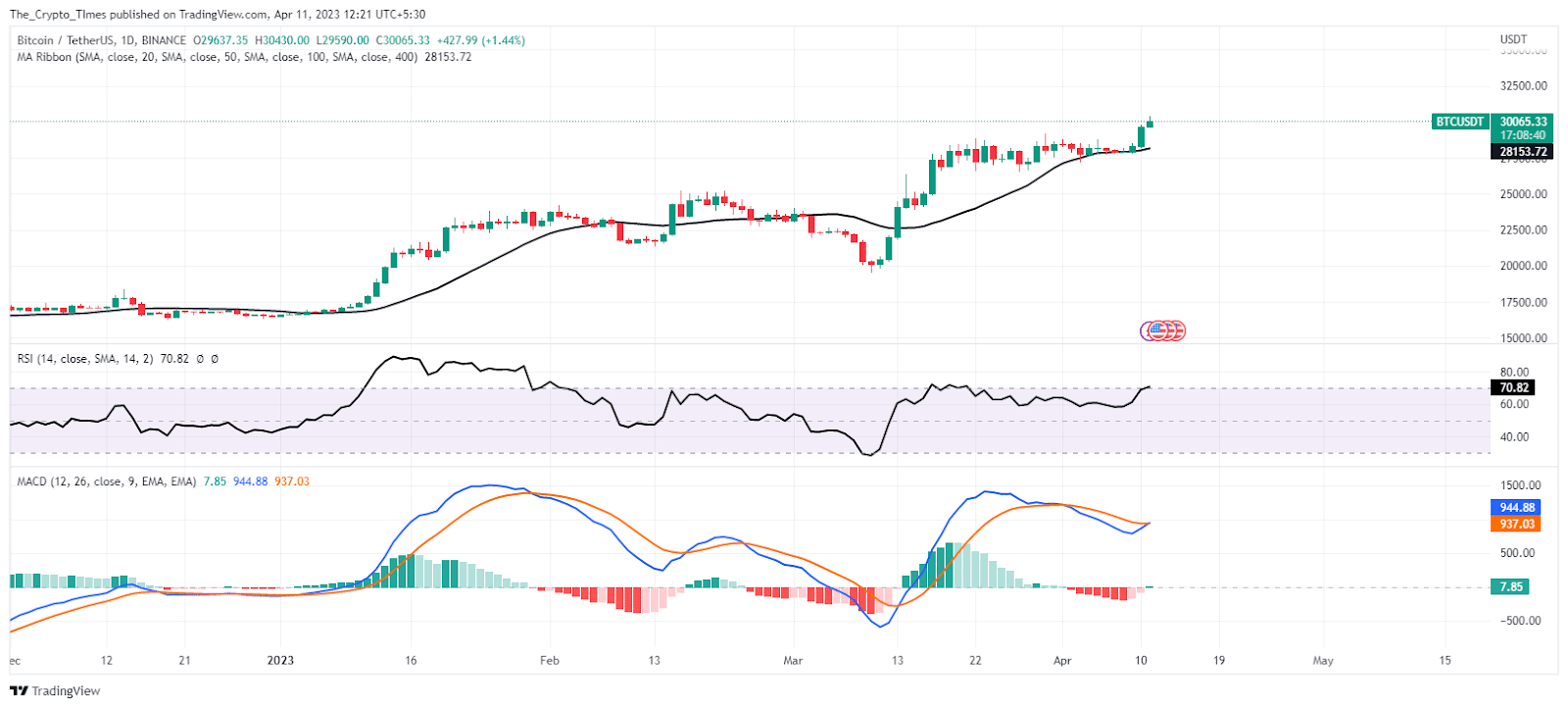

Significant technical indicators display strong positive momentum as Bitcoin holds above the 20-day moving average. In addition, RSI and MACD also hint at more bullish trends ahead.

Gaurav Dahake, Founder & CEO, BNS said, “Bitcoin’s breakthrough past the $30K mark for the first time since June signifies a promising milestone for the entire crypto sector. The resolute demonstrated by Bitcoin in the past three months emphasize the optimistic investor sentiment towards the leading cryptocurrency. It also indicates how investors have come to view Bitcoin as a viable alternative in the current climate. Its popularity is growing alongside traditional assets like gold and silver worldwide.”

“This bull run further underscores the faith investors have in the resilience of global macroeconomics, particularly that of the United States. Moreover, we are only 12 months away from the Bitcoin halving event, a factor that has previously propelled Bitcoin’s momentum as seen in the last three cycles. BNS remains highly optimistic about Bitcoin’s long-term potential, and we consistently advise investors to adopt a systematic investment plan (SIP) approach towards it,” further added.

Stay ahead of the crypto game with the latest market analysis and insights. Subscribe to The Crypto Times today!