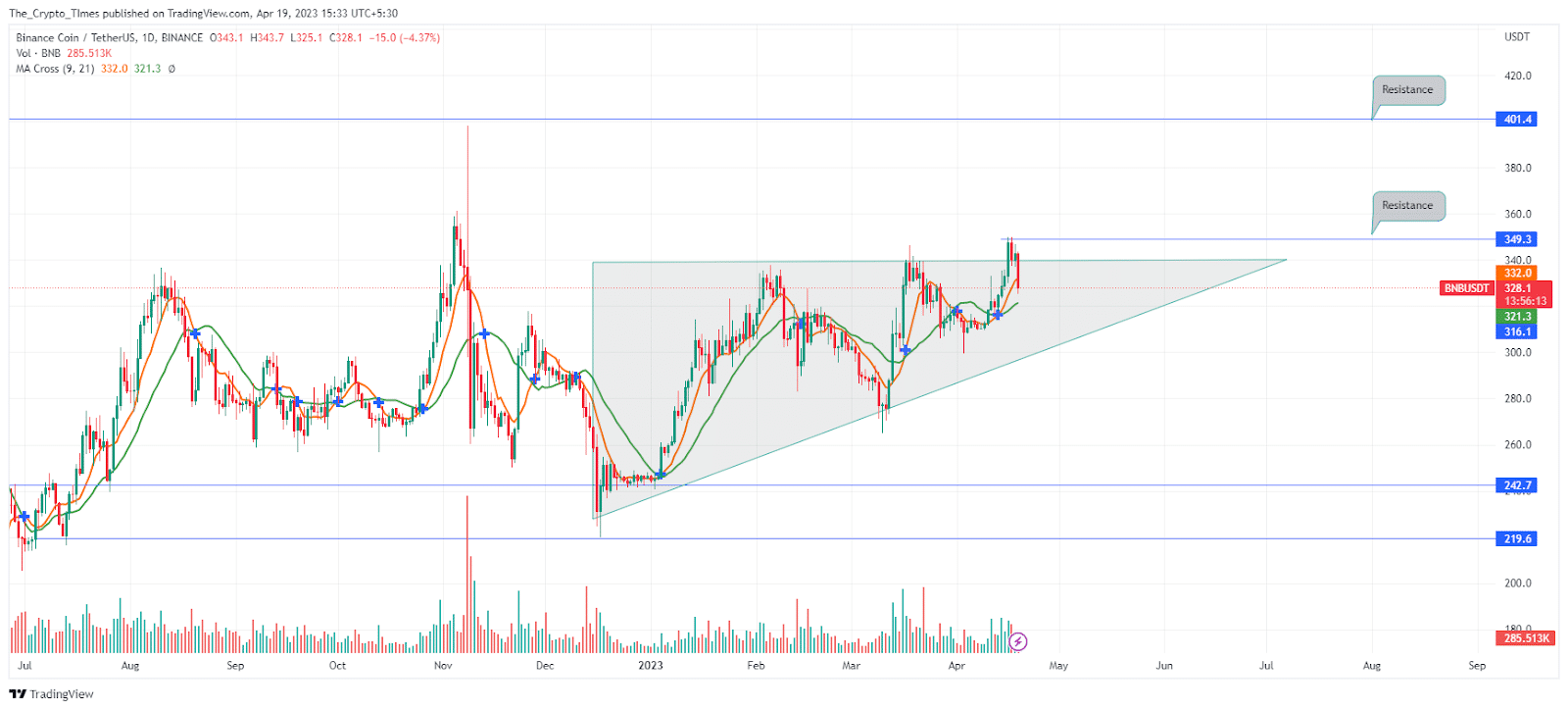

The native token of one of the largest cryptocurrency exchanges – Binance, BNB, is struggling to follow an ascending path despite its strong price action. Buyers are facing rejection at the $350-key resistance, and at the same time, bears are taking advantage of this price point to push BNB price lower.

Although the price action in the Binance token – BNB suggests a further bullish rally towards $400, bears dominated the BNB price this week due to high volatility in the cryptocurrency market. Last week, buyers saw the BNB price rally by 11.16%, but token is down about 5.5% so far this week.

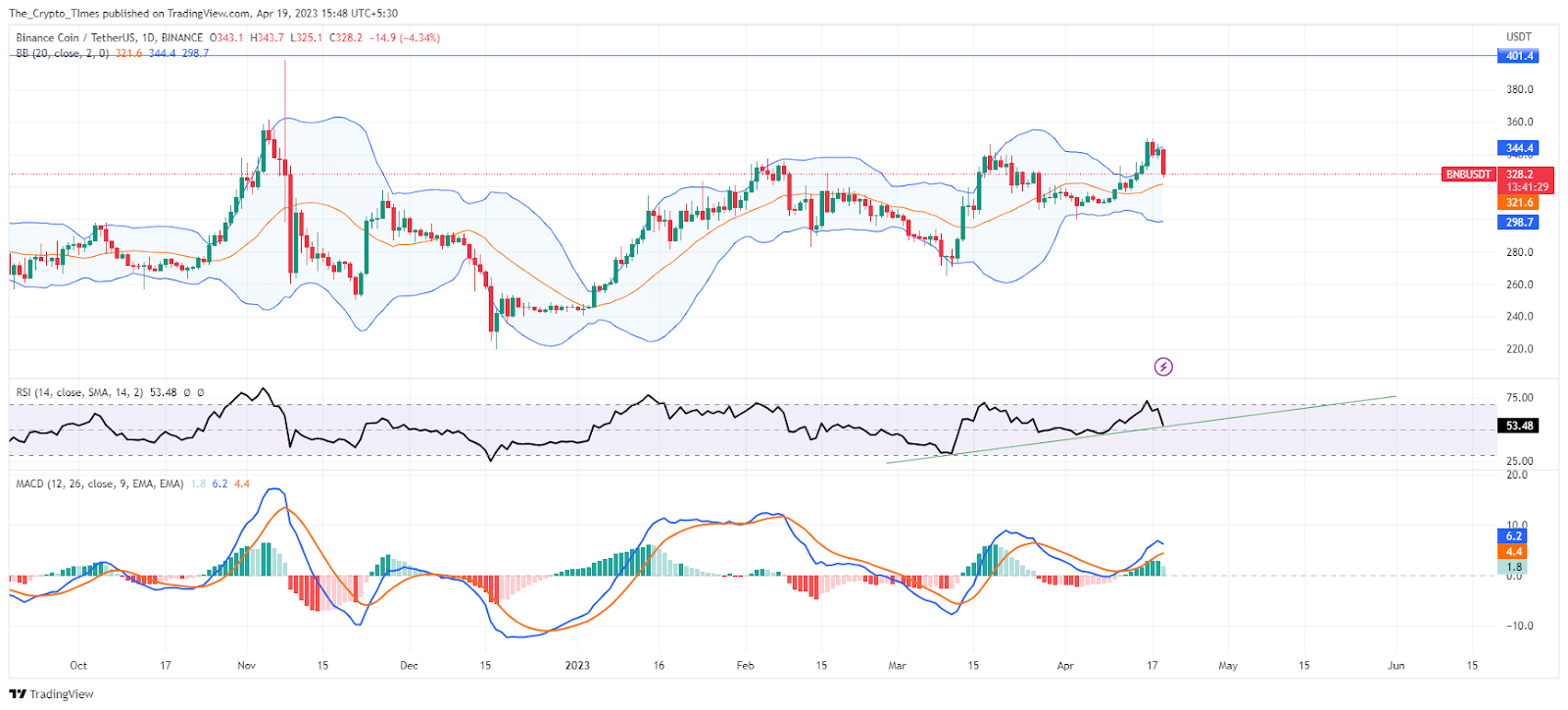

At press time, crypto market head bitcoin fell below $30K, resulting in selling pressure dumps BNB token price by 4.5% overnight, when the current price remains at $328.7 level. Meanwhile, the market capitalization of BNB reached $51.16 billion in the ongoing selloff.

Also read: Bitcoin Continues to Attract Investor Interest with $104M Weekly Inflows

Buyers failed to keep BNB above the 9-day simple moving average, but the 21-SMA remains to be seen for a trend reversal. The pullback appears as a retracement phase before the next bullish run to $400 if the buyers defend the $310 support area.

According to an official announcement, on April 21, BNB Beacon Chain is scheduled to implement the upcoming hard fork barrel upgrade at block height 310,182,000. This upgrade could soon fuel a bullish breakout in BNB token price.

The mid-band of the Bollinger Bands indicator may act as a support for the BNB. However, the MACD is still looking in the positive zone but the RSI is showing weakness at the support trendline. If the RSI bounces off the support trendline, BNB could again move into a bullish trend.

- Support Levels – $320 and $310

- Resistance Levels- $350 and $400