The stumbling block in the overall crypto market affected the directional trend of bitcoin, which failed to hold the vital level of $30,000 this week.

Following the decline, bitcoin investors have seen losses of around 7.14% so far this week and the indicators are showing further downside unless BTC price finds strong accumulation levels.

After last week’s retracement signal, sellers have been aggressive in the last two days, but they look tired in the intraday trading session.

Meanwhile, Bitcoin is trading at $28,290 against the US Dollar, down 2.55% overnight. Although, the trading volume in the last 24-hours appears to be neutral at 20.7 billion, this could be a favorable opportunity for the bulls to reverse the trend.

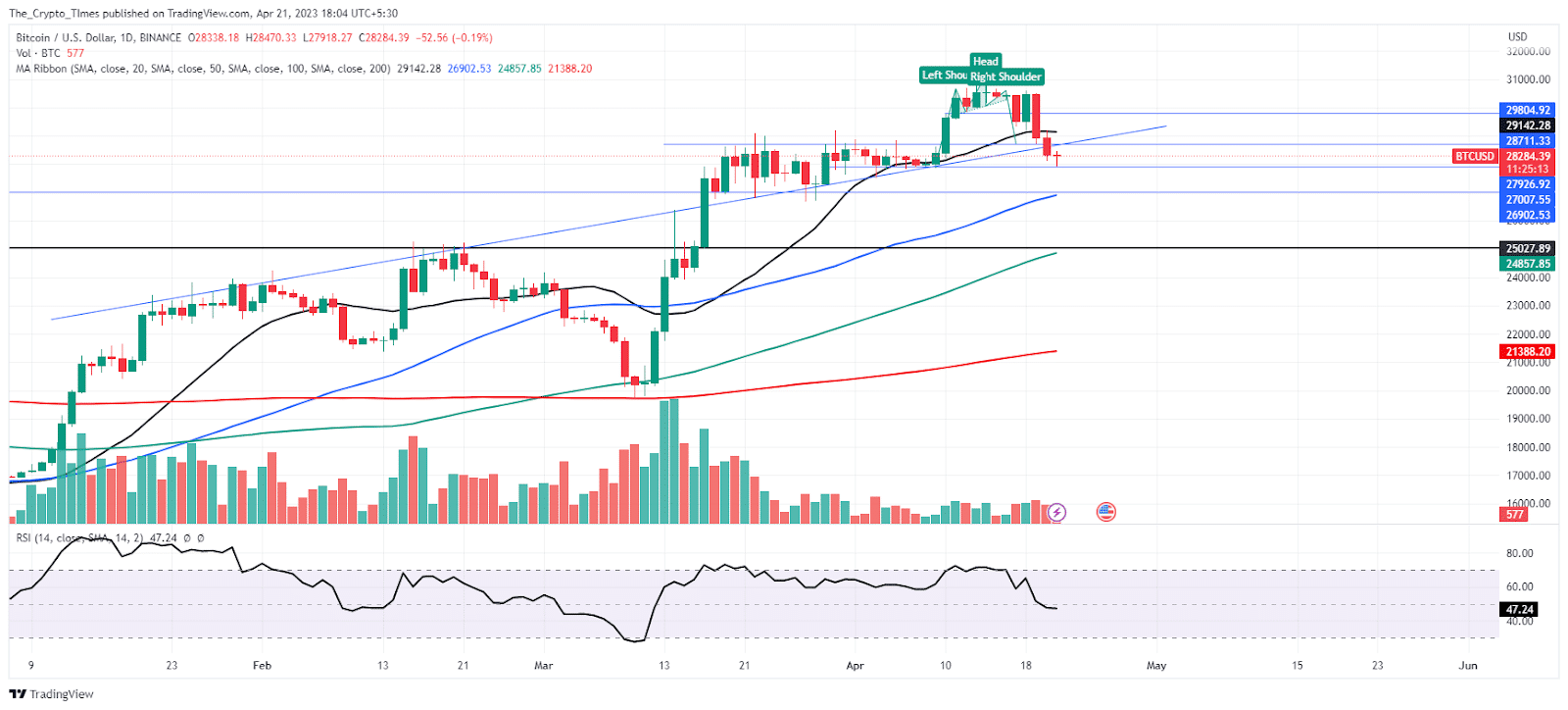

Amidst high selling pressure, BTC slipped below the 20-day simple moving average on the daily price chart. In terms of downside momentum, BTC could slide towards the 50 SMA, where buyers have a strong accumulation zone at $27,000.

Besides this, the Relative Strength Index (RSI) also declined below the semi-line (50 level), there could be some more selling in BTC driving its price down before the end of this week.

There is no need to fear this sell-off, it could be a retracement phase for the latest bullish cycle.

Also read: Crypto Market to Take a Hit Before Big Pumps