BNB chain based decentralized exchange (DEX) PancakeSwap has been falling like crazy for the past several weeks. Buyers are in big trouble and have lost 30% this month due to the sharp fall.

Despite the exciting hype surrounding the launch of PancakeSwap V3 in early April, investors have failed to push CAKE token up. The altcoin’s valuation is now very close to its 52-week low of $2.5, found in the recent bearish cycle, and looks ready to be tested again.

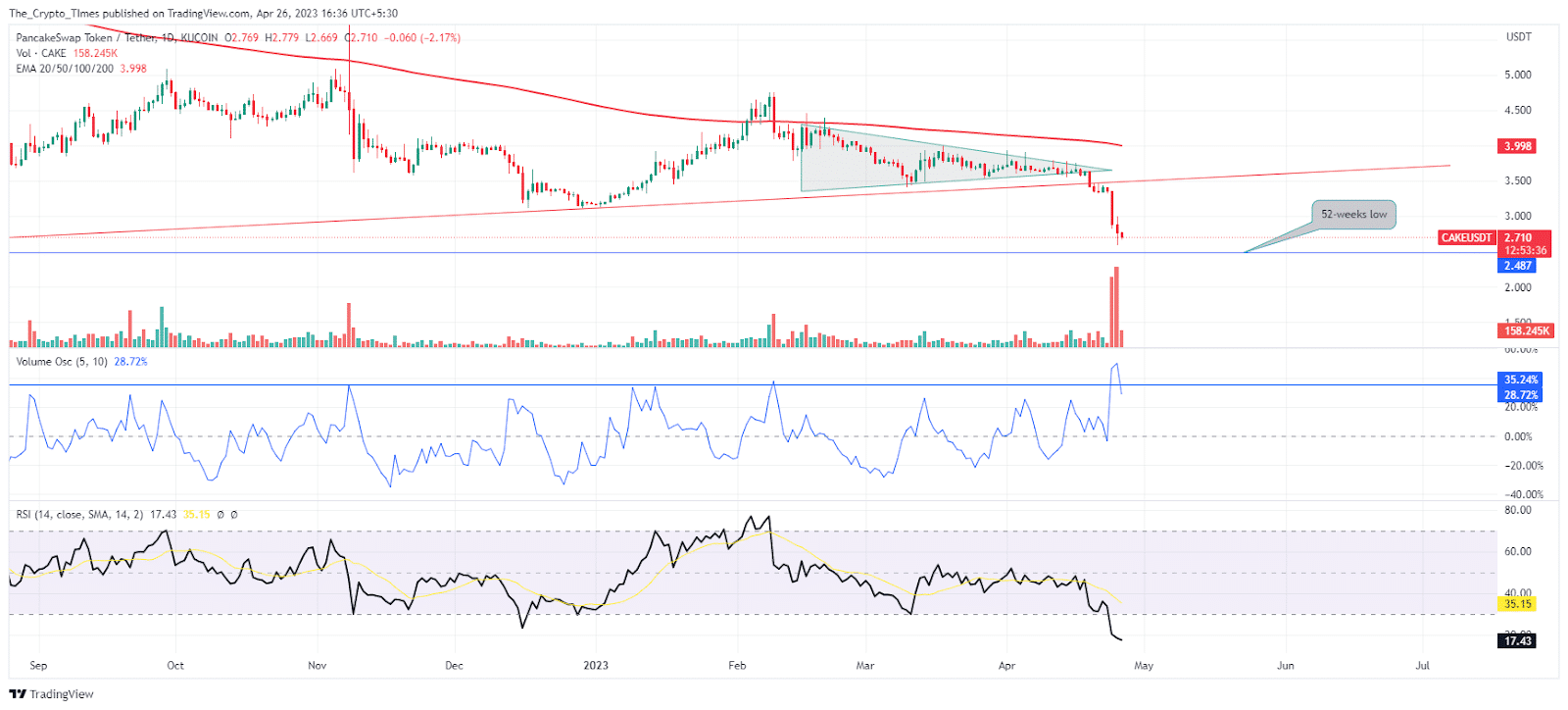

PancakeSwap price is looking extremely bearish after it broke the ascending support line (red) on April 19. Bearish price action leads CAKE down more than 19% this week, thus catapulting CAKE token into the limelight as the top loser of the week.

Meanwhile, against the USDT pair, sellers are bidding for the CAKE token at $2.7 as of press time. The aggressive selling pressure can be clearly seen in the trading volumes of the past few days. The Volume Oscillator indicator also hit a two-year high last night, suggesting a bloodbath scenario for the CAKE token.

In the midst of a bearish cycle, the daily RSI indicator dipped into the highly oversold zone, on the other hand, CAKE token is currently trading near its annual low of $2.5. Buyers may further attempt a trend reversal at this price point.

- Support levels: $2.5 and $2.0

- Resistance levels: $3.4 and $3.9

Follow The Crypto Times for more Altcoin Analysis!!