Amidst the correction phase in the cryptocurrency market, most digital assets have been affected in the past two weeks. Following the correction, BNB, the native token of the Binance exchange, is again looking closer to its monthly high of $350, suggesting a hidden bullish pattern for long-term perspective.

Recently, crypto exchange Binance, the largest trading volume holder, resumed its service for Russian users. Starting this week Binance now supports Russian Ruble, Euro, British Pound and Turkish lira deposits from Visa and Mastercard in Russia.

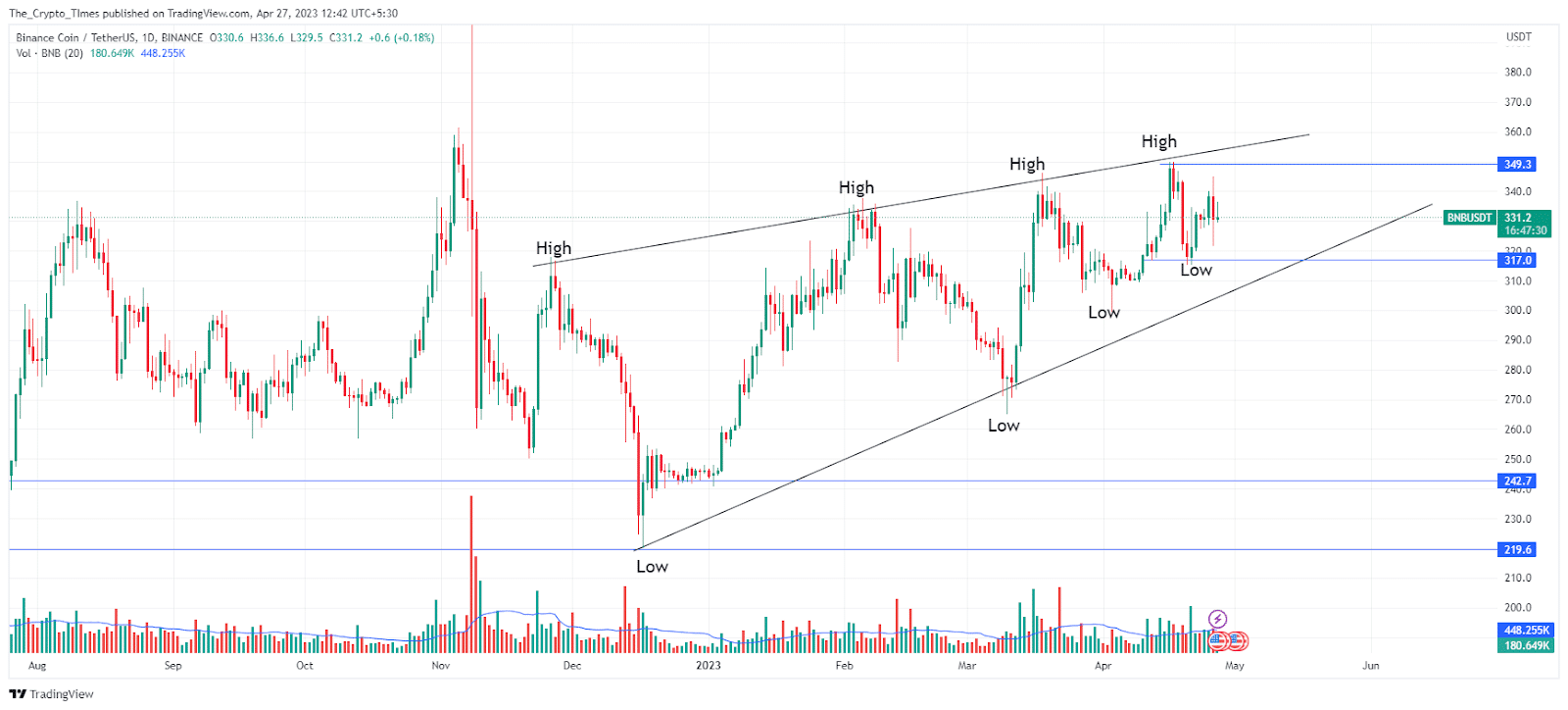

As we can see on the daily price chart above, price action formed higher-highs and higher-lows since the beginning of 2023. The trading range is gradually declining, indicating a breakout of the previous swing high at $350.

Currently, BNB token is trading at $331.3 against the USDT pair. For the time being, BNB coin appears to be neutral with gains of 0.09% on weekly chart. Consolidation in the altcoin increases possibilities of a bullish breakout above the $350 resistance.

Meanwhile, the trading volume increased by 35% to 963.09 million in the last 24 hours. Buyers need more buying pressure to take advantage of the current bullish pattern.

BNB coin is trading in the range of $317 to $350 for the last 15 days and price stability above $317 could provide vital support.

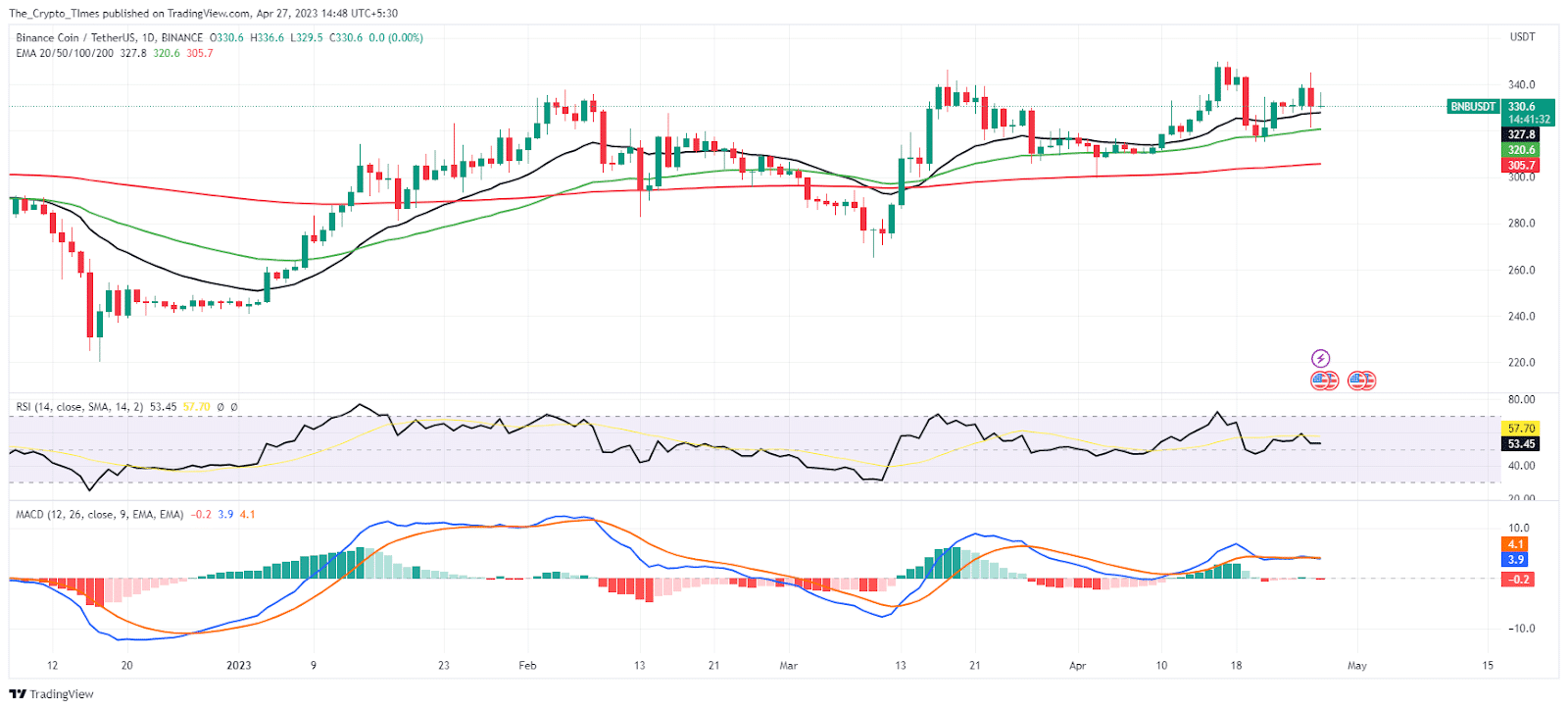

The 200-day exponential moving average is seen as a rescue zone for the buyers. Specifically, the buyers are holding BNB above the 20 and 50 EMAs. As long as the altcoin remains above 200 EMA, sellers will often fail to dominate it.

However, RSI and MACD indicator shows sideways momentum for BNB token as of now.

- Support Level: $317 and $300

- Resistance Levels: $350 and $360

Also read: Binance US Drops $1.3 Billion Deal for Voyager Assets Acquisition