The Bitcoin market consolidated last week raining joy over the bears and putting the bulls in a tough spot. Crypto investors are anxious how Bitcoin’s movements will affect the market.

Bitcoin re-attempted to escape from the current $30,000 resistance level but the bear’s preparedness did not let the price gain movementum. Thus, the crypto capitalization sank by 1.93% following the selling pressure in the market.

Bitcoin’s Price Movement In The Last Week

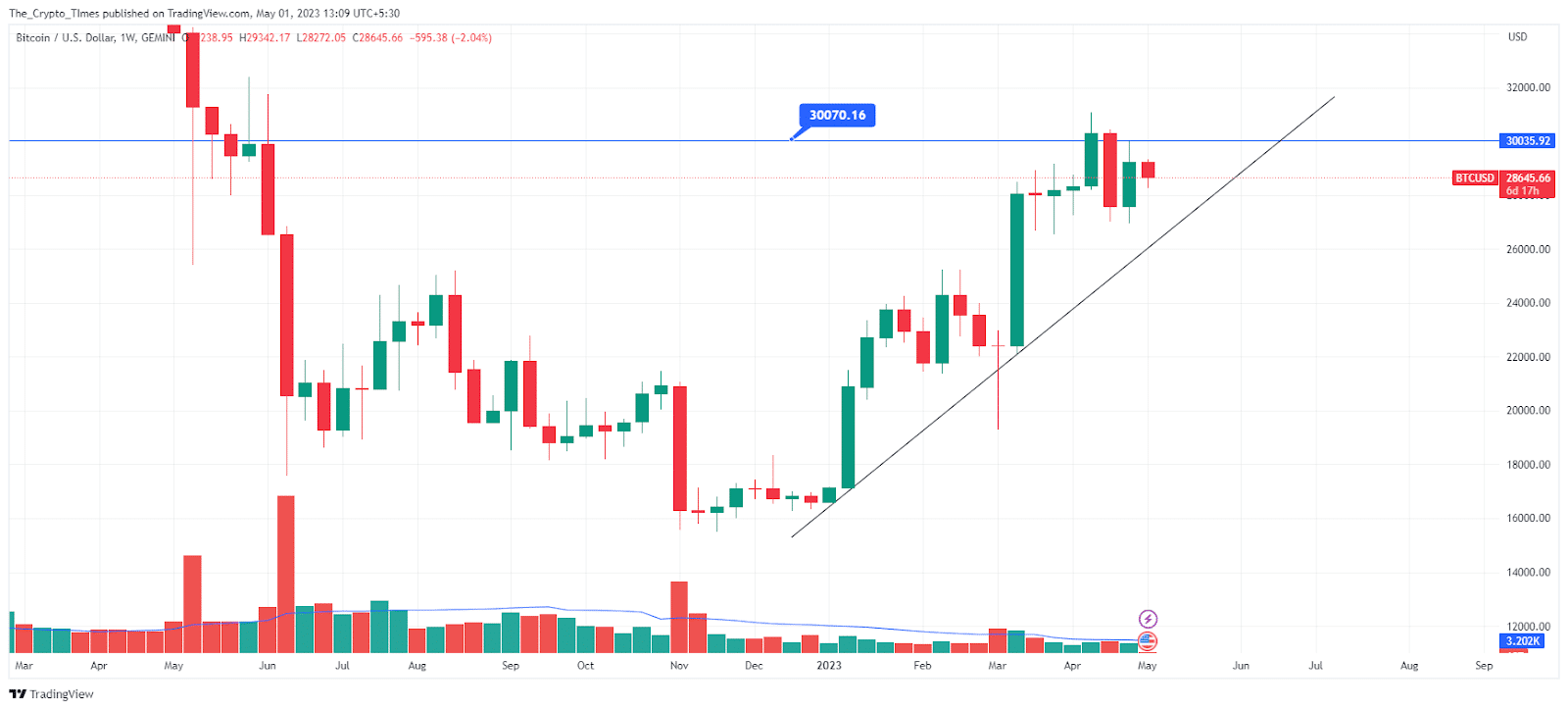

The bears looked aggressive at the conceptual round level of $30K in late April, which still remained a major hurdle for the bulls. Buying sentiment of the traders didn’t seem enough to overwhelm the bearish pressure created once the price hit the resistance level.

However, this past week, buyers briefly took in profits and pushed BTC up as much as 5.85% to the $30k mark.

Eventually, the bears turned it into a reversal by pulling down the crypto giant – Bitcoin by 2.23% at the time of writing.

Will buyers turn active at $28,000?

Currently, Bitcoin price is standing at 50 SMA on the 4-hour price chart, while the price is trading at $28,514, down 2.6% overnight. If the bulls fail to defend this level, they could see the retest of $28,000 level as the RSI continues to move down toward the oversold zone.

Trading volume surged 74% in the last 24 hours amid the monthly opening. After the decline, the market capitalization reached $552.138 billion.

Bitcoin Price action Influencing Sellers

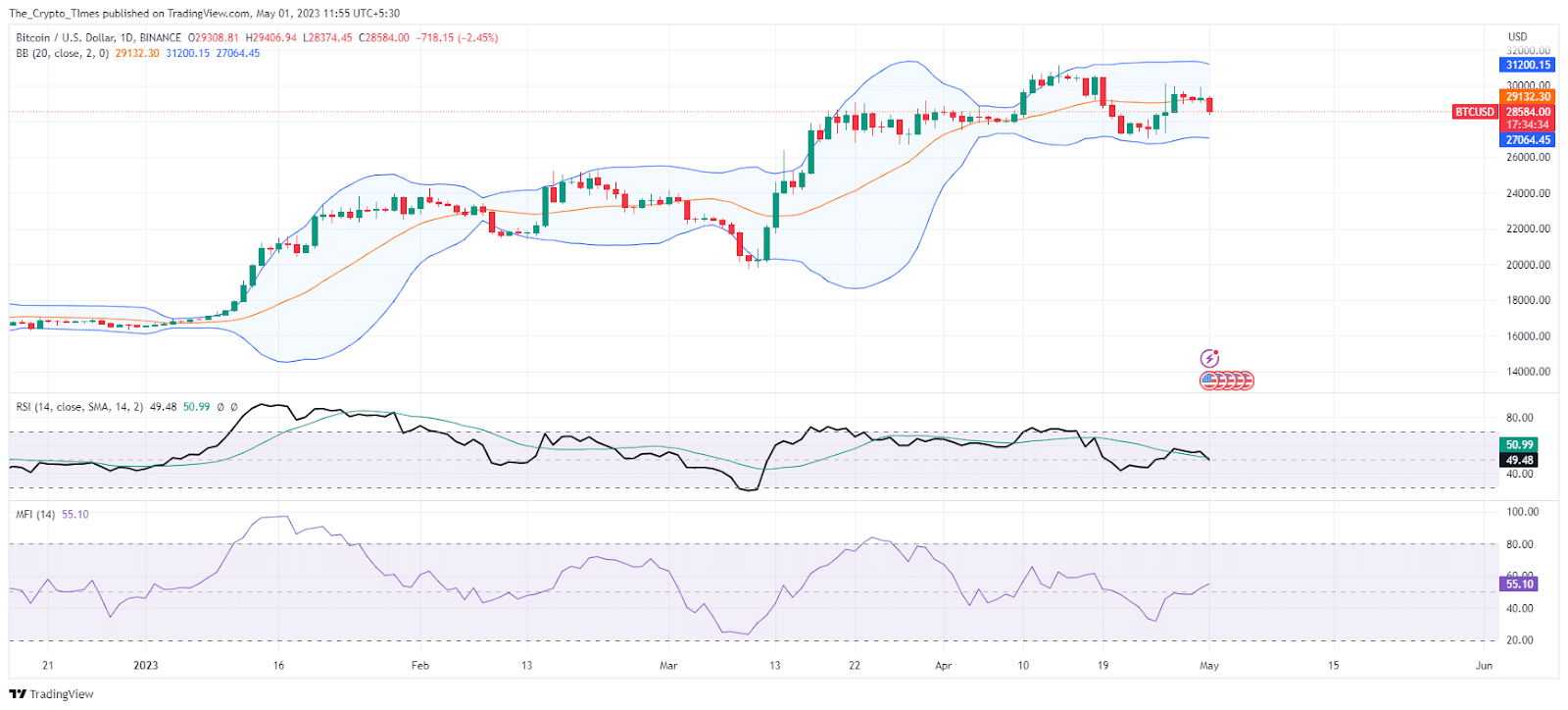

Bitcoin price is showing bearish signs after three days of consolidation in a tight range. On the daily price chart, BTC declined below the mid-band of the Bollinger Bands indicator. This bearish signal causes buyers to experience another 5% retrace in BTC if the lower-band of the BB indicator breaks below the currency price.

On the daily RSI side, a downtrend momentum can be seen in the coming trading hours. The RSI moved below the 50-level after a bearish crossover to a bullish decline. This retracement phase could create a strong foundation for the next upward rally in BTC.

Will the MFI positive signal affect the retracement cycle?

The Money Flow Index (MFI) is rising marginally despite investor jitters. At that time it had touched the level of 55 against the negative market sentiment. An increase in the MFI indicator is suggesting a hidden accumulation of bitcoin for the next bull run.

For this week, the $28,000 support is close to the current price and an impending retracement, which could provide short-term support. Furthermore, if bitcoin price hits the lower band of the Bollinger Bands indicator, it could start another bull run cycle.

Also Read: Bitcoin Price Recovers to $30K Amid the Monthly Options Expiry

Disclaimer:

The information provided in the analysis is strictly for academic purposes and not financial advice. We request that you to do your own research before investing in any cryptocurrency.