Ethereum (ETH) has been a major player in the volatile crypto market, and recently it has been causing excitement and concern among investors. Last month, the price of Ethereum reached a modest monthly high of $2020 on May 06, creating considerable interest among buyers. However, the buyers were unable to sustain this level, which resulted in a subsequent price drop.

Ethereum created extreme Volatility last week

Following the last month’s ups and downs, traders witnessed another period of market turbulence last week as Ethereum’s price fluctuated within a 200-point range and ultimately closed with another doji weekly candle. However, the choppy market brought opportunities for derivatives traders.

The major correction in Ethereum’s price, following its new high in May, has been pinned on the Ethereum Foundation. On May 06, the Foundation transferred around $30 million in ETH tokens to the US-based Kraken cryptocurrency exchange, resulting in a 4.82% drop in ETH’s value in just one day.

Due to the increased selling pressure, the price of ETH has dropped by 1.30% at the start of this week, which suggests a possible downside move towards the crucial support level of $1,800. However, there is still hope among bulls, as the 20-week simple moving average is situated around this price point, which could potentially serve as a support level and provide an opportunity for the price to bounce back in the coming days..

What does the current market sentiment say?

The daily price chart shows that over the last three days, bears have controlled the Ethereum trend. In the past 24 hours, selling pressure has intensified, pushing the price of the second-largest cryptocurrency down to $1,852 at the time of publication.

According to data from CoinMarketCap, trading volume fell by 8% overnight to $8.2 billion. However, the trading volume appears to be lower than last week as sellers are unwinding short positions.

Will sellers decide next on bearish technical indicators sign?

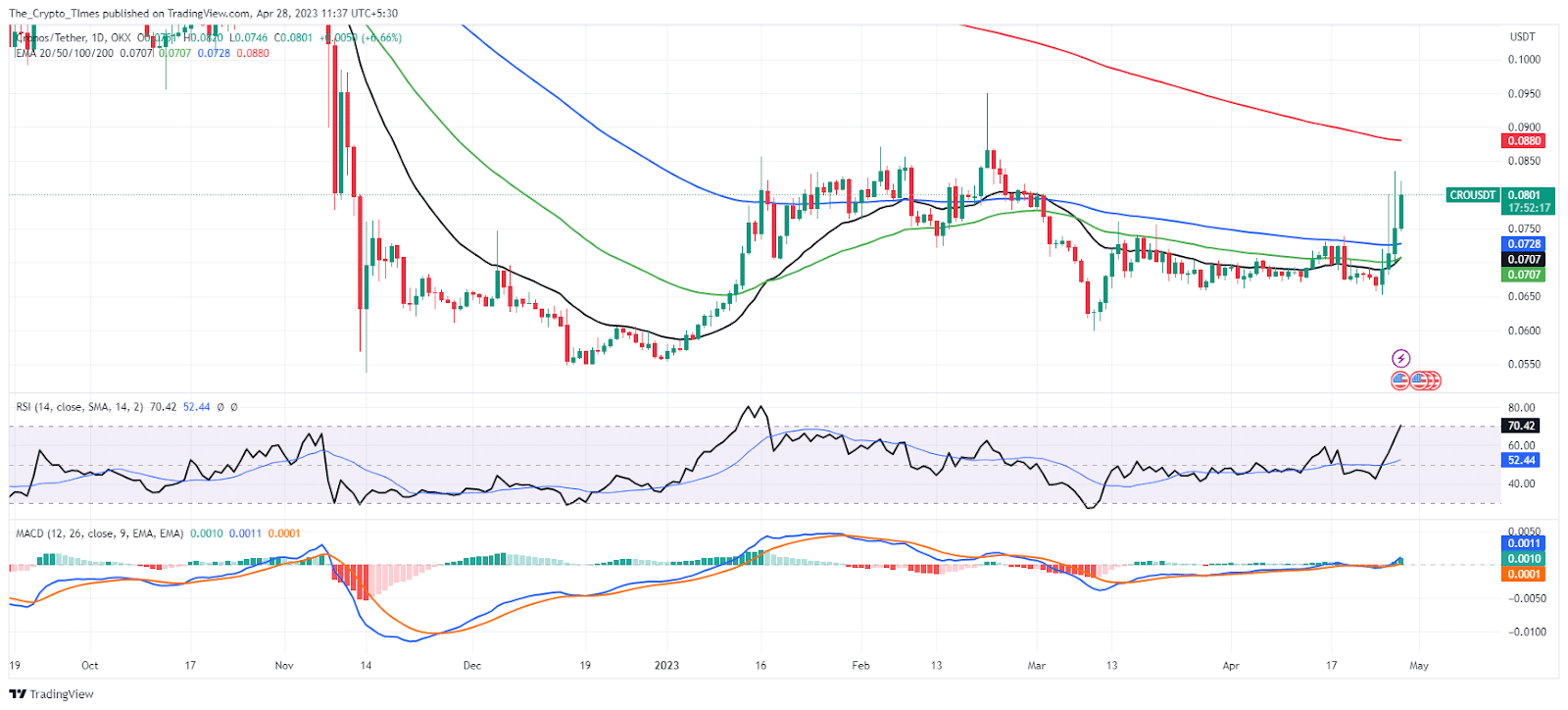

In the context of a bearish trend, Ethereum price action is forming a descending triangle pattern. At that point, the ETH price is standing at the support level of this bearish pattern, any drop below the $1820 to $1800 support area could put the buyers in trouble.

The daily RSI has moved into the bearish zone, which could lead to a breakdown of the descending triangle if the buyers are unable to hold the support. Notably, the MACD is looking close to the neutral zone, with both poised to move into the negative zone.

If the buyers fail to sustain the $1800 support, the technical indicators suggest further downside in the Ethereum price.

Also Read: Ethereum Under Selling Pressure!! Price drops below $2000