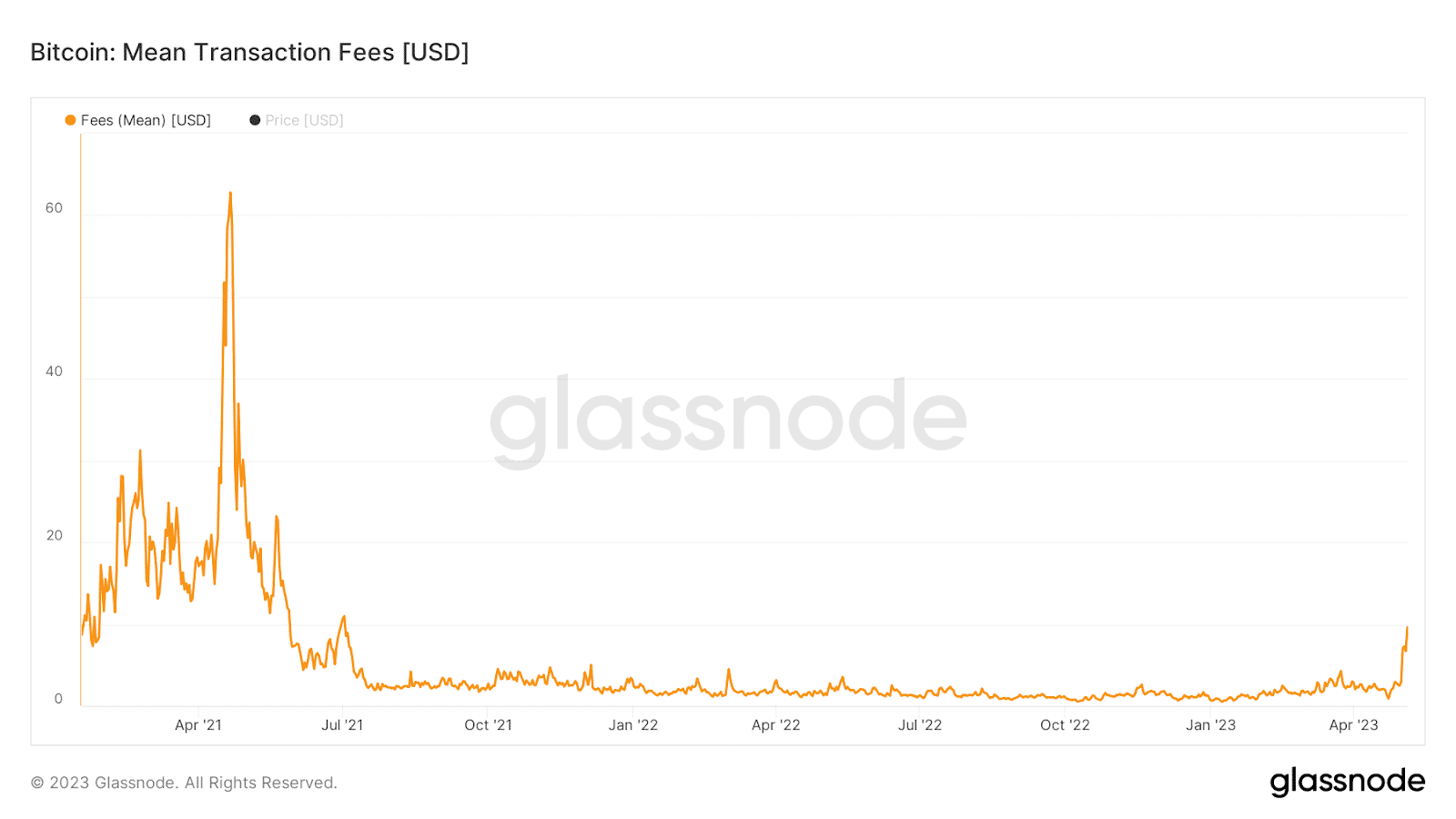

The transaction fees of Bitcoin have spiked rapidly in the past few days. Despite the fact that Bitcoin’s trading price remains below its $30,000 resistance level, the current transaction fees of BTC reached at the two-year’s highest peak.

In early May, the crypto community experienced a sharp increase in Bitcoin transaction fees. According to Glassnode data, the average Bitcoin transaction fee have reached a two-year high of $9.61 on Friday.

The total amount of fees paid on the Bitcoin blockchain has been reported to exceed $3.5 million with over 450% increase since April.

Ethereum-style “BRC-20” tokens that are the new standard for memecoins such as Ordinal tokens and PEPE coin are being cited as reasons for the increase in Bitcoin transaction fees.

On May 2nd, data from Galaxy Research revealed that a staggering 50% of all Bitcoin transactions were related to BRC-20 transactions.

The wild popularity of memecoins like PEPE has caused a ripple effect in the cryptocurrency market, leading to a rapid increase in Bitcoin transaction fees in just a matter of days. In addition, the transaction fees boomed when PEPE Coin got listed on the biggest crypto exchanges such as Crypto.com, Binance, and KuCoin, giving ample room for buyers to go long.

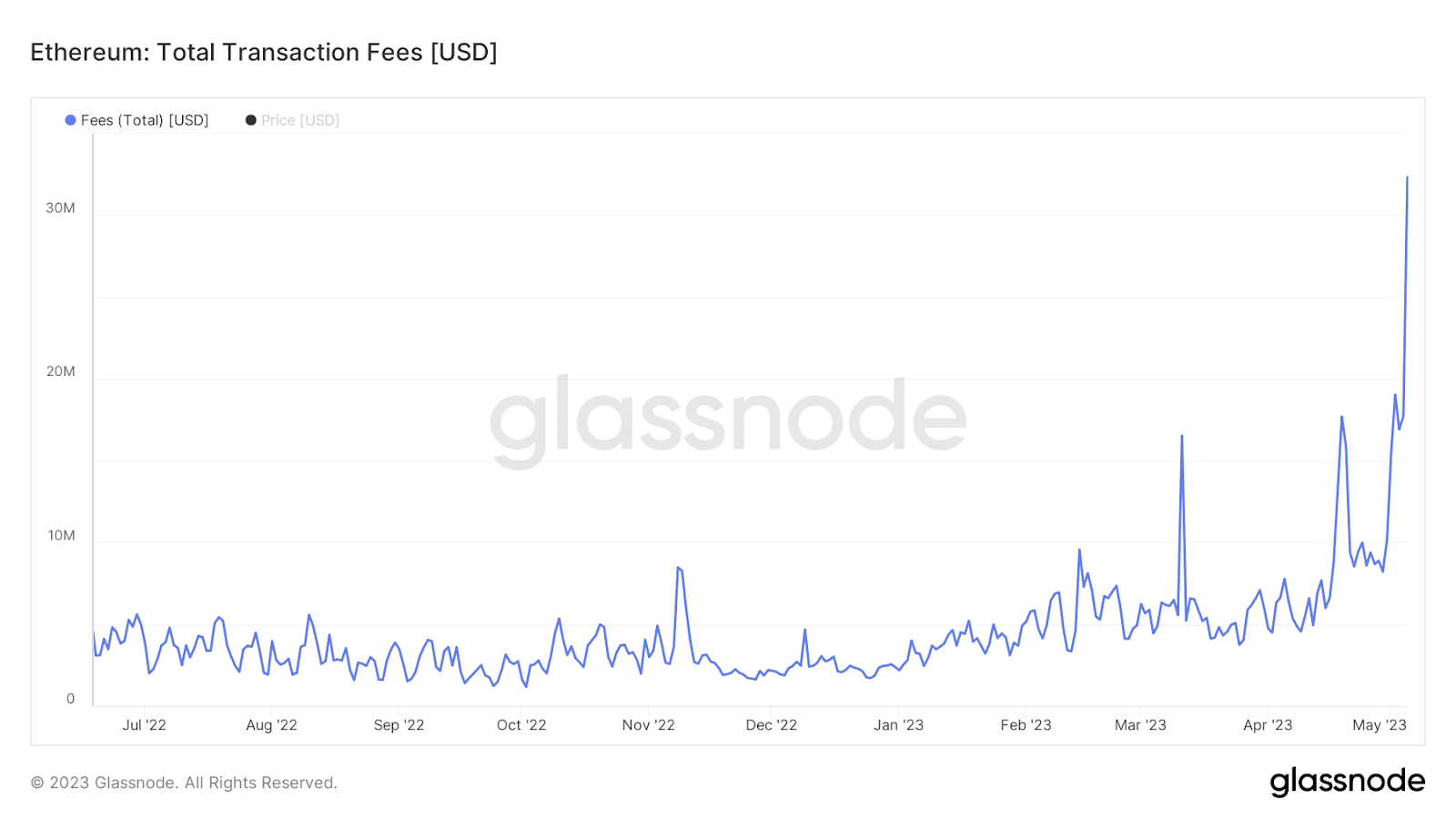

The Bitcoin blockchain is not the only network affected by the BRC-20 token hype rush. Even the Ethereum blockchain has been affected by memecoin hype and its total transaction fees have reached a yearly high of 16.720 ETH according to Glassnode.