The bankrupt cryptocurrency exchange, FTX, is facing a barrage of new lawsuits and charges with no clear end in sight, in what has been a shocking turn of events the IRS has joined the party.

The US Department of Justice and Internal Revenue Service (IRS) submitted 45 charges against the exchange and its affiliated companies, amounting to a whopping $44 billion.

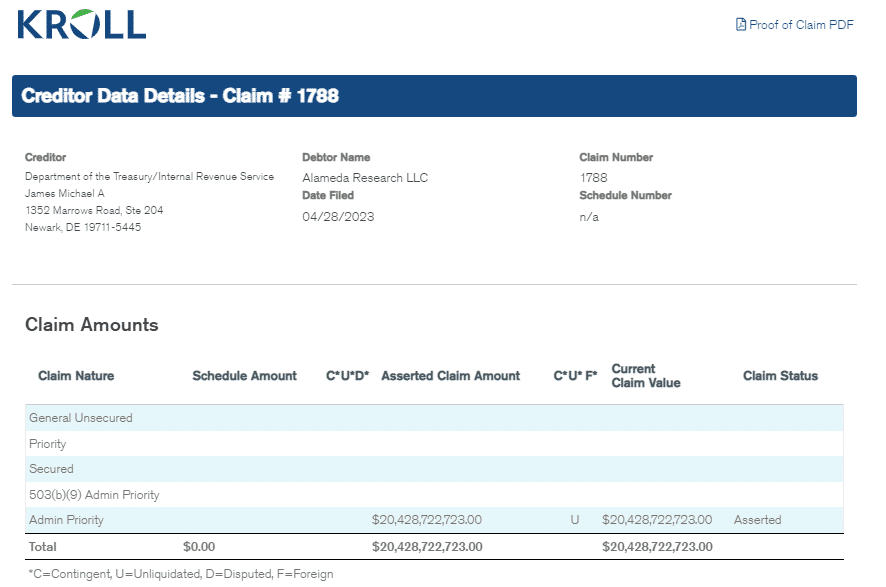

According to recent bankruptcy filings, the Internal Revenue Service (IRS) has imposed 45 claims against various FTX companies, such as West Realm Shires Services Inc, Ledger Holdings Inc (the parent company of LedgerX and LedgerPrime), Blockfolio, North Wireless Dimension Inc, and notably Alameda Research LLC, among others.

The biggest claims made by the Internal Research Services (IRS) against FTX and its subsidiaries include a staggering $20 billion and $7.9 billion against Alameda Research LLC, as well as two claims totaling against Alameda Research Holding Inc.

When it comes to the bankruptcy case against FTX and its subsidiaries, the IRS is not holding back. Some of the 45 claims filed by the IRS could take priority over other creditors. One claim in particular cited by the IRS as “partnership taxes” that amounts to a staggering $20.4 billion. This could potentially have a major impact on the outcome of the case.

Also Read: FTX Founder Requests Dismissal of Criminal Charges