Bitcoin’s price has been exhibiting a bearish trend lately, with a significant setback after being rejected from the $30K resistance level. Additionally, it has also lost essential support of $27,000 recently.

Bitcoin price has dropped by almost 15% from its yearly peak of $31,170, leading to concerns among institutional and retail investors alike. This decline in value has prompted panic in the market, with many closely monitoring the situation to see how it will unfold.

Following Bitcoin’s price momentum, other major cryptocurrencies such as ETH, ADA, BNB, DOGE, and others also experienced a decline in price ranging from 2-5%. In addition, the overall crypto market cap decreased by 2.71%, settling at $1.10 trillion.

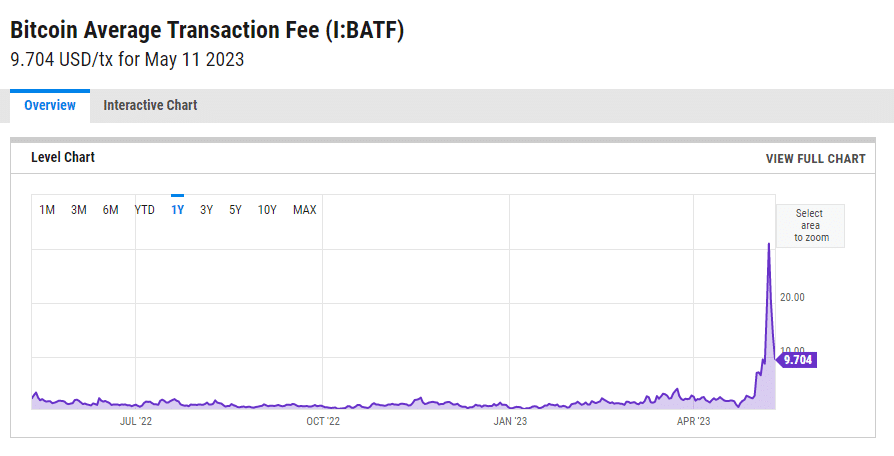

YChart reports that Bitcoin’s average transaction fee has fallen back to the 9.7 range after reaching multi-year highs. It seems that this has contributed to BTC’s 6% weekly decline as traders held off on executing orders due to the high volume of transactions.

Also Read: BRC-20 Tokens Overloads Bitcoin Network: Gas Fees Reach New Heights

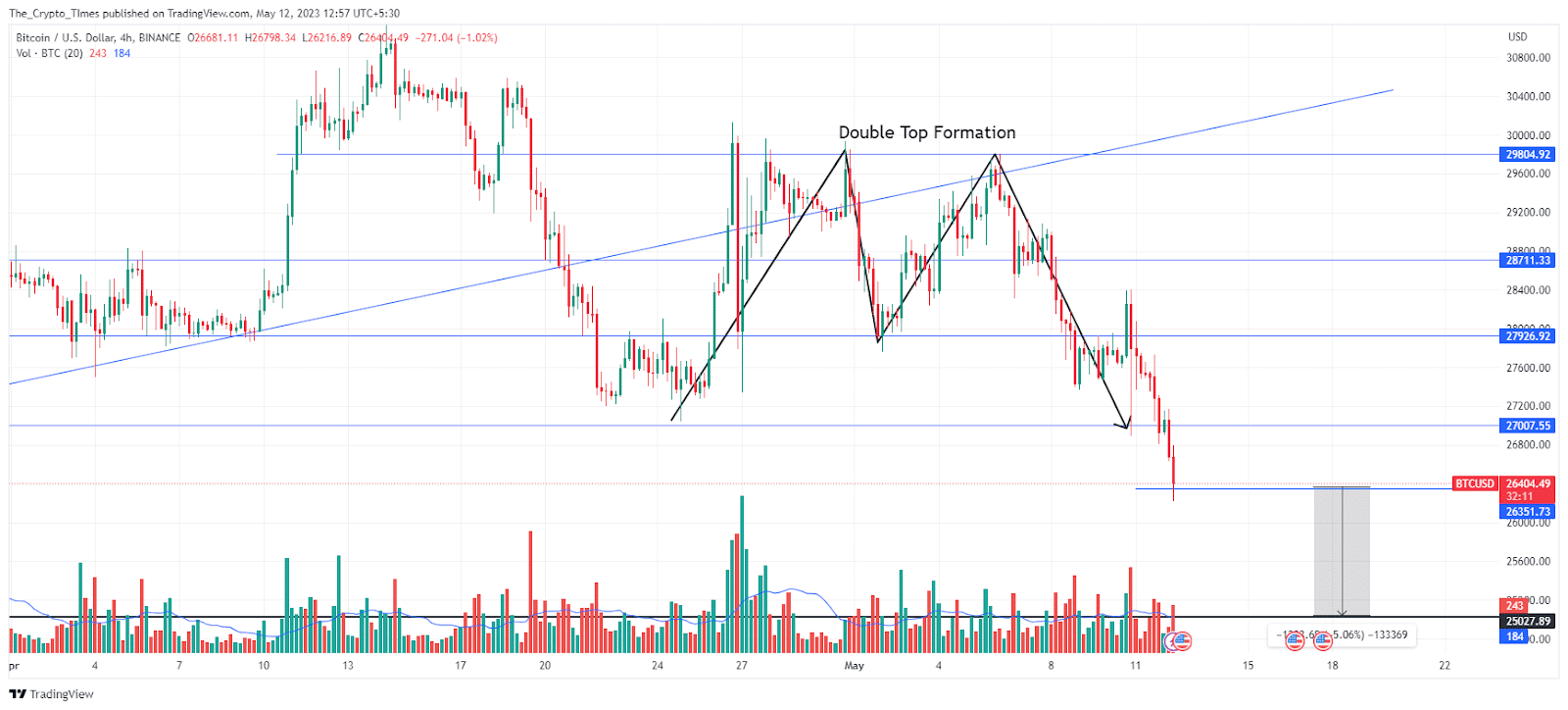

Bitcoin’s Bearish Double-top Pattern

As The Crypto Time reported earlier, Bitcoin’s price has been predicted to potentially drop to the significant $27,000 support level, thanks to its double top formation. At present, the price of Bitcoin is hovering around $26,325 with a loss of 2.4% during the day.

As for the market as a whole, Coinmarketcap data shows a decrease in Bitcoin’s market capitalization to $508.5 billion. However, there has been an increase in trading volume over the past 24 hours, which currently stands at $18.3 billion.

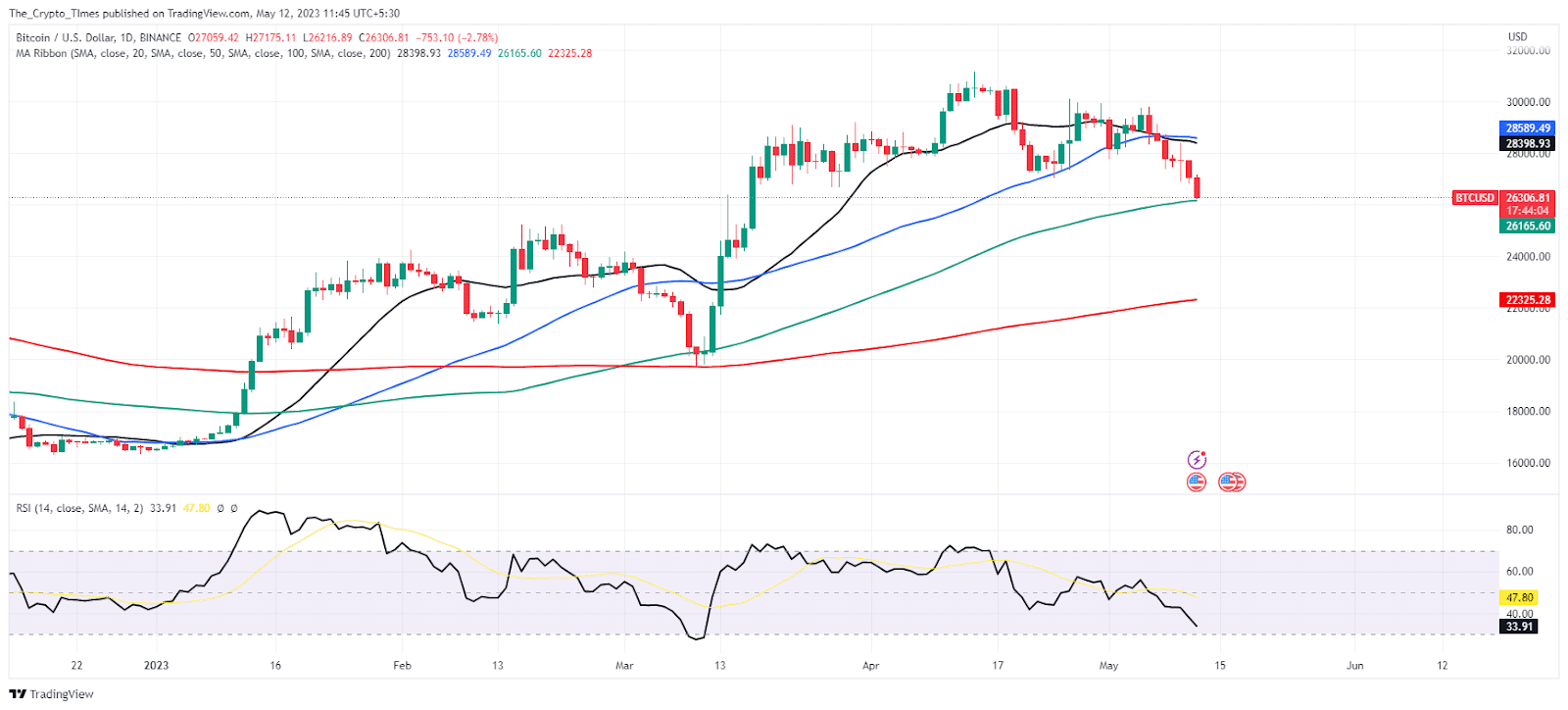

Bitcoin’s current price is fast approaching the critical 100-day simple moving average, which is a significant support level for buyers. If the price drops below this level, there may be another 5% decrease, potentially reaching the $25,000 mark.

The daily RSI is currently at a level of 33 and is close to entering the oversold region. If buyers fail to keep the Bitcoin price above the 100-SMA, the market could experience a significant downturn.