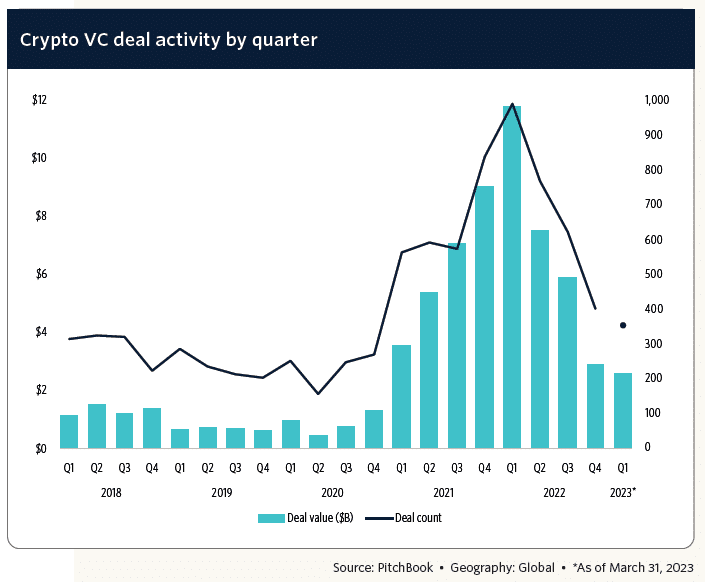

The cryptocurrency industry is facing a bumpy ride due to regulatory uncertainty, and venture capital (VC) deals with crypto companies have been hit hard.Despite the challenges, crypto businesses managed to raise a total of $2.6 billion in VC globally during the first three months of the year.

However, this figure represents an 11% decline in quarter-on-quarter (QoQ) deal value, as revealed by a recent study published by capital market analytics firm PitchBook on May 11.

In the first quarter of 2023, crypto-focused companies worldwide raised $2.6 billion, but this was spread across only 353 investment rounds, representing a 12.2% decrease in the number of deals during this period. The decline in investment activity can be attributed to regulatory uncertainty in the crypto industry, which has made investors cautious.

The analysis further noted, “this was the lowest amount of capital invested and deals completed since Q4 2020, representing the fourth consecutive quarter of declining investment activity.

The latest study by PitchBook has shed light on the reasons behind the continuous decline in VC investments in the crypto industry.

Also Read: KPMG Forecasts Slowdown in Crypto Interest for the Rest of 2022

The report cites a lack of regulatory clarity, the failure of several crypto companies, and uncertain practical benefits in many experimental projects as the key drivers of this trend.

Despite the expanding use cases and growing user base of cryptocurrencies, investors remain cautious due to these challenges. Notably, the report highlights the failure of the crypto trading platform FTX as one of the reasons for the decline.

The crypto industry is set for a potential policy shift in 2023, as financial regulators and central banks worldwide ramp up their efforts to write new rules aimed at preventing the type of collapse seen with FTX and other failed crypto companies.

This is according to analysts at PitchBook, who also revealed a continuous decline in VC investments in the crypto space due to a lack of regulatory clarity and uncertain practical benefits in many experimental projects.

Meanwhile, a recent study by Clarify Capital found that over half of the investors surveyed plan to steer away from buying digital assets in 2023. The study ‘Catching the Eyes of Investors’ interviewed 254 investors during 2022, highlighting the ongoing challenges and uncertainty facing the crypto industry.