The impressive price rally of Bitcoin of almost 65% in 2023 has validated the emergence of a promising bull market. However, navigating the highly volatile world of Bitcoin can be challenging for new investors who may struggle to profit without understanding the critical support and resistance levels.

After two consecutive weeks of declining prices, bitcoin has finally shown some signs of bullishness, with a gain of over 2.25% earlier this week. Bulls have managed to push the price of Bitcoin above the crucial volatility level of $27,000, potentially paving the way for more upward momentum.

How did the bulls turn the downtrend?

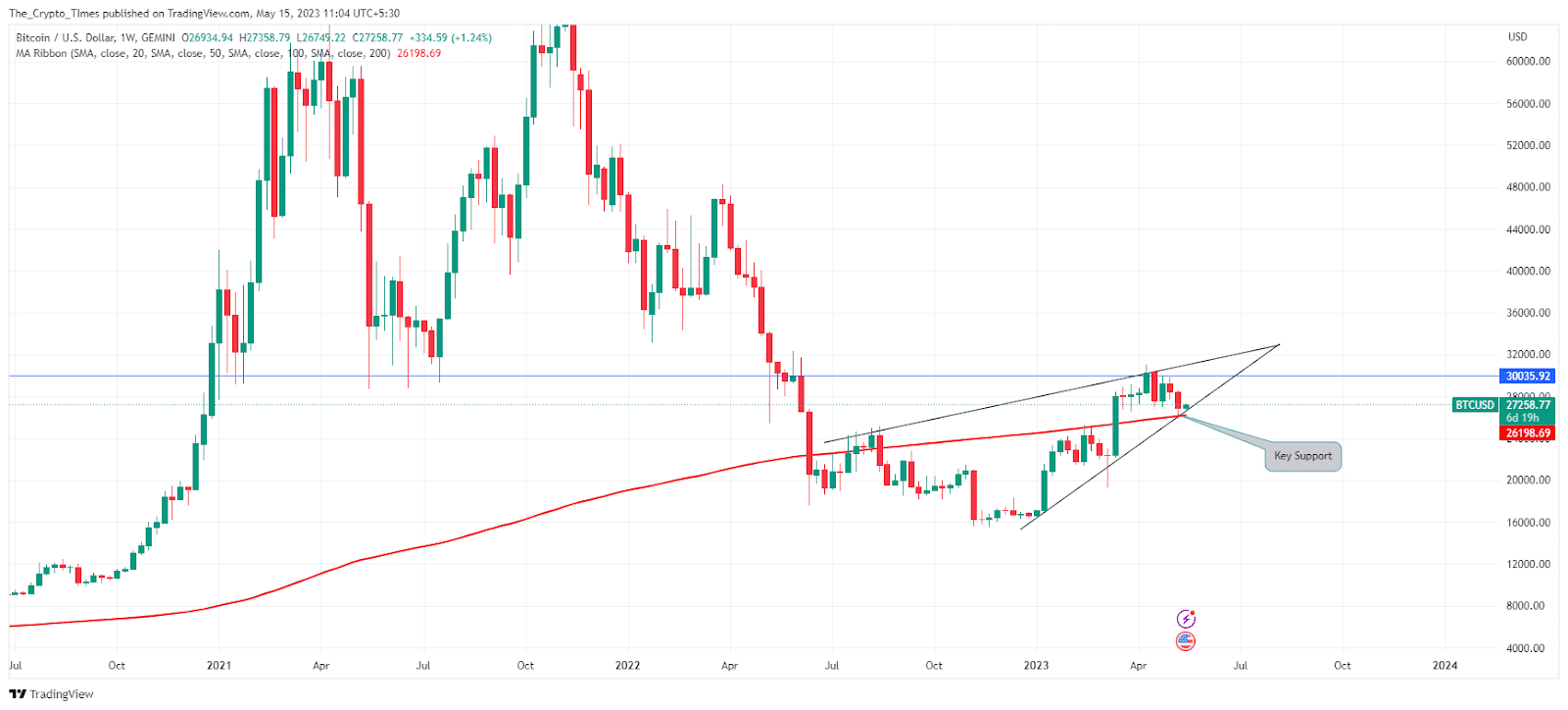

Bitcoin price experienced a significant decline of nearly 13% from the monthly open at $29,238, reaching a recent low of $25,818. Interestingly, the bulls managed to find support at the 200-week simple moving average, which could potentially drive the price higher in a more stable manner.

Meanwhile, the weekly price action has formed a rising wedge pattern, with the BTC price currently hovering near the lower boundary of this formation on the weekly price chart. Despite the recovery, if the buyers fail to sustain price stability above the lower range of the bullish channel and the 200-SMA, there is a possibility of the bitcoin price moving toward the range of $22,000 to $20,000.

Bitcoin price appears to be low volatile, why?

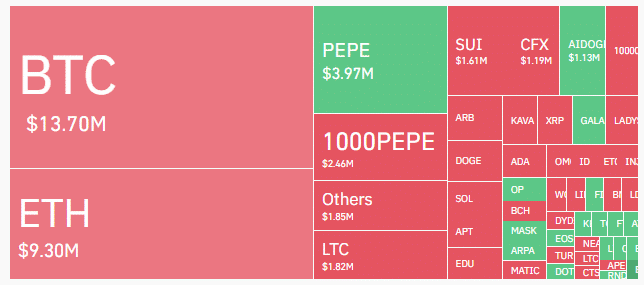

In the past 24 hours, an astounding number of around 15,000 traders in the Bitcoin market faced liquidation, resulting in a total liquidation amount of $13.7 million, as reported by Coinglass. This significant liquidation event occurred as a result of the sudden recovery above the key support level of $27,000.

As of now, Bitcoin is trading at $27,500, showing a notable overnight gain of 2.25%. CoinMarketCap data indicates a substantial trading volume of $12 billion within the last 24 hours, showcasing the continued interest and activity in the market.

What does the daily price chart indicate?

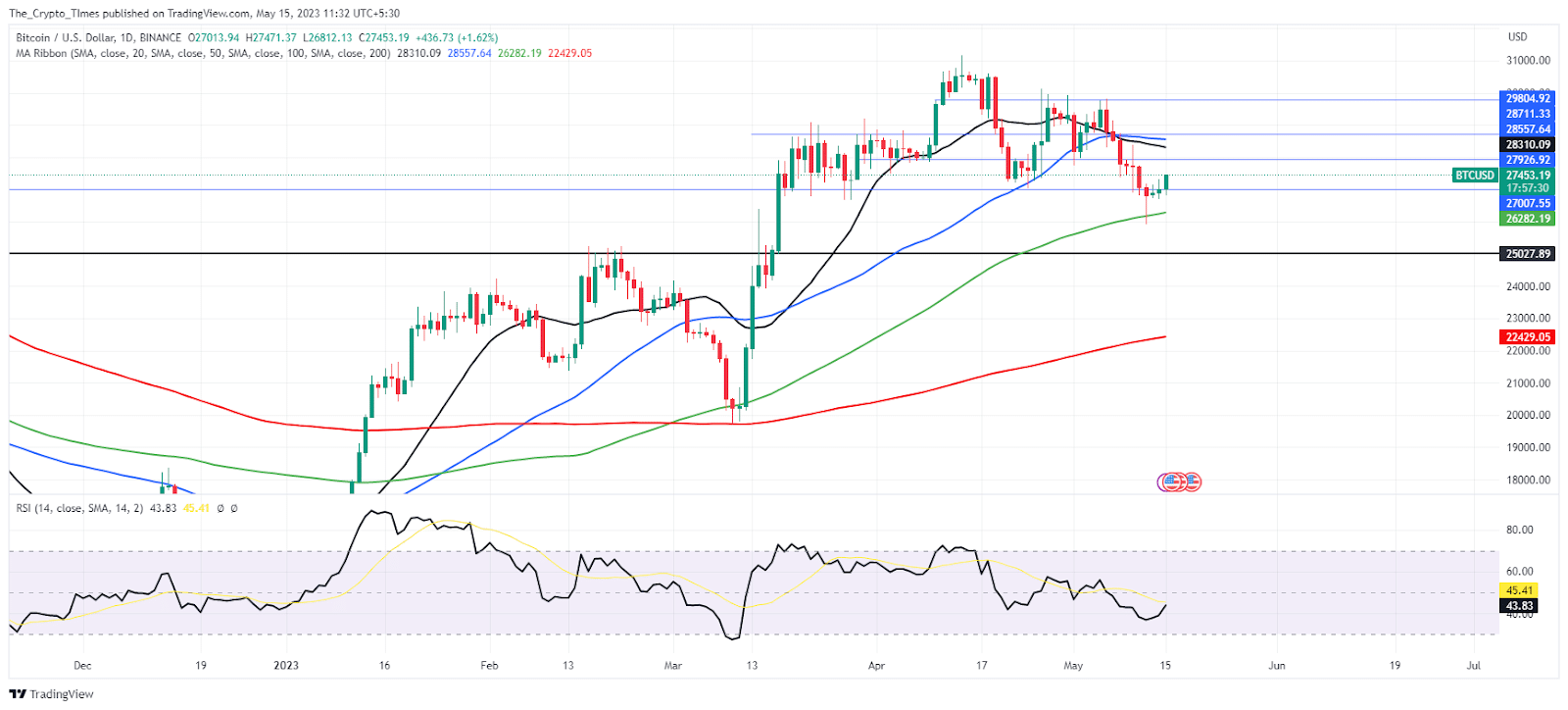

Over the weekend, bullish momentum was evident as Bitcoin approached the significant 100-day simple moving average. On a daily timeframe, the 100-SMA played a crucial role as a zone that could potentially change the trend, and it still holds as a key support level.

Currently, Bitcoin has bounced back above the $27,000 level and is making its way toward the 20-day simple moving average (SMA), marking an initial milestone.

It’s worth noting that the Relative Strength Index (RSI) has shown signs of potential recovery for the upcoming week. The RSI is on the verge of surpassing the signal line, indicating the possibility of a bullish acceleration that could push Bitcoin’s price toward the $28,000 mark in the near future.

Also read: Bitcoin Suffers Major Sell-off as it Breaks Key Support of $27K